Learn the Quantifiable Edges newest numbered system – System 88, and the Quantifiable Edges Double-B indicator that is at its core.

Quantifiable Edges has provided our gold subscribers access to our “numbered systems” since 2008. But we have never taught any of them to non-subscribers, until now. Our newest system – System 88 uses the Quantifiable Edges Double-B indicator to identify opportune times to enter pullbacks in strong uptrends. The Double-B also provides the exit trigger.

The Double-B indicator is a Bollinger Band derivative that not only measures overbought/oversold, but also automatically adjusts based on the strength and direction of the trend.

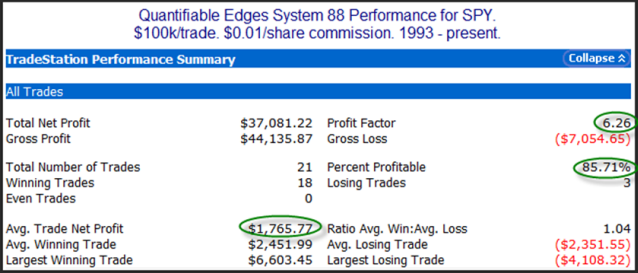

System 88 seeks to identify high-probability entry opportunities in strong uptrends. It then looks to ride that trend for a while. At Quantifiable Edges we identify System 88 opportunities in our list of about 100 ETFs as well as S&P 500 stocks. So to identify the best opportunities we use fairly strict entry criteria. Here is how SPY would have performed historically using our standard entry criteria. (Please note: All results shown below are hypothetical. See disclaimer at bottom of page for more information.)

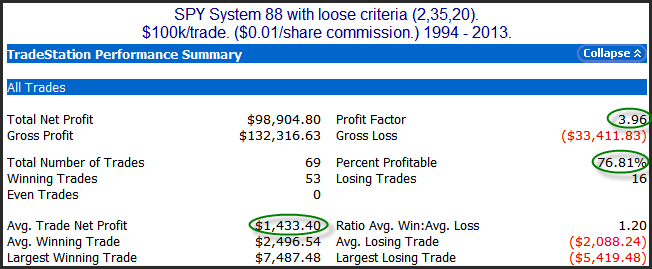

As you can see, the opportunities identified were generally strong, but there have not been a whole lot of them. If traders wish to utilize System 88 to trade a smaller subset of securities, they could loosen the criteria some without much degradation to the results. Here’s SPY results with “looser” criteria.

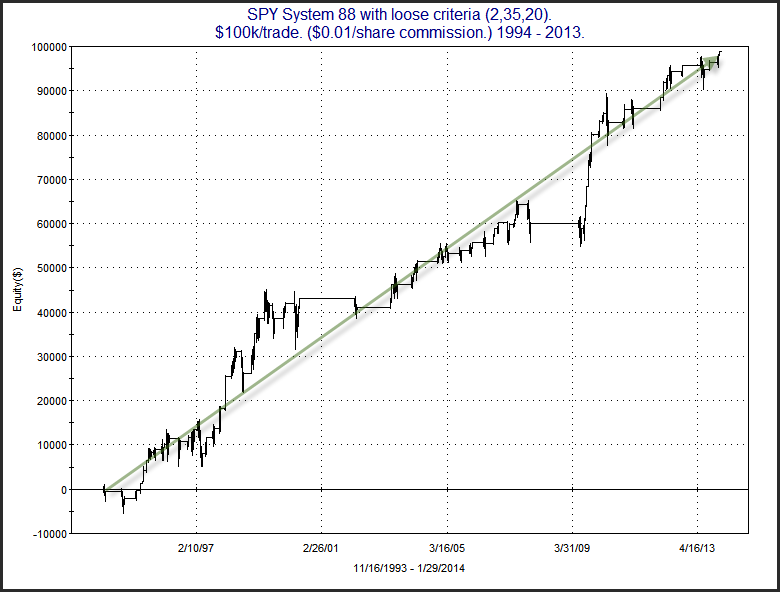

As you can see, the average stats are only slightly weaker, and the total gains are substantially higher. Here is a profit curve for the loose criteria.

