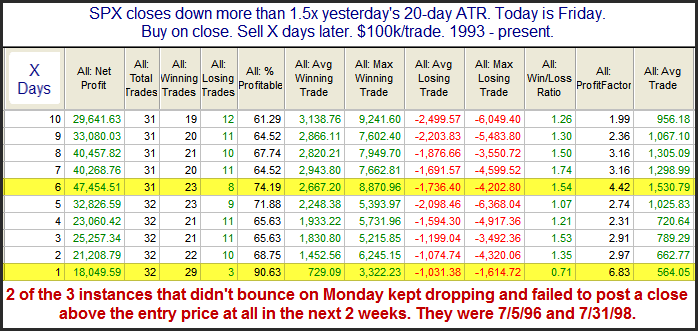

The study below appeared in the Quantifinder on Friday. It is one I last showed on June 3, 2013 and it examines large drops on Fridays. Both the Crash of ’29 and the Crash of ’87 happened on Monday. The Crash of ’87 is still remembered by many traders that are active today. There was a strong selloff on Friday and then all hell broke loose on Monday. But since then strong Friday selloffs have commonly been followed by bounces on Mondays. Perhaps this is due to the fact that fear of a crash causes what might otherwise be an ordinary selloff to become exaggerated and overdone on Fridays. Or perhaps it is just that people don’t want to hold over the weekend. Whatever the reason, the tendency to bounce has been very strong. All results are updated.

The numbers here are all very impressive and suggest a strong bullish bias. Traders may also want to take notice of the note at the bottom of the table. A failure to bounce today could be a warning that the market is not following historical norms and the environment is becoming more dangerous.

Want research like this delivered directly to your inbox on a timely basis? Sign up for the Quantifiable Edges Email List.