The Quantifiable Edges Capitulative Breadth Indicator (CBI) has been in play lately, but todays Holy Thursday rally is taking it down from 7 yesterday to likely 0 at the close this afternoon.

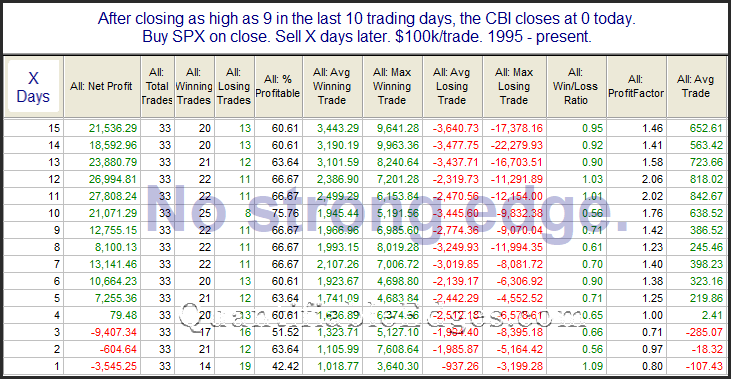

After alerting followers of the move to zero, I received a few questions asking about SPX performance following such drops in the CBI. I looked at it a number of ways. Results are pretty much what I expected, but some of you might find them disappointing. Below is an example of one test I ran looking for an edge.

I don’t find the numbers here to be compelling for either the bulls or the bears. This is not terribly surprising, since 0 is considered “neutral”. This does not mean that there is no edge to be found in the market at the moment. It does mean that traders will need to use tools other than the CBI to identify an edge. Capitulative selling that was evident a few days ago has been exhausted. We’ll need to wait a while until the CBI comes back into focus. In the meantime, I’m sure we will find hints elsewhere.

To learn more about the CBI, check out the CBI Research Paper.

Want research like this delivered directly to your inbox on a timely basis? Sign up for the Quantifiable Edges Email List.