The profit curve has been pointed higher for a long time.

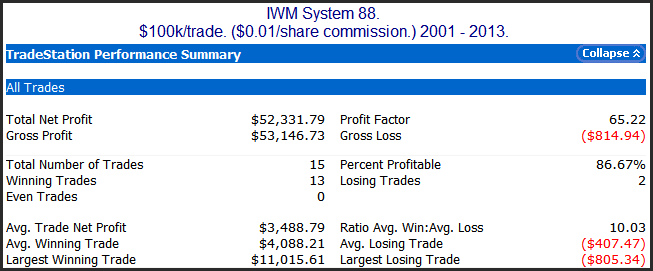

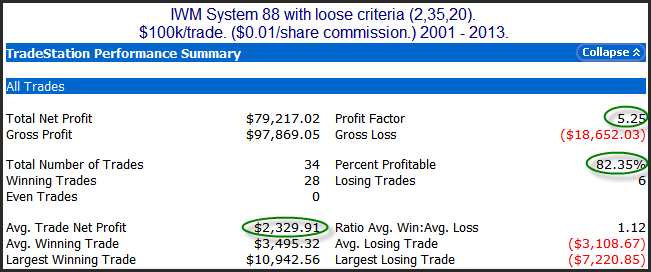

Of course System 88 is not specific to SPY. Here are a few other examples. First, IWM with standard criteria.

Again, low instances, but very strong results. Now let’s look at “loose” criteria.

Similar to SPY, slightly worse average stats, but substantially more profits.

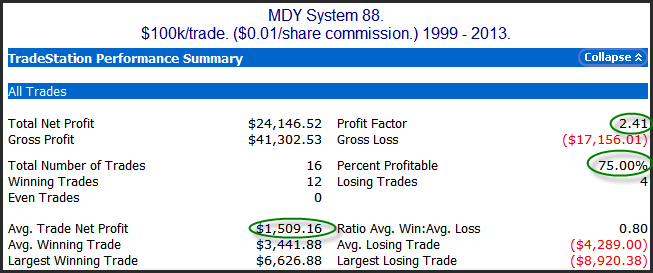

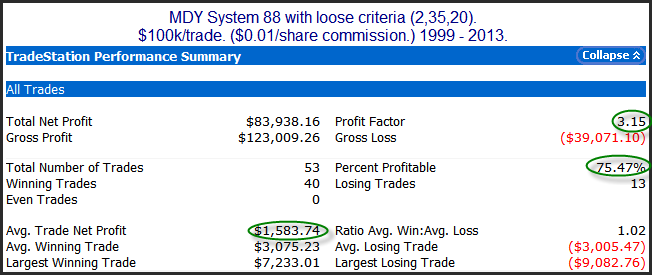

And finally, MDY, both standard and loose.

MDY actually did slightly better all-around with the loose criteria. With many different securities and with a large range of settings System 88 has historically provided a solid edge.

In a special webinar Rob Hanna taught traders all the rules and logic behind Quantifiable Edges’ System 88. He also showed how the Double-B was constructedand discussed adjusting the parameters for your own use.

Additionally, purchasers will have access to the full Tradestation code for both the indicator and the system. They’ll also be able to download a Tradestation Workspace that has the Double-B indicator and System 88 preset for viewing and testing. Purchasers that do not use Tradestation can download the code in a text file format so that they may more easily convert it to their own platform.

While there is no guarantee of performance moving forward I am confident in the worthiness of the material. So

Quantifiable Edges will guarantee your immediate satisfaction. If you’re unhappy with the webinar and don’t feel System 88 and the Double-B indicator was worth the price, let us know. Simply send an email requesting a refund and explaining why you were dissatisfied within 48 hrs of purchase and you will get your money back. (As long as you do not download the code before requesting the refund.)

So sign up today and put System 88 and the Quantifiable Edges Double-B indicator to work for you.