Big Gaps Down the Day Before a Fed Day

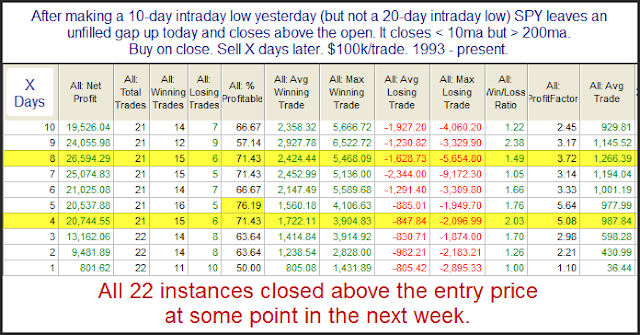

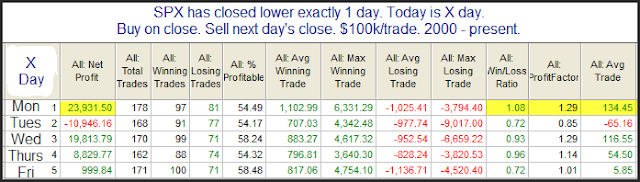

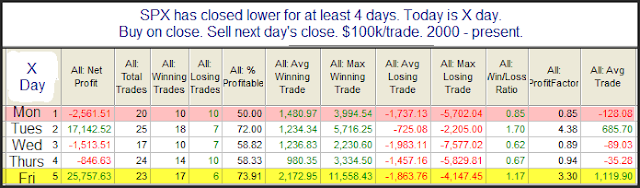

The pre-market indications are for a gap down of about 1% as I write this around 8:20am EST. With tomorrow being a Fed Day I decided to see how the market has performed other times it has seen large gaps down on the day prior to a Fed Day. This first study looks at performance from open to close on the day of the gap down.

Note that the only instance that did NOT gap down at least 1% was the last one on 12/12/11. Instances are low. Initial returns are mixed with a mild bearish tilt.

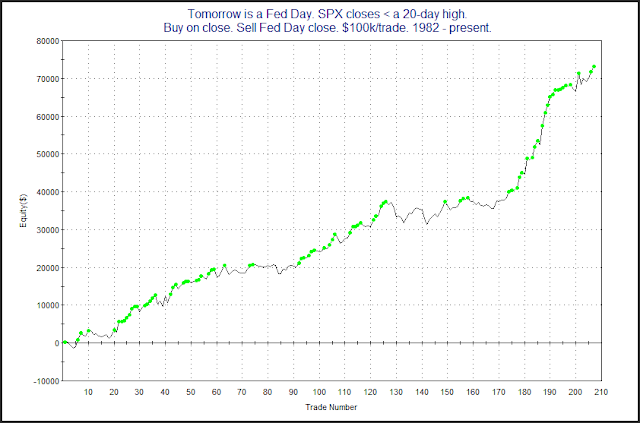

Now let’s see what happens if we hold through the Fed Day.

Here we see a big turnaround. All the 1% gaps down turned net positive from their opens. And the only instance not to see a gain of greater than 1% on the Fed Day was the last one (which gapped down less than the others to start). It added to its day 1 losses.