After the first few weeks, the Quantifiable Edges Market Timing Course has received an incredible amount of positive feedback. We also received some helpful feedback from purchasers who wanted to see a few more things. Therefore, we have added some features to the Quantifiable Edges Market Timing Course and wanted to make readers aware of them.

These first few enhancements were done to the Market Timing Course Downloads page. To be able to access it, you must first complete the course.

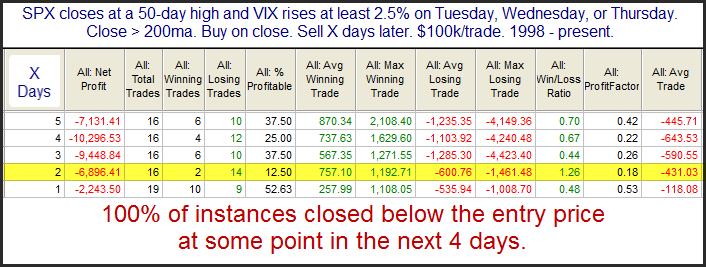

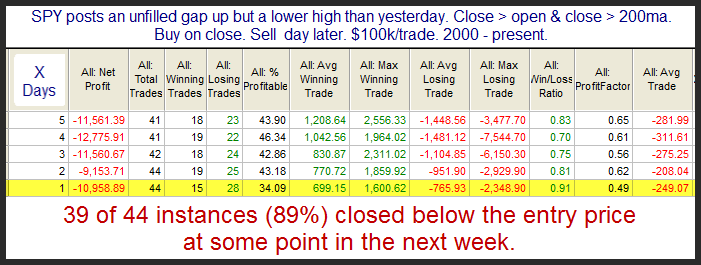

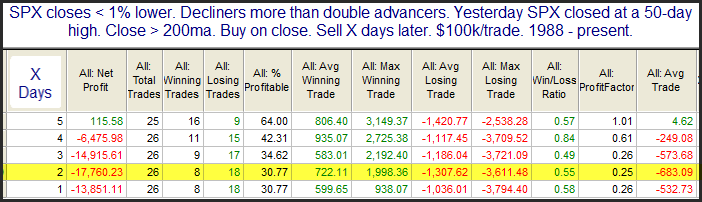

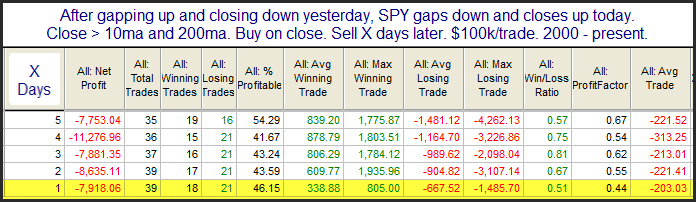

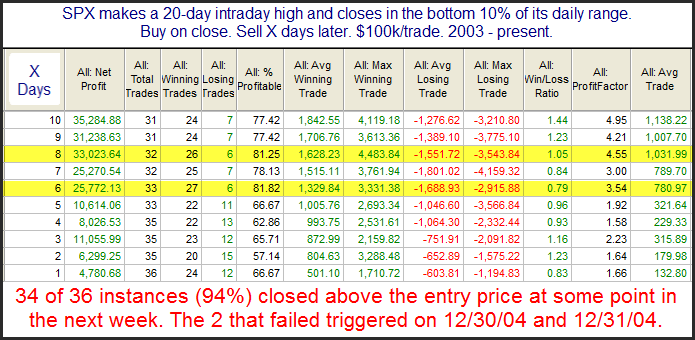

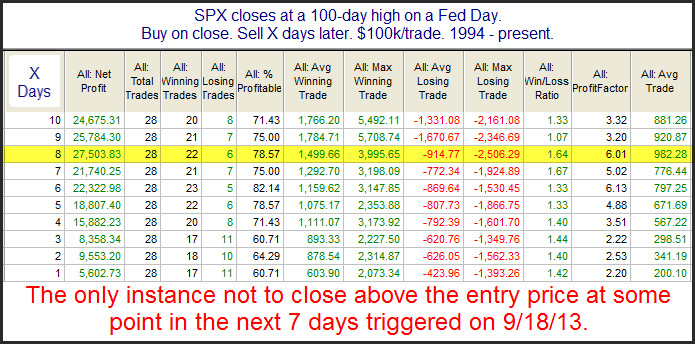

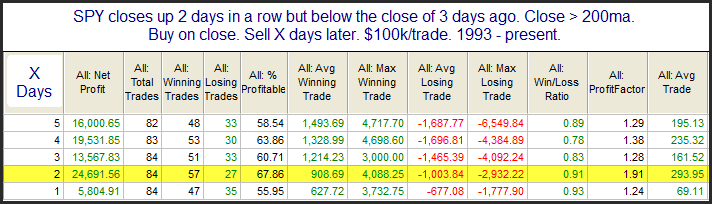

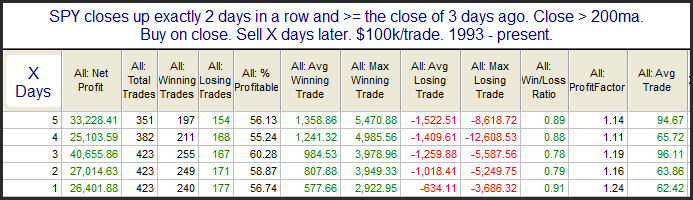

1) The Excel spreadsheets that show historical triggers and results for our price-action based indicators are now updated on a regular basis. Those that purchase (and complete) the course may download these spreadsheets any time to get the most recent performance history and status of the indicators.

2) The Tradestation Code for the price-action based indicators is now downloadable in text format for people that would like to translate it to work on their platform.

3) Thanks to a Market Timing Course student, the indicators are now also available for download in Ninja Trader format.

Additionally, updated indicator charts and statuses may be found at any time on the Market Timing Course Indicator Charts page.

And the Market Timing Course now has its own Facebook page, so if you liked it, then please Like it!

And if you want to hear what others have had to say about the course, here are just a few of the comments we have received in the last couple of weeks:

Thanks Rob. It’s an awesome course.

– Mauro (Gold subscriber)

The Market Timing Course was absolutely informative and valuable.

– Durk (Gold subscriber)

Well researched, straightforward and simple.

-Jose (Gold subscriber)

Great job on the course! Very simple approach & well presented.

Thanks,

Steve (Gold subscriber)

The format was excellent, lessons were short and to the point.

-M.A. (Gold subscriber)

I think it was very helpful how you broke the material into segments and had small testing at the end. It made it easier to digest all the material.

– Mike W (course purchaser)

I found it very useful. I liked the format – I thought the short sections aided both initial learning as well as subsequent review…this has given (me) a statistical rationale, rather than a mere “gut feeling”. Thank you.

David B. (course purchaser)

Thanks for the course, which for me was like an appetizer to dig deeper into the QE universe. I’ve been reading the blog for quite some time…the course provided new insights to me…

Thanks,

Simon (course purchaser)

I loved the course. Very detailed information on some compelling strategies.

– J.Z. (course purchaser)

Your new market timing course is friggin awesome.

Jim (@jimkoford)

For more details, or to purchase the course, click here.