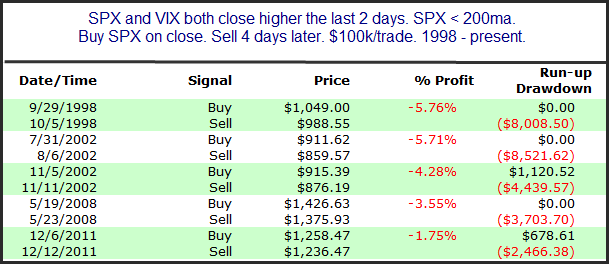

Monday was the 2nd day in a row where the SPX and VIX both closed higher. For those unaware, VIX is a measure of options volatility. It most often will trade inverse to the SPX. So it is unusual to see both SPX and VIX close higher. It is especially unusual to see this happen 2 days in a row. And even more so when SPX is below its 200ma. The study below looks at other times this has happened.

Early indications from this setup suggest the market could experience a sharp drop in the next few days. Instances are too rare to make a big fuss over, but the strongly negative numbers are at least noteworthy.

Want research like this delivered directly to your inbox on a timely basis? Sign up for the Quantifiable Edges Email List.