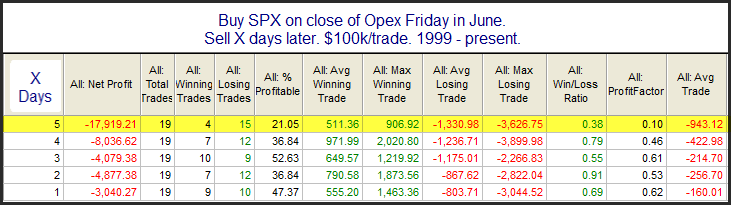

I noted a few years ago here on the blog that the week after June options expiration has done especially poorly in recent years. The table below is updated and shows all such weeks dating back to 1999.

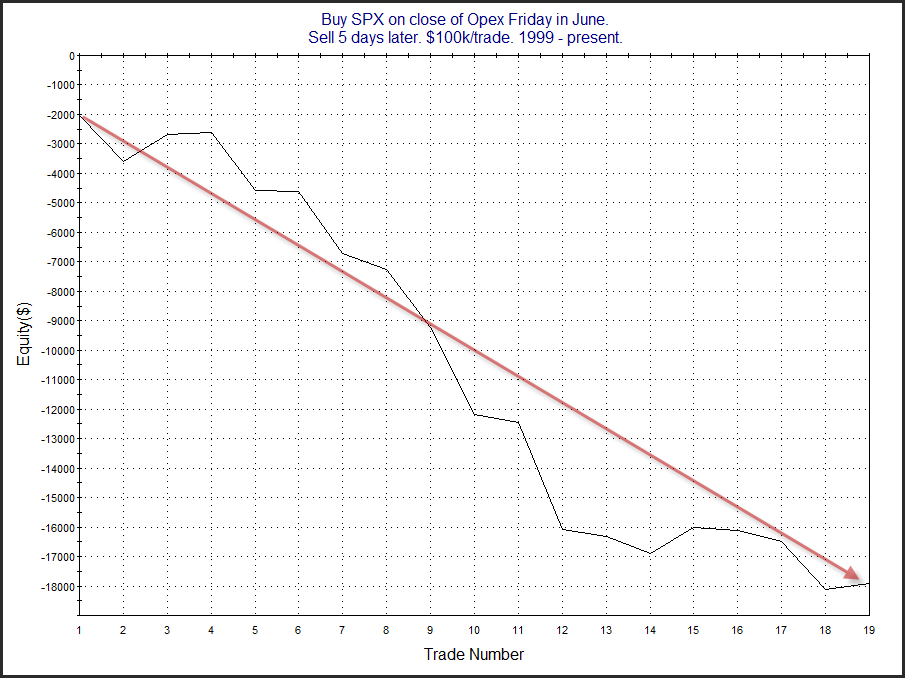

Those are some pretty weak numbers. Below is a 5-day profit curve.

As you can see, it has been quite a streak of bearishness. Twelve out of the last fourteen years have closed down. So it would seem we may be entering a week seasonal period.

I will note that this week has not always exhibited such bearishness. Between 1979 – 1989 this week posted gains every year. (But S&P options, and hence opex week, did not exist until 1984.) Overall, I am viewing it as a mild bearish headwind for the time being.

Want research like this delivered directly to your inbox on a timely basis? Sign up for the Quantifiable Edges Email List.