With the 1st quarter behind us I thought a summary of what we learned on the blog through the studies would be interesting. (You should also note that most of these studies are now available in the 1st Quarter 2008 Quantifiable Edges Studies Package for Tradestation users.)

If the VXO spikes higher and the market doesn’t rebound…look out below!

Some kinds of reversal bars really do work. And so do others.

IBD Follow Through Days provide an edge – but it’s not as advertised. (FTD’s are not included in the 1st Quarter Studies Package but will be separately available soon.)

When time gets stretched, price reversals are typically close at hand.

When capitulating markets bounce, it’s the most beat up stocks that bounce the highest. (Not included in Q1 package -study done outside of Tradestation.)

When the Nasdaq and Russell get disjointed it typically means volatility and rising prices.

Large gaps in downtrends should be bought. Both down and up. (Not included in package – done mostly outside of Tradestation).

Big Arms can lead to next day buying.

Inside Days have a tendency to lead to short-term downside.

Some contracting ranges suggest more upside.

3 up days in a downtrend tend to lead to selling.

Failed gaps aren’t as bad as they seem.

Triangle breakouts are highly unreliable and may provide an edge to fade.

A late surge may or may not carry over to the next day.

Not all breakouts are good.

Nasdaq Leadership can be important.

There is a recent edge on the 1st trading day of the month.

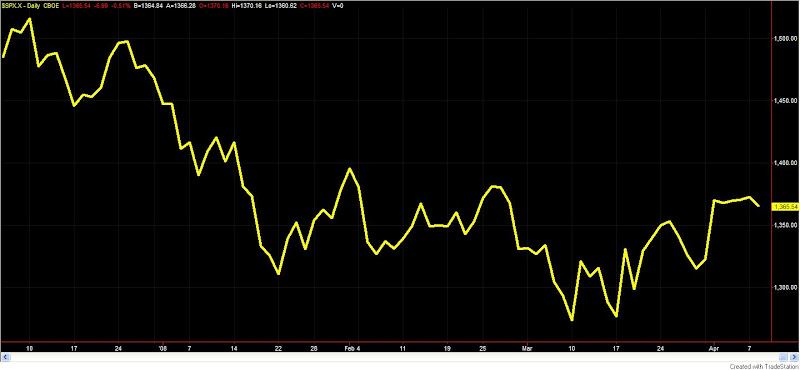

Four months lower doesn’t mean we’re going up.

More proof reversal bars work.

Put/call ratios can help signal a reversal is near.

Stretched VXO readings are generally a short-term positive for the market.

New low divergences are nice but not overly positive.

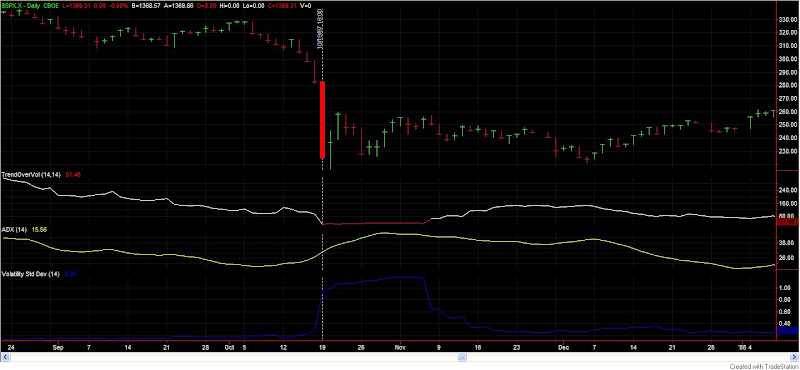

Strong moves off bottoms can lead to intermediate-term rallies.

Sharply declining consumer sentiment tends to precede stock market lows.

Fed rallies tend to be short-lived.

Overbought in a downtrend can lead to some nice shorts.

Light volume on a pullback isn’t necessarily positive.

The market doesn’t get marked up on the last day of the quarter.

And a few more.

In all, there are 45 studies included in the Quantifiable Edges 1st Quarter package. At a time when programmers charge $100 – $150/hr, I’m offering the entire package for $195. That’s about $4.33 per study. All open coded. Flexible inputs for further research. Ready-to-import data files for those studies that need it (like the Consumer Sentiment Index study). If you want to test you own ideas in Tradestation, this group of studies can also provide some nice templates to work with. Click here to purchase and you can download and import the studies and workspaces into Tradestation in just a few minutes.

I’ll bet the 2nd quarter teaches us just as much as the 1st…