QE Big Time Swing System Navigates Bear and Posts Moderate Gain for 2018

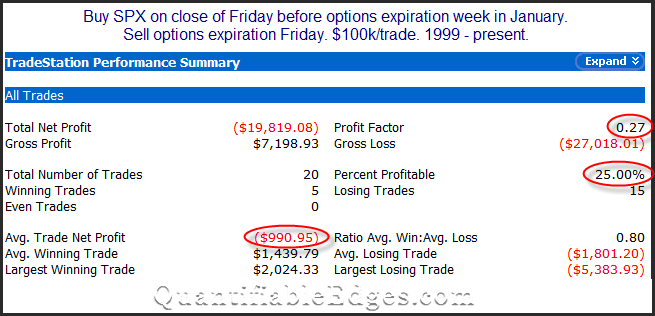

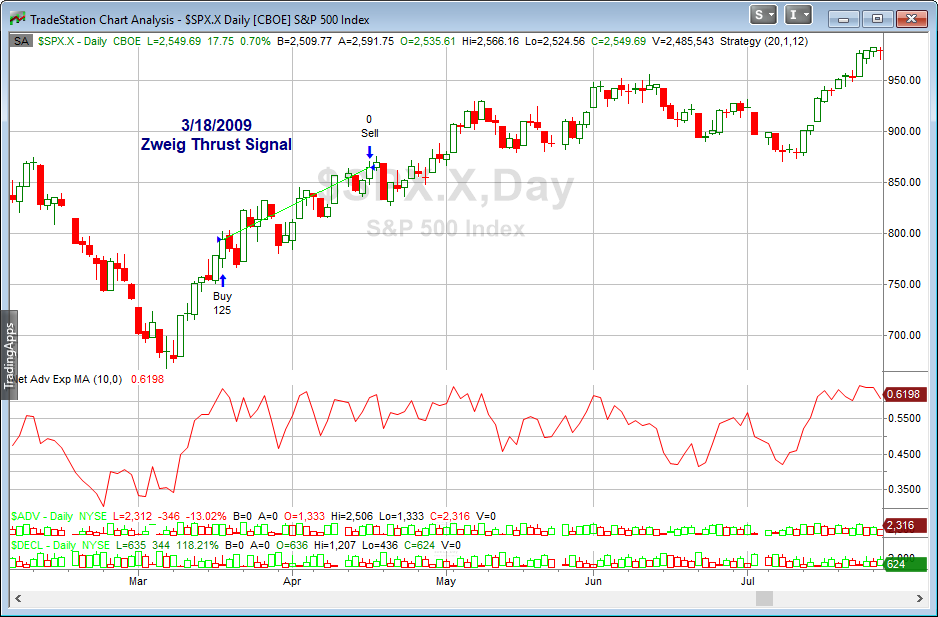

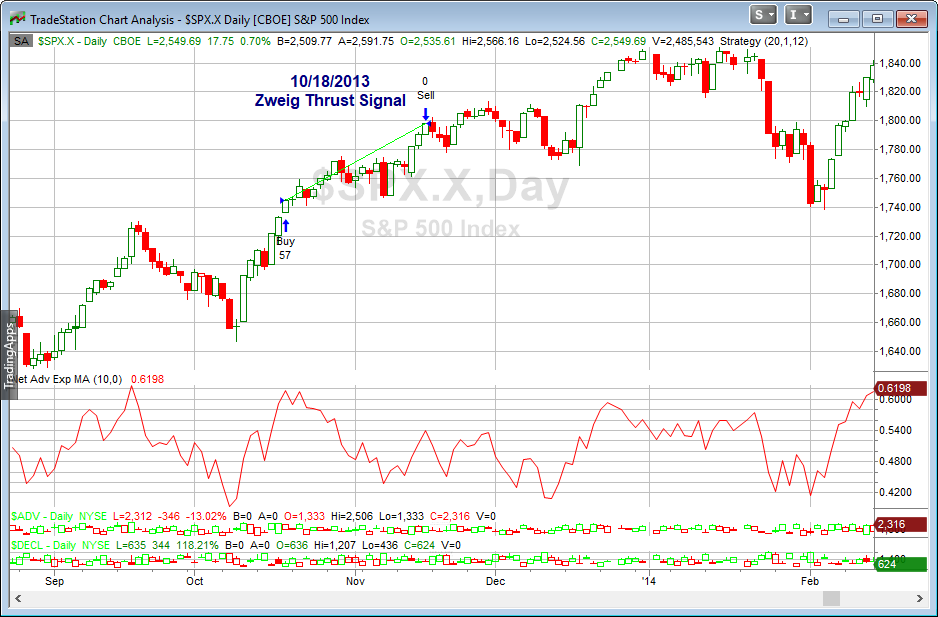

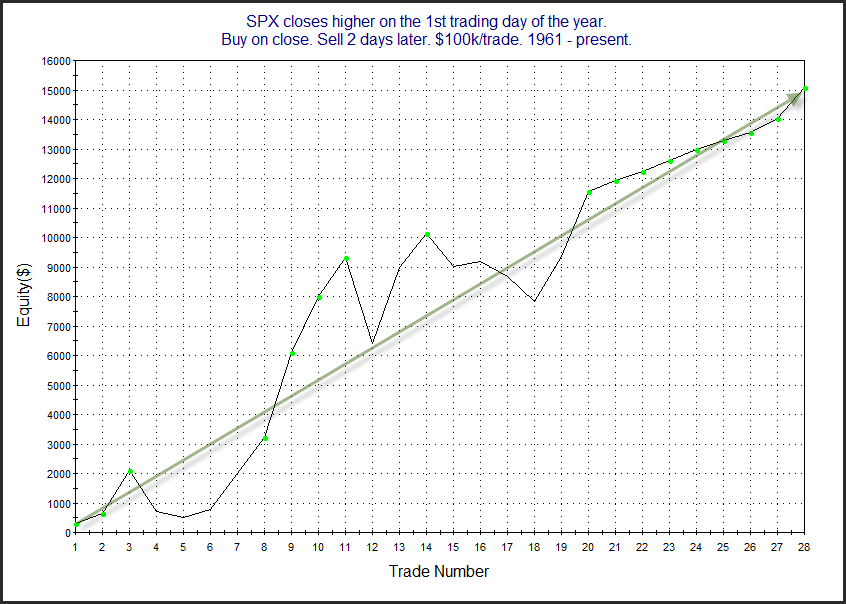

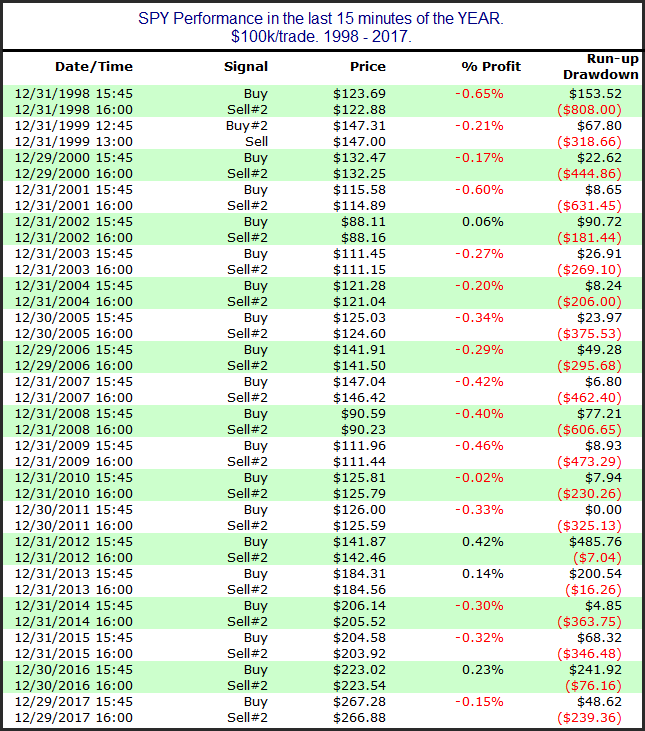

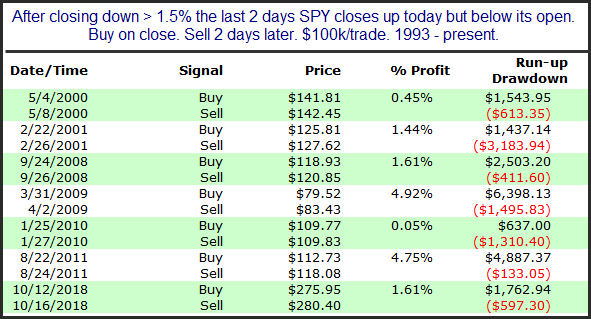

Despite a challenging trading environment, which included a bear market and a down year for the major indices, the Quantifiable Edges Big Time Swing System managed to continue its winning ways utilizing SPY signals. I’ve updated the Quantifiable Edges Big Time Swing System overview page with results through 1/2/2019. The system only averages about 1 trade per month, so I generally only update it on a semi-annual basis. For 2018 there were just 8 signals that triggered for SPY. Four of them closed positive and four negative for a net gain of about 2.4% (including dividends, commissions of $0.01/share, and an assumed interest rate on cash equal to the average Fed Funds rate of 1.8%). While that is well off the average pace for the system, and a contrast to 2017 when all 9 signals turned out profitable, it is nice to see it continue to manage gains in a challenging environment. The QE Big Time Swing System still has not posted a losing year for SPY.

The system provides easy to follow mechanical rules, with no black box component. The standard parameters are not optimized, and have never been changed since the system’s release in 2009. There are only about 11 trades per year averaging 7 trading days per trade. To make it even easier, all entries and exits are either at the open or the close. And to be sure you have everything set up properly, traders may follow the private purchasers-only blog that tracks SPY signals and possible entry/exit levels.

For system developers looking for a system that they can use as a base to build their own system from, the Big Time Swing is an attractive option. It is all open-coded and comes complete with a substantial amount of background historical research. And since it is only in the market about ¼ of the time, it can easily be combined with other systems to provide greater efficiency of capital. Once you’re ready to try and improve the system yourself you can also refer to the system manual or the purchaser-only webinar on the private BTS web page. Both of these resources discuss numerous ideas for customization.

The system has proven its worth since its release over 9 years ago. Don’t wait another year to determine if the QE Big Time Swing System is appropriate for you. For more information and to see the updated overview sheet, click here.

If you’d like additional information about the system, or have questions, you may email BigTimeSwing @ Quantifiable Edges.com (no spaces).