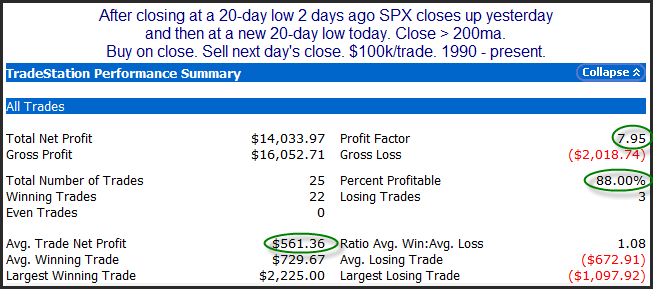

Thursday quickly undercut Tuesday’s closing low and put an end to Wednesday’s bounce attempt. How has the market responded under similar circumstances in the past? For the study below, I look at times when a 20-day low was followed by a 1-day bounce and then another 20-day low (when above the 200ma).

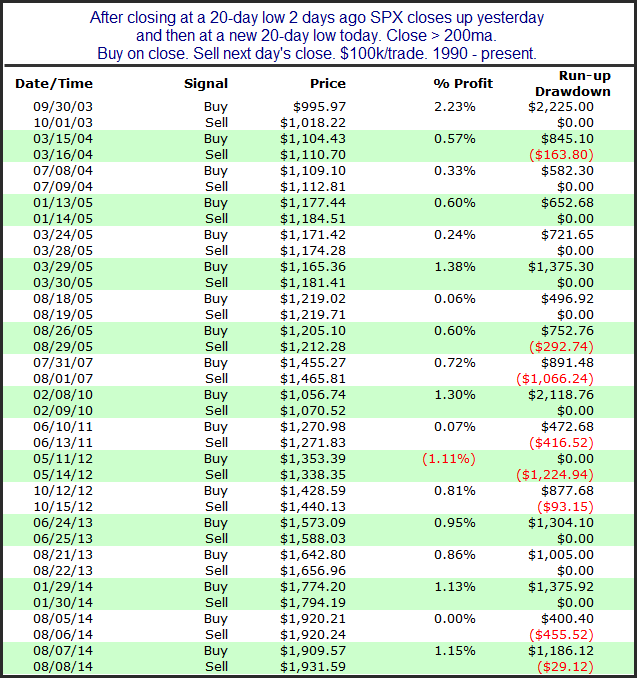

The numbers here look very solid and suggest a bullish edge for Friday. In fact, the setup has done especially well in recent instances. Below I listed the last 18 trades.

17 of 18 winners is quite the streak. I will also note that the stats have been substantially less impressive when SPX has been below its 200ma. This edge has only been prevalent during long-term uptrends.

Want research like this delivered directly to your inbox on a timely basis? Sign up for the Quantifiable Edges Email List.