Trader Feedback On Quant Edges Swing Trading Course

The first group of traders has now completed the Quant Edges Swing Trading Course, and the feedback we received has been tremendous. The course is self-paced, and all Q&A sessions were documented and recorded, so you won’t miss out any anything if you decide to take it now.

Below is a sampling of the feedback we received:

The course is well organized and well presented. The level of detail and coverage was impressive. It was great to see the thought process involved when evaluating an edge. I especially liked the spreadsheets because of their detail and sorting capabilities. This allowed me to see how strategies performed in different environments. The Amibroker code was also a big plus.

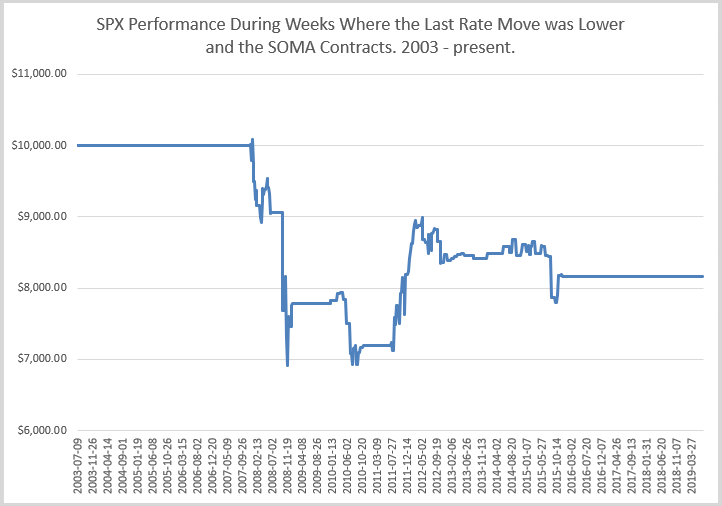

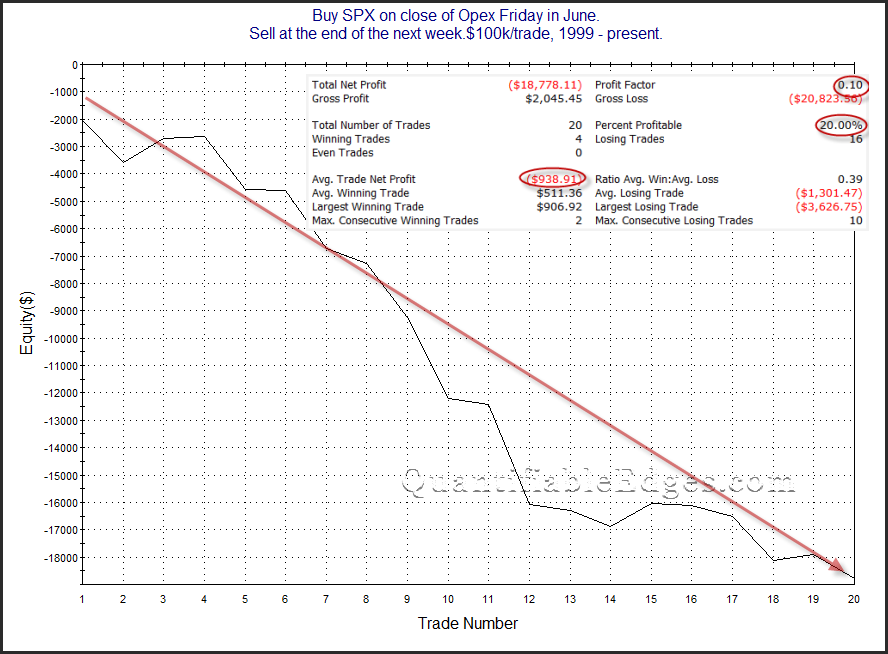

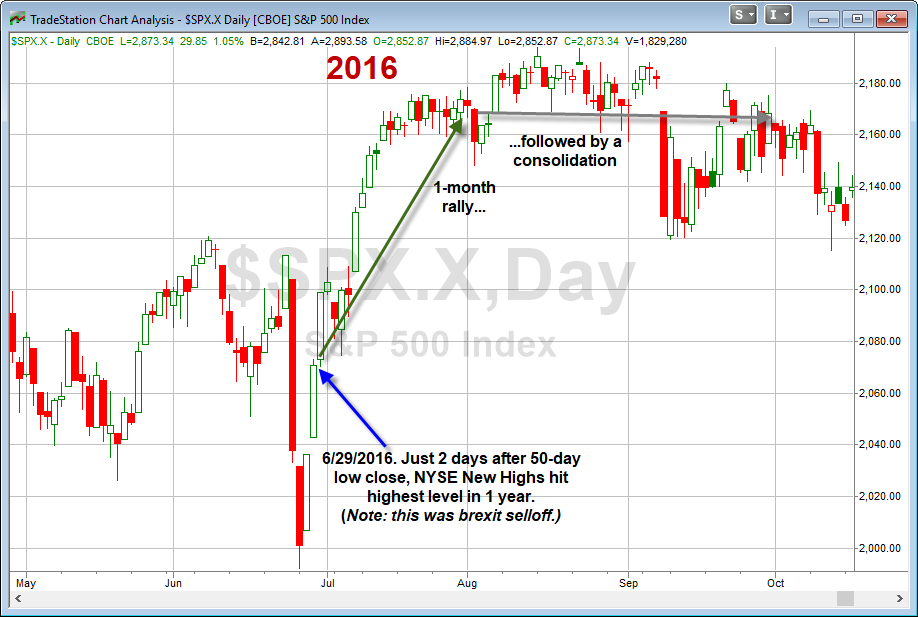

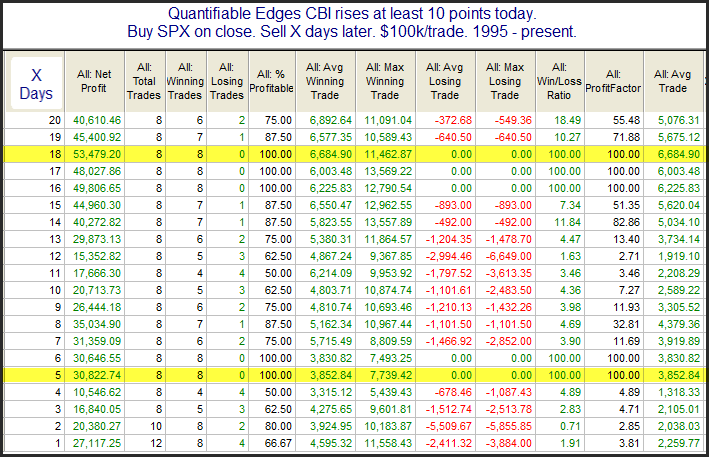

I had done no quant studies or analysis before this course and was looking for a good intro and this one was excellent. It gave me good insight into how to look for tendencies via raw studies, try to combine those into a strategy and test that. And Rob expanded the course to various areas to lots of interesting and (to me) new ideas I hadn’t thought of such as Double B, SOMA flows and that you can’t rely on historical NYSE/SPX opening data, among many of the gems and insights of the course. This is a course whose material I’ll need to go through 4 or 5 times to really absorb.

Learned a lot about how quantitative trading works and it gave me a great stepping stone into learning how to develop systems and motivated me to learn how to code in AFL and use Amibroker, which I did not even know existed prior to the course. Basic systems coding in Amibroker was surprisingly easy to learn coming from a non programming background.

