A Look At Past NDX Leaders That Gapped Down Big (For FB Traders)

After the market close on Wednesday, Facebook (FB) released earnings, and the news and future outlook was not viewed well. After closing at an all-time high on Wednesday, it traded down in excess of 25% in the after-hours. So it seems certain it will be opening Thursday with a sizable gap lower. I decided to take a look back at other leading NDX stocks that suffered large gaps down. I first checked for all stocks that:

- Closed at a 252-day (1-year) high yesterday

- Were a NDX constituent at the time

- Opened over 15% below yesterday’s close

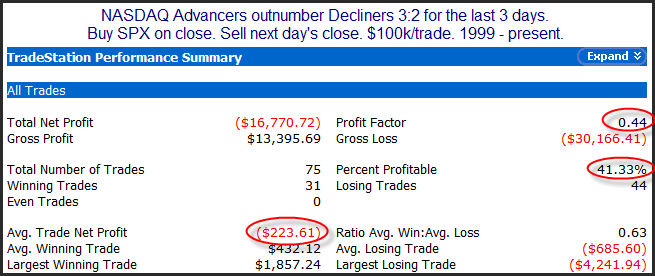

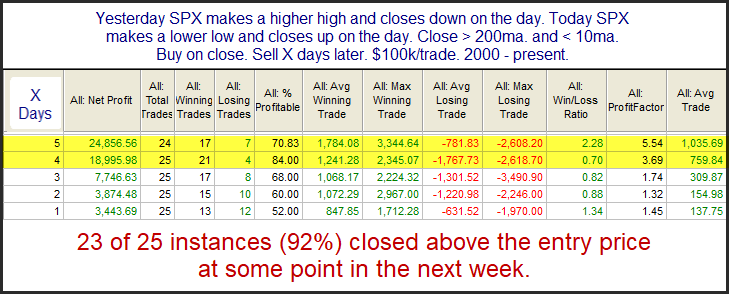

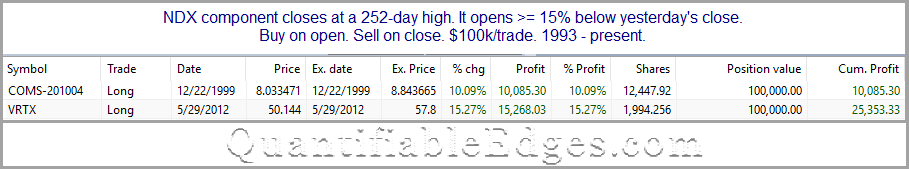

Looking back to 1993, I found only 2 examples. They are shown below with results of buying at the open and selling the close the same day as the gap down.

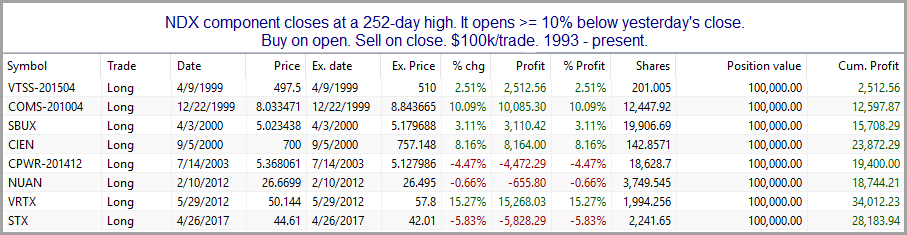

Amazingly, there have been only 2 instances in the last 25 years. Both saw sizable intraday bounces. Loