Declining SPY Volume At New Highs

Over the holidays it was easy to ignore the low volume and dismiss it as typical holiday traffic. Traders may have now returned but trading volume is still lacking. The low volume isn’t blatantly obvious because it’s still higher than it was during the holidays. Still, it’s definitely going in the wrong direction here. Below is a study I looked at last night using SPY.

Aggregator System for Swing Trading The S&P 500 Finishes 2009 Up Over 36%

A couple of months ago I discussed the Aggregator System on the blog for the 1st time. The Quantifiable Edges Aggregator is a tool I introduced just after I began publishing the Subscriber Letter. The Aggregator tool looks at two things:

1) The net expectations from the active studies published in the Subscriber Letter and on the blog over the next few days.

2) The performance of the S&P versus expectations over the prior few days.

The Aggregator System produces mechanical signals based on the values supplied by the Quantifiable Edges Aggregator. Its signals are based on the S&P 500 cash index and all trades are assumed to take place at the close.

While it can sometimes be difficult to anticipate whether that night’s research will suggest a bullish or bearish tilt and whether it will be enough to shift net expectations, I have been able to incorporate the Intraday Quantifinder into the process to get a fairly accurate read on what the Aggregator is likely to signal that night.

“Probable” signals are published on the Quantifiable Edges systems page about 10-15 minutes before the bell each day. I’ve been publishing them for nearly 4 months now and to this point I believe there has only been one instance where the “probable” signal was switched based on that night’s research.

Once the “probable” signal is posted each day I typically send out notification and a link via Twitter to alert subscribers.

When I first discussed the Aggregator System on the blog in October it was trying to fight out of an 8% drawdown. It did manage to do so and it finished 2009 at a new high. The total reinvested (hypothetical – not including commissions/dividends/interest on cash) return for 2009 was 36.27%. The Quantifiable Edges Subscriber Letter began publishing on 2/25/2008 so that is as far back as Aggregator values go. Total returns for the partial (10+ months) year of 2008 was 60.20%. Therefore the total compounded profits since inception have been 118.31%.

For more general information on the Aggregator System and the Quantifinder you may refer to these posts:

1) The Quantifiable Edges Aggregator

2) The Quantifinder Unveiled

3) Quantifying the Value of Historical Research (The Aggregator System)

A detailed research paper on using the Aggregator System is available on the Quantifiable Edges Systems page in the members’ area. You may also download the complete performance spreadsheet there showing many different statistics and details of all individual trades. All this information may be accessed with a free trial.

I’ve placed a graphic on the right hand side of the blog showing the Aggregator System (hypothetical) equity curve. I will continue to update the performance periodically.

So what does a subscription to the Aggregator System cost? It’s included with all gold memberships. If you’ve never trialed Quantifiable Edges, you may sign up to do so here.

If you have trialed it in the past, but would like another peak before subscribing, just send an email request to support @ quantifiableedges.com (no spaces).

A Study Based On Thursday’s Action

Thursday’s price & volume action had a lot of characteristics that would appear bullish. These include the fact that it posted an outside day and closed higher. It also made a new 50-day intraday high. The SPX is in a long-term uptrend and trading above its 200ma. Lastly, the volume rose Thursday as the market rallied. Sometimes it can be interesting to take a number of market observations like these that would seem to obviously suggest a bullish edge and run them through the wayback machine. Below is a study that did just that:

Rather than combining for a bullish edge it appears the scenario above has often been followed by downside.

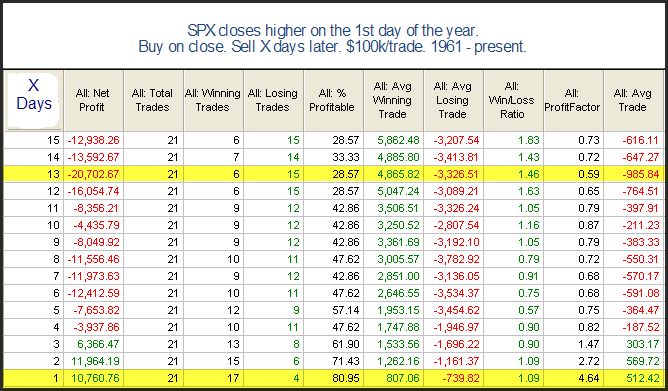

After An Up Day To Start The Year

One interesting study I showed in last night’s Subscriber Letter was to look at market performance following a positive 1st day of the year. Below are the results:

There appears to be a high probability of immediate follow-through. After the first 1-2 days, though, expectations expectations for the next 2-3 weeks turn negative.

