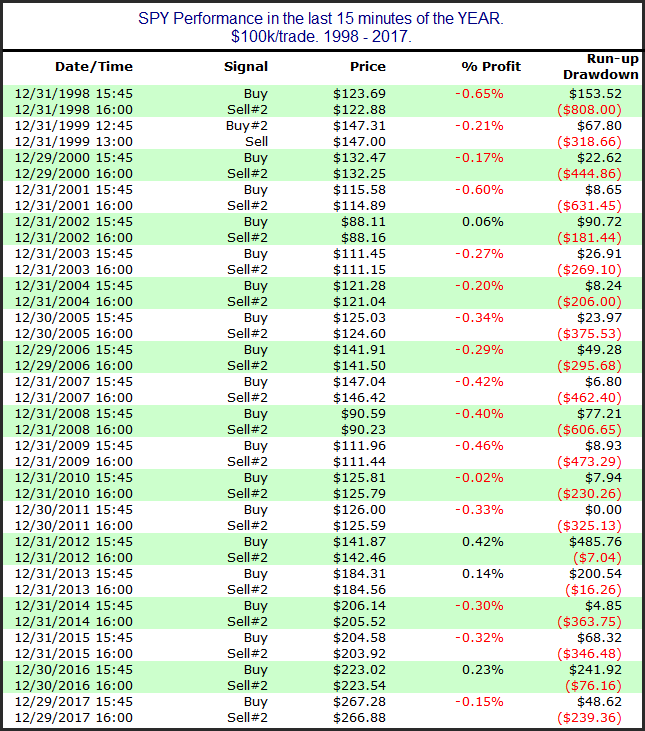

In the subscriber letter over the weekend (and for the last several years) I showed some studies that examined market performance in the last 15 minutes of trading for the year. The table below is from those studies – also seen here on the blog in 2015. Stats are updated and it shows all “last 15 minutes” from 1998 – 2017.

The average trade has seen SPY drop over 0.2%, and the average losing trade has seen it close down 0.32%. That’s a sizable average move for a 15-minute period. Three of the last six years have bucked the trend and closed up. Prior to that the results were extremely bearish. Wishing you a happy and prosperous 2019!

Want research like this delivered directly to your inbox on a timely basis? Sign up for the Quantifiable Edges Email List.