January Opex Weak (revisited)

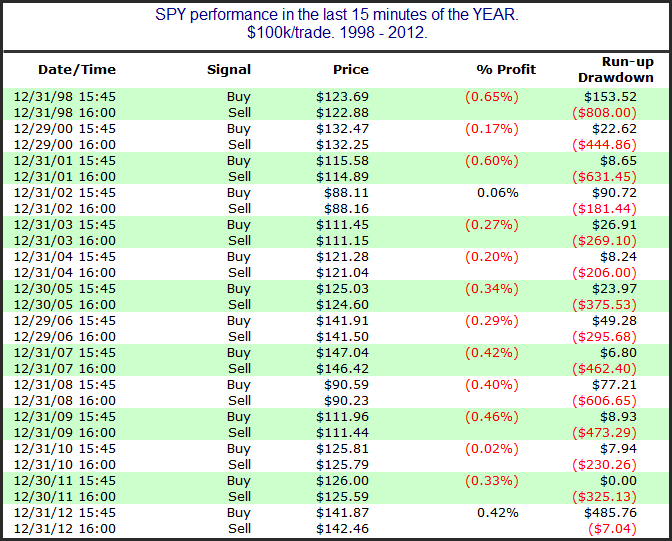

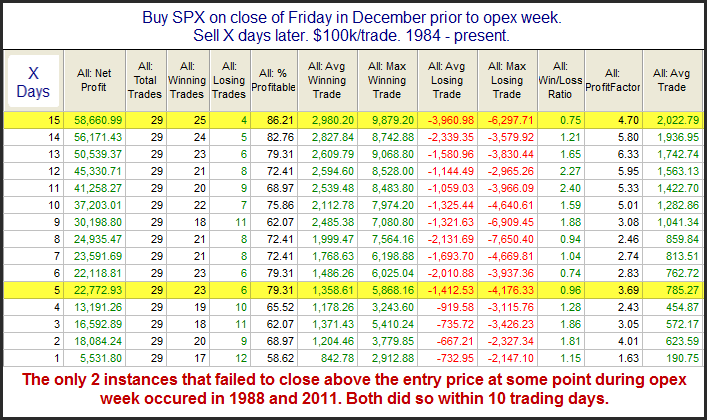

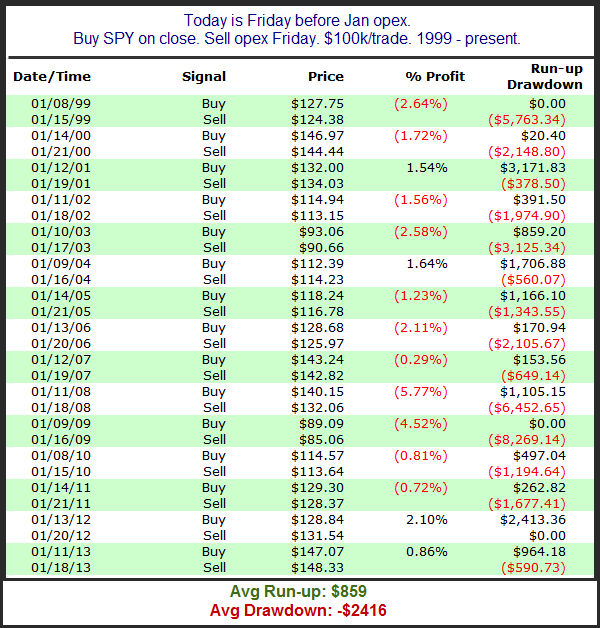

As I discussed last month, opex week in December has historically been wonderful. But January – not so much. Below is a list of the last 15 January opex week returns (updated from the study shown last year). While it is not the case this year, January opex week often occurs in conjunction with Martin Luther King Day. So some of these weeks contained four trading days and some contain five.

Even with the positive performance the last 2 years there has been a decided downside tendency over the last 15 years. The drawdown / run-up stats at the bottom remain quite compelling for the bears. This study still appears worthy of some consideration.

Want research like this delivered directly to your inbox on a timely basis? Sign up for the Quantifiable Edges Email List.