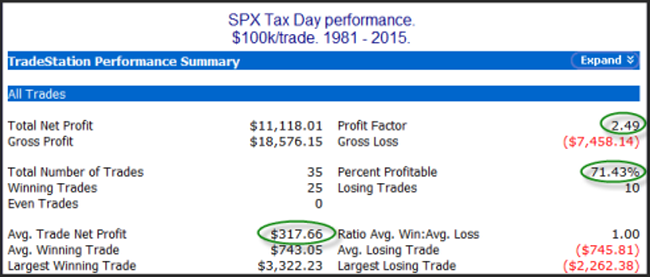

Happy Tax Day?

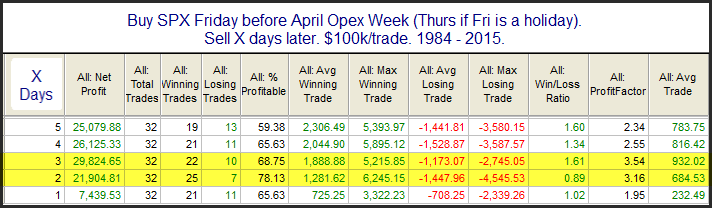

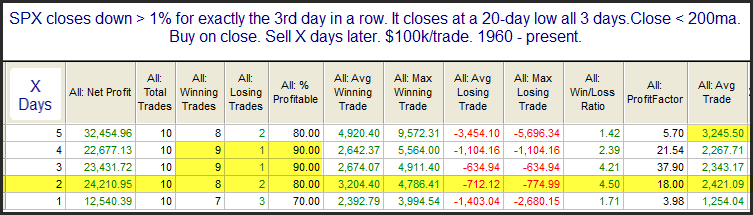

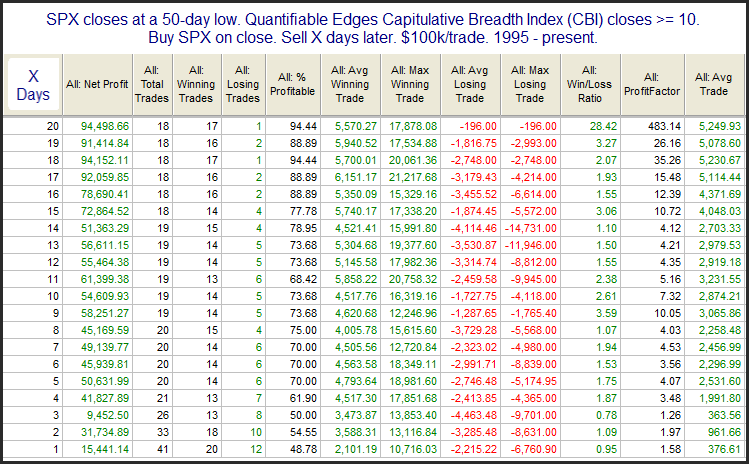

Today is the day taxes are due in the U.S. The reason tax day may be important is that it is the last day that people can make IRA contributions to count for the previous tax year. This can create a last-minute rush and you will often have an inflow of funds heading into the market right around and on April 15th. Fund managers will often put this money to work immediately and it creates a positive bias for the market. Tax Day itself seems to have benefited over the years. I showed this on the blog last year. Below I have updated the statistics.

The numbers are certainly impressive. It looks like the market is going to open with a gap lower this morning so it will be interesting to see if the positive Tax Day seasonality can kick in and overcome today’s weak start.

Want research like this delivered directly to your inbox on a timely basis? Sign up for the Quantifiable Edges Email List.