Rob put in great effort to continue to build out the course through the Q&A and added content to provide more information for course participants. Rob’s effort and additional work moved this course from an 8 to a 10 for me.

The build up from tendencies (studies) to strategies was excellent. Discussion of the generally “right number” of indicators to have in a strategy. Having most of the studies/strategies be independent of Quantifiable Edges proprietary work (Aggregator, CBI) but also showing that they can be integrated is appreciated. The Fed and SOMA work was all new to me so really great and insightful. Providing the spreadsheets and Amibroker code – thank you! Good references for following work and reading (e.g., Bandy’s work). The extra effort Rob put in to answer a boat load of questions in each section was well appreciated. That helped round out much of the material in the course and put things in context.

Looking at how each input (the vix, days up/down etc) affects returns was great. The best section to me was the one that put several of the inputs together and studied how to use them in conjunction with each other to build a robust system.

I am more of a position trader (2-8 weeks). Even though the timeframe was too short for my taste, I learned plenty from your research process, explanations and techniques. Thanks!

Informative, well explained, and for me just plain fun!

I cannot compliment you enough on the depth and detail you go into during the course. Though I have traded for many years, the value I received from this course was incredible.

Since new course participants will only have access to the recordings of the Q&A sessions, each new purchase comes complete with 1 hour of Q&A / consulting from Rob. Join our group of graduates and incorporate quant edges into your swing trading today!