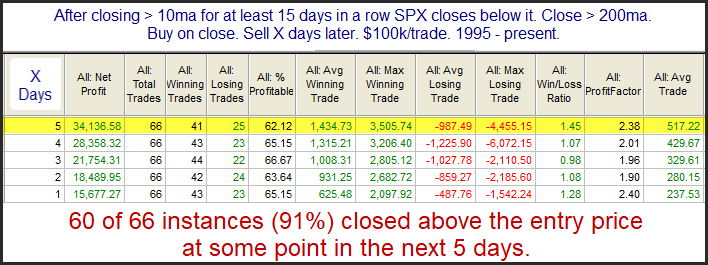

I’ve shown numerous studies in the past that suggest uptrends often become choppy before they ultimately end. It is highly unusual for an uptrend that is showing strong persistence to abruptly top out. The study below demonstrates this concept. The persistent uptrend of late has kept SPX above its short-term moving averages for an extended period. Tuesday, after 22 consecutive closes above the 10ma, SPX dipped down and closed below it. The study below looks at performance following other instances where SPX closed below its 10ma for the first time over 15 days.

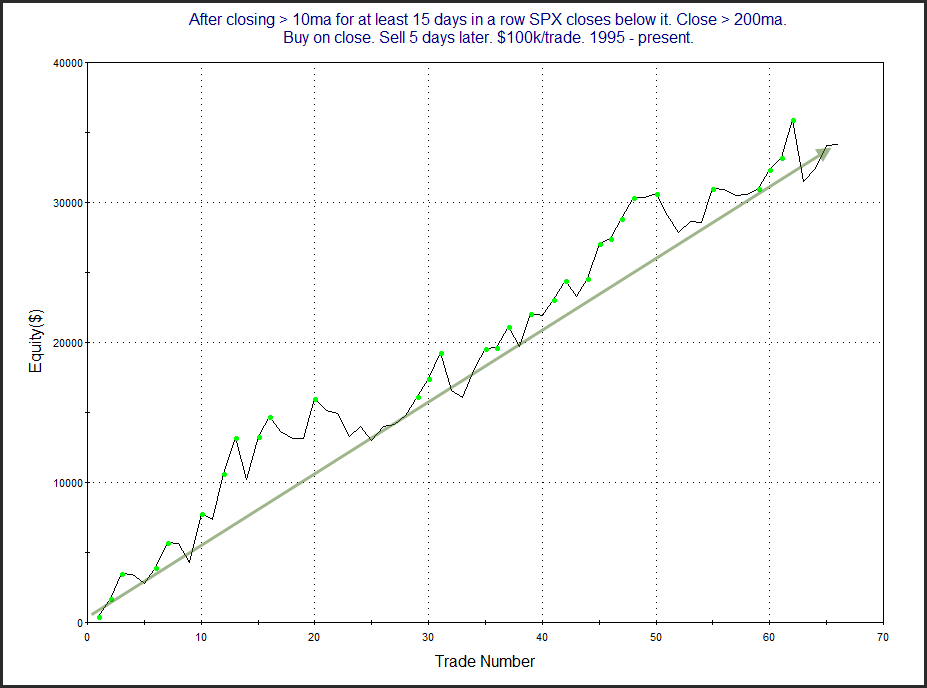

The numbers here all look solidly bullish over the next week. Below is the 5-day profit curve.

The strong upslope serves as some confirmation of the bullish edge. As my friend and colleague, Tom McClellan says, “A spinning top does not just stop spinning and fall over. It wobbles first.” I saw a few bullish studies along these lines last night. Odds seem to suggest a good chance of a bounce arriving in the next few days.

Want research like this delivered directly to your inbox on a timely basis? Sign up for the Quantifiable Edges Email List.