Sunday Feb 18th marks the 10th anniversary of the Quantifiable Edges Subscriber Letter. I can hardly believe I have been writing it for 10 years, but it is true. A few highlights and anecdotes from the last 10 years…

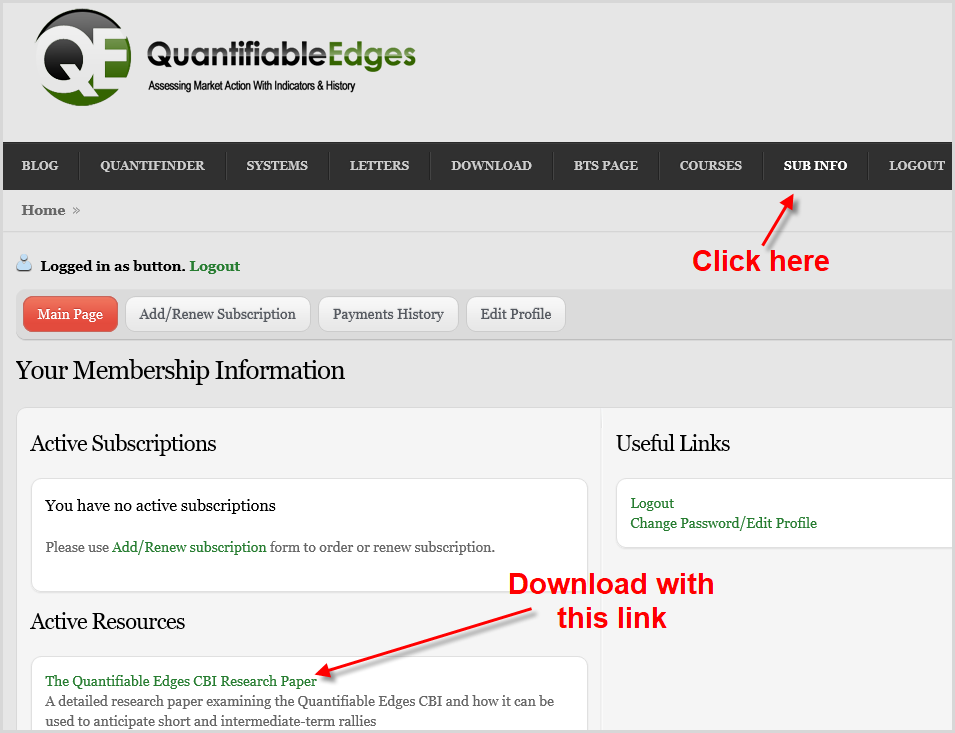

· When the letter began, there was not even a website – just a blogspot blog and a Paypal button.

· My 1st subscriber was Mr. Norwood. I remember distinctly, because my wife grew up in a town called Norwood and I thought perhaps that was a good sign. It was, and Mr. Norwood is still a subscriber today!

· I’ve been honored to be able to speak at several conferences, contribute to books, and be interviewed by magazines. But my favorite interview was with Ben Powers for Your Trading Edge magazine. What made that one special was that they put my name on the cover in big bold letters. My daughter was 6 years old at the time, and after she saw her dad’s name on a magazine cover, she told several teachers and camp counselors that I was famous. (Despite my fame, in 10 years I have yet to ever have someone stop me out in public and ask if I am Rob Hanna of Quantifiable Edges.)

· I have made some good friends through Quantifiable Edges – some who I ended up doing work with and spending lots of time with, and others that I still have never met in person! One friend I spoke with for 8 years before meeting. Then on a family trip a couple of summers ago I finally got the pleasure. Jeff took me all over Orcas Island, and we went out on his boat, and my family and I got to see whales in the wild for the 1st time! It was the thrill of the entire summer!