Why The 1st Day of January Has Been So Interesting

Back in July I did a study that looked at the upward bias of the 1st day of each month. As you may recall I ran the study back to 1987 because prior to that there was no significant bias on the 1st day of the month. January is interesting because over the last 23 years its had the worst % profitable of any month but still the 4th highest average returns. When New Years optimism runs high it can create a sharp up move. In fact there have been 3 years (1988, 2002, 2009) since 1987 where the S&P 500 has gained over 3% on the 1st day in January. Below is a copy of the table from the July 1, 2009 blog post with breakdowns by month (stats not updated).

Best of Quantifiable Edges 2009

So the other day I ran a “Greatest Hits” of 2009. They were the most popular posts I wrote each month of the year. When going through them I realized I would have chosen very few to make any kind of top list myself. So now I present to you MY picks for the “Best of Quantifiable Edges 2009”. (Note while there are only 1 or 2 on the other list that would have had a chance to make this one, I didn’t allow for repeats. These are all less popular than those.) In countdown reverse order…

15) Equity Put/Call Ratio Suggests Down Day

14) The 2009 Rally – Breadth Without Compare

13) 3 Lower Closes – A Largely Misunderstood Edge

12) My Take On Optimal Position Sizing

11) Turnaround Tuesdays (A myth that actually confirmed!)

10) Stops Part 2 – When to Use Them

9) Gaps Up From 10-day Highs

8) Intermediate-term Consequences of a 30’s-Like Market (I still believe the market will undergo several intermediate-term exaggerated overreactions in both directions over the next few years.)

7) Some simple shorting systems

6) A Long-term look at Put/Call Ratios

5) The Importance of Positioning In Analysis

4) Distribution Days Quantified (Tradestation code associated with this study is available on the Free Downloads page.)

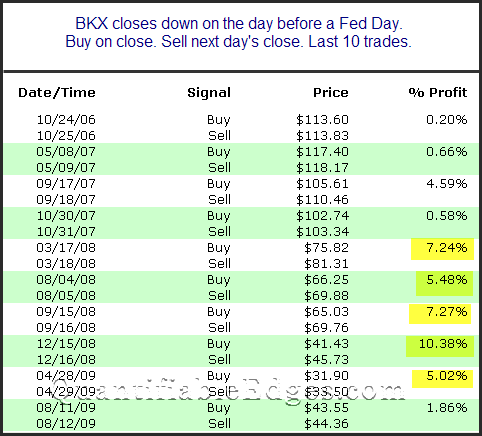

3) A Long-Term Look At Fed Days

2) My Interview With The Kirk Report (More than just a post. This is long but Charles Kirk got more info out of me than the rest of these posts combined.)

1) The Quantifinder Unveiled & Quantifying The Value of Historical Research (These tools represent Quantifiable Edges biggest accomplishments this year – effectively semi-automating the application of historical research to trading.)

I’m very much looking forward to 2010. The Quantifiable Edges Big Time Swing System was just released and feedback so far has been great. I’m excited to monitor the progress of that in the upcoming year. Additionally, I’ll have more announcements in the coming weeks about improvements and new features for the website.

A safe and happy New Year to all. Thanks for reading, writing, and inspiring me throughout the year!

Quantifiable Edges Greatest Hits of 2009

So my son got Band Hero for Christmas and the Hannas now rock. Like a rock band, I decided Quantifiable Edges needed to release a “Greatest Hits”. The list below shows the most popular post (by number of hits) for each month of 2009. I’m calling it “Greatest Hits” because it is based on popularity. I don’t think it’s a “Best Of”. Many of my favorites were excluded and some of the ones below I didn’t think were all that great. So perhaps I’ll have some time to put together a “Best Of” later this week.

Jan – Stops Part 1 – When Not To Use Them (Somewhat controversial post here. One I should perhaps expand on at some point.)

Feb – 2% Gaps Down Revisted (We see here that large gaps down often fail to hold over the next few days.)

Mar – Why Tuesday’s 90% Up Day May Not Be Bullish (The implication of this popular study couldn’t have been more wrong.)

Apr – The Most Overbought Market In At Least 23 Years? (Based on a short/intermediate-term indicator.)

May – A Simple & Powerful Timing Indicator (Includes a heavily downloaded free spreadsheet available on the free downloads section of the website.)

Jun – From A High To A Low In 1 Day (A study that looks at a fast move from the high end of the market’s range to the low end.)

Jul – What Happens After A Sharp Contraction In Volatility (I now track this indicator each night on the members charts page. There are also a few studies associated with it that are tracked by the Quantifinder.)

