97 Years of Death Crosses

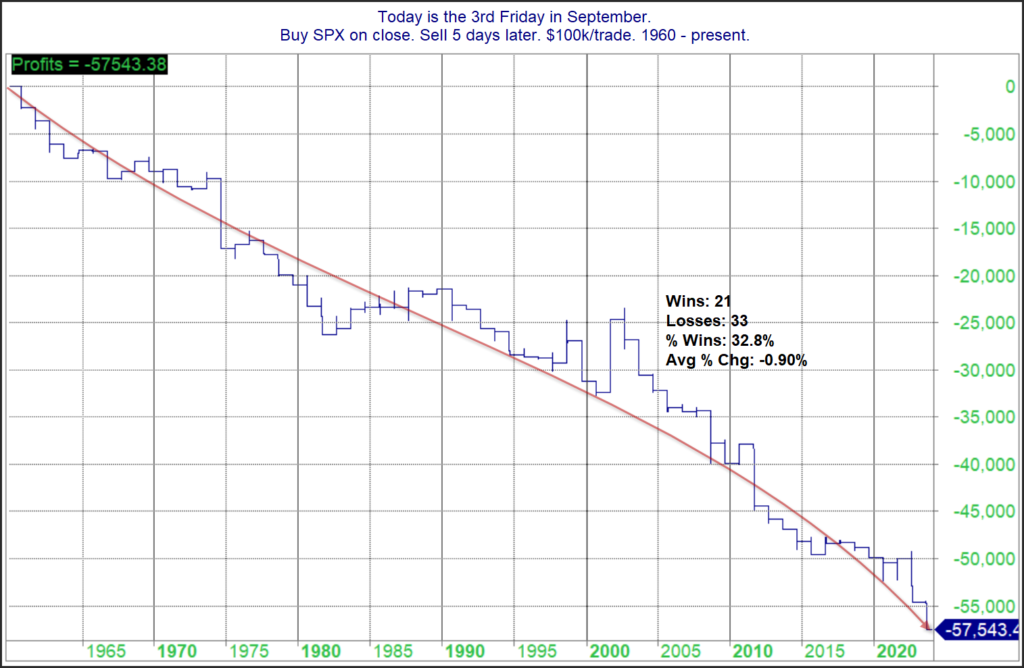

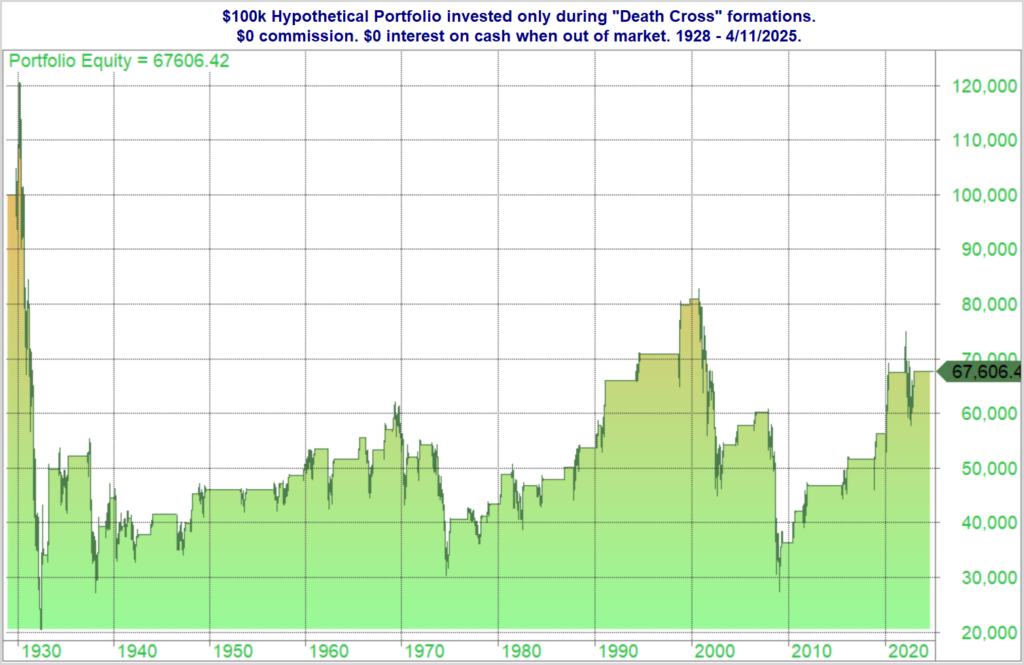

The SPX is going to experience a Death Cross today at the close. I’ve written many times in the past about “Death Crosses”. A Death Cross is when the 50ma crosses below the 200ma. It is confirmation of a downtrend. Some people view it as a bearish signal. As you’ll see, it is not a great “signal”. My Norgate data goes back to 1928 for SPX (this includes its predecessor, the S&P 90, from 1928 – 1957 when the S&P 500 officially began). This made for an interesting starting point, because the 1st instance, in 1929, came shortly after the 1929 market crash that was followed by the Great Depression. It was also followed by the most substantial decline – by far. Let’s first look at a list of all the Death Cross formations and how the SPX performed while they were in effect.

Interestingly, 36 of the 49 instances (73.5%) actually saw the SPX realize gains while the Death Cross was in effect. The problem is the losing trades were very large. And even most of the winners saw a sizable round-trip lower before they were able to carve out some gains (like the last one in 2022). The average drawdown for these 49 trades would have been 13.2%. And there were 5 separate instances that saw drawdowns of at least 45%.

Even though the giant losers were relatively rare, their impact is large. And the fact that the 1st instance was the worst instance also provides a great example of how devastating large drawdowns can be. The profit curve below shows a hypothetical portfolio of only being invested in the market during SPX Death Crosses.

The 1st instance from 1929 – 1933 saw the portfolio rise to $120k before falling down as low as about $20k and then finishing that trade with a value of about $34k. And it has never managed to get back to breakeven. The 73.5% “win rate” on the Death Cross tells me it is NOT a reliable timing device. But the few instances of massive losses show just how valuable it can be to protect gains and avoid large portions of nasty bear markets. If we get into a big bear market, I won’t actually be sitting out of the market for several years. But it does allow us to adjust strategies, exposure and other risk parameters. The Death Cross / Golden Cross on its own is not a great system. But it can help us put the market into a context where we can better evaluate opportunities. And I have also found it helpful when combining with other timing indicators, as I’ve done in the Market Timing Course.

Note: The Quantifiable Edges Market Timing Course does look at the Golden Cross / Death Cross in combination with other timing indicators.

Want research like this delivered directly to your inbox on a timely basis? Sign up for the Quantifiable Edges Email List.