The TICK TomOscillator & How It Is Suggesting A Bounce

This morning @PsychTrader was kind enough to mention Quantifiable Edges and the TICK TomOscillator on StockTwits.

The blog post he linked to was this one from May 13, 2011.

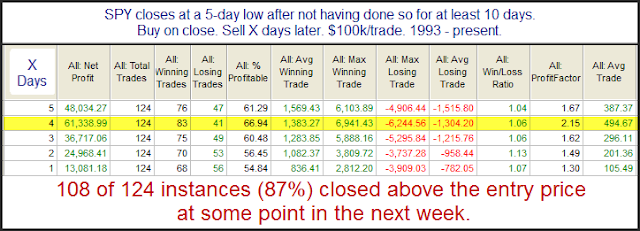

In light of this I thought I would share the study that was discussed in the subscriber letter last night that @PsychTrader referred to as the long signal. It utilized the standard TICK TomOscillator (as Tom McClellan designed it). The standard reading was -245.42 at the close yesterday. This is extremely low. In fact, there have only been 3 lower readings in the past year. The study looked at readings below -200 that coincided with a 5-day low in in SPX and an SPX close above its 200-day moving average. Here is the results table:

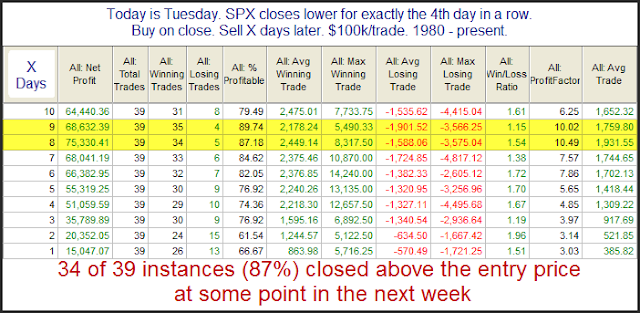

There has been a strong propensity for the market to bounce over the next 2-3 days. Despite the negative reaction to the jobs report, traders may want to keep this in mind.