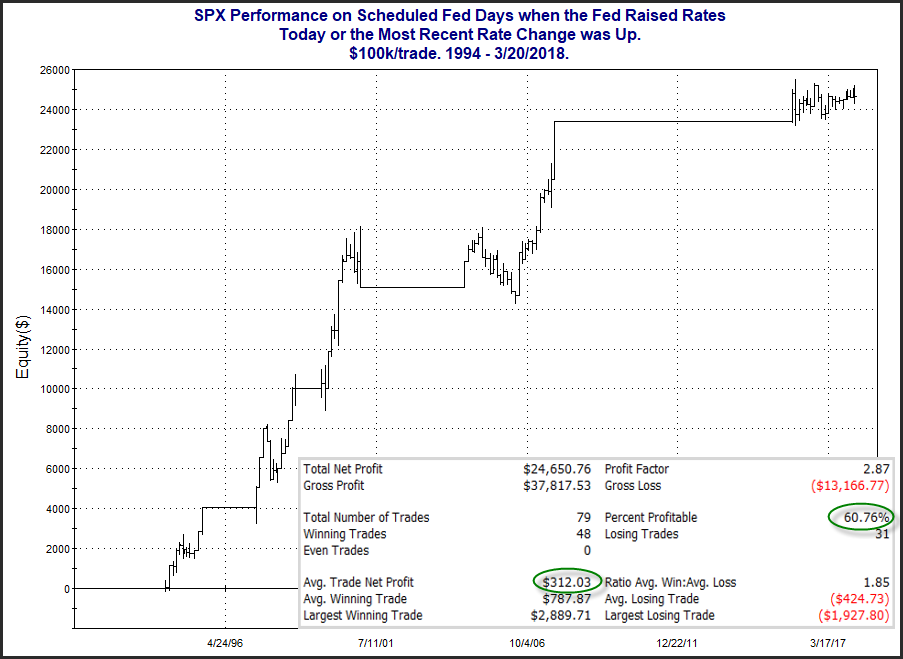

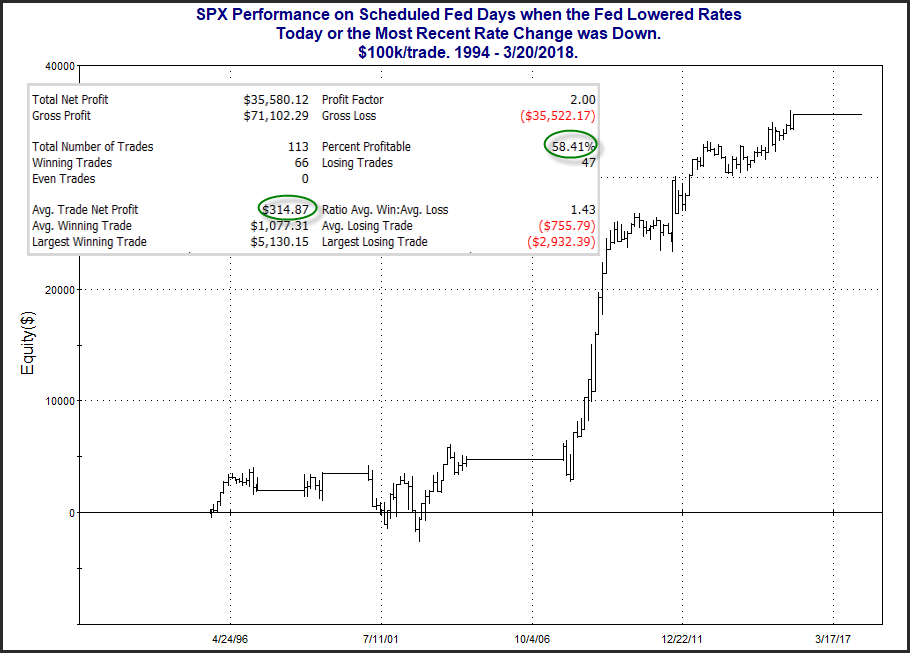

· Another friend I have made along the way is Tom McClellan. Tom’s father Sherman (along with Tom’s mother) created the McClellan Oscillator. I mention them here because several years ago I spoke at an event in California. (I live in Massachusetts.) Sherman lives in California. And when Tom heard I was going to speak at this particular conference, he told his dad he should go see me. So I knew Sherman was coming to see my speech, and I was a bit nervous to meet him and have to speak in front of him and a big crowd. The function room where I was speaking had about 250 chairs set up. Sherman was one of the 1st people to arrive, and he came up and introduced himself and we spoke briefly before I had to talk. My talk was about Fed Days, and I guess I chose a topic that was too narrow for many people, because of those 250 chairs, 238 of them went unused! I flew all the way across the country to speak in front of 12 people! And Sherman McClellan, whose work I greatly admired, and who I had hoped to impress was one of those 12. I was mortified. He couldn’t have been nicer. But I was still mortified.

So thanks to Quantifiable Edges I have had some wonderful experiences, and some trying ones. I’ve met many terrific people. I have also traded through a lot of ups and downs – both professional and personal. Many of my market calls and trade ideas have turned out very well, and a few have not. But when it comes to QE, perhaps the stat I am most proud of is this one: in 10 years there has never been an NYSE opening bell that was not preceded by a Quantifiable Edges Subscriber Letter. Through ups and downs, deaths, surgeries, illnesses, vacations and more, I have managed to get a letter out every single night for the last 10 years. (I didn’t always WANT to write it, but I always have.) And at this point I am as energized as I have ever been to continue writing. But I will say this…some time in the next 10 years I intend to take a day off…maybe even a few days off. Not yet, though. Sunday will mark the 10th anniversary, and I’ll once again be writing the letter, looking to find Quantifiable Edges that will help me and my subscribers.

Thanks to all the readers and subscribers who have supported the Quantifiable Edges Subscriber Letter over the years. And if you don’t have a subscription yet, then there is no time like the present. Don’t wait another 10 years before trying it!