Aug – Percent of Stock Above Their 200ma’s Hitting Extreme Levels

Sep – Never Have So Many Stocks Been So Stretched Above Their 200ma (I’m seeing a theme here. Everyone loves to hear how we’re hitting all-time extremes. It’s like when I was little and I would be excited when the weatherman said we made a record high or a record low on the day.)

Oct – Extreme Weakness Never Before Seen By This Measure (The measure was the McClellan Oscillator. The comparison was a little unfair since it used the standard McClellan Oscillator rather than the ratio adjusted version. I now track the ratio adjusted version on the members charts page. Traders not familiar with the McClellan Oscillator should familiarize themselves with it. And while the oscillator has been around a long time, the McClellan’s continue to do good work to this day. The “Learning Center” on their website is full of goodies. https://www.mcoscillator.com/learning_center/ )

Nov – What A Strong Early Tick Has Meant In The Past – Perhaps I’ll need to post more intraday edges in 2010.

Dec – Twill Be 3 Nights Before Christmas (A seasonal study. It was only posted about a week ago.)

Introducing The Quantifiable Edges Big Time Swing System

After much hard work I am pleased to announce the release of the Quantifiable Edges Big Time Swing System. The QE Big Time Swing System simply combines a few of my favorite edges into a powerful new swing trading system. The system was designed to trade the major indices. It looks to take advantage of high probability, high expectancy moves that generally occur about once per month. Using SPY over the last 16 years it has shown great consistency in both profits and frequency of opportunities. The system trades both long and short in both up and down markets.

It is not a black box. It is completely open sourced and Traders may even elect to purchase the open code in Tradestation and Excel formats. While it’s completely open it still comes with a supporting web page for purchasers as well as a 2010 alert service at no extra cost.

I’m extremely excited to be able to offer it at this time. I’m confident it will help some traders improve their results in 2010. For more information please visit the Quantifiable Edges Big Time Swing overview page.

Rob

If you have questions after viewing the information page, feel free to email them to BigTimeSwing @ QuantifiableEdges(dot)com

Index Put/Call Closes Below Equity Put/Call

Due primarily to some massive trading in index calls in the last ½ hour of the day on Tuesday, the CBOE index put/call ratio actually finished lower than the CBOE equity put/call ratio. This has only ever happened 4 other times since they began tracking the data in 2003. It’s dangerous to try and draw conclusions from only 4 instances, but I found the results below interesting enough to share. I’ll continue to monitor this setup in the future to see if the early indications hold true.

Twill Be 3 Nights Before Christmas

At Tuesday’s close we will enter the next strongly bullish seasonal period. Last year I showed the “Twas 3 Night’s Before Christmas” study. I have updated that study below.

High Vol Rise on Op-ex Day – Good or Bad?

Option expiration on Friday saw the market rise on exceptionally high volume. Over the last 13 years high volume rises on an up op-ex day have often led to a selloff.

Could it be different this time? If it opens here then it already is. In no instance over the last 11 years did the market gap higher by as much as 0.5%. It did manage to do so on 12/21/98 – exactly 11 years ago. It also added to the gains and closed above the open that day. Overall implications appear short-term bearish though.

Nasdaq Confirms S&P New High – Does It Matter?

Below is some research from last night’s Subscriber Letter…

The S&P and Nasdaq set new closing highs Monday. They were the 1st closing highs since late November. Typically when the SPX breaks out to a new closing high after not making one for at least a couple of weeks, it leads to short-term follow through. I looked at this a few different ways – using both SPY and SPX and considering 50 and 200 day highs. All the results came out very similar. Below is one example.

I find it interesting that the while the breakout typically is accompanied by short-term follow through, it doesn’t carry over to the intermediate-term.

One thing I’m neglecting to look at in the above test is the fact that the Nasdaq also broke to a new closing high. Many traders might see this as “confirmation” of the S&P’s closing breakout. I decided to check and see how much difference the Nasdaq confirmation made.

These results are almost identical to the first test, though with a reduced sample size. I compared several ways and kept coming up with the same answer. The confirmation seems to be worthless. It neither greatly enhances nor greatly detracts from results. This holds true both short and intermediate-term. Frankly this was a bit surprising to me since we know a leading Nasdaq has been a good sign historically.

The Most Wonderful Tiiiiime Of The Yearrrrrrr

This week is options expiration. Over the last 25 years December options expiration week has been the most consistently positive week of the year for the SPX. Below I’ve updated and expanded the study from last December that looked at this phenomenon.

The bullish tendencies over the last 25 years have been exceptionally strong. And as we now see above, not only do you have strong indications that this upcoming week carries an upside edge, but also out as far as 3 weeks.