Another Study Suggesting The Bounce Continues To Look Good

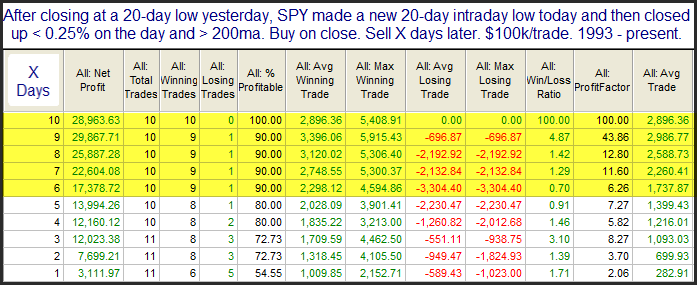

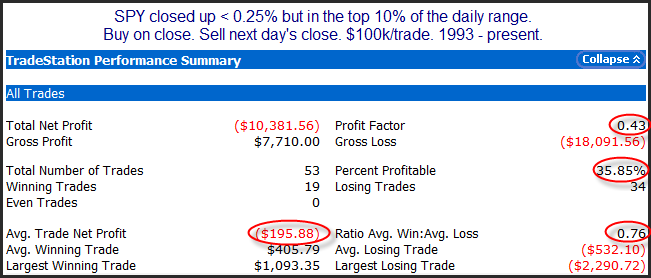

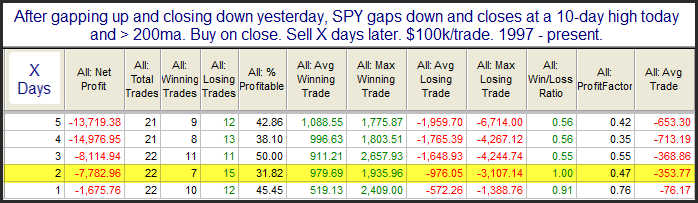

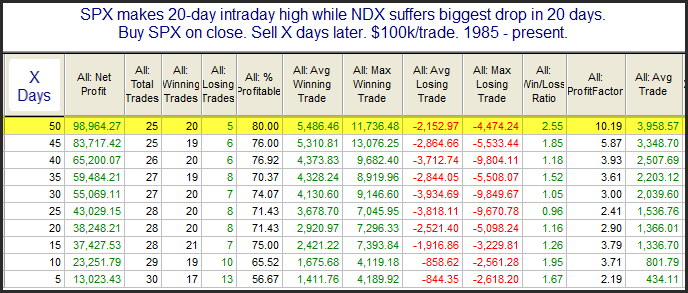

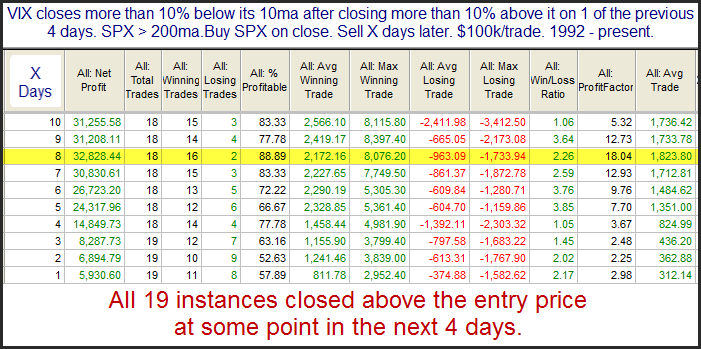

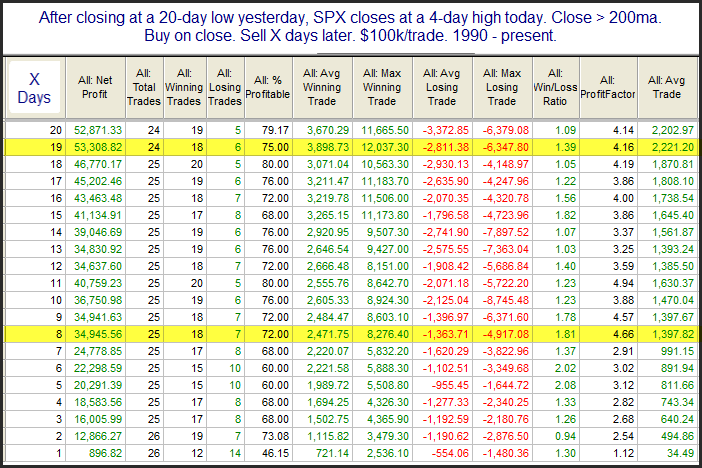

I showed on Friday that the “weak” bounce coming off the 20-day low was not something to be frustrated about. More evidence along those lines triggered Friday afternoon with the following study:

Instances are a little bit low here, but the stats are compelling. I’d also note that all 11 of the instances that closed higher 4 days later did so by over 1%. So the intermediate-term low has often been a nice launching pad. Of course not everything is pointing higher right now. So it will be interesting to see how things play out. But this one narrow view suggests the bounce could have further to go.

Want research like this delivered directly to your inbox on a timely basis? Sign up for the Quantifiable Edges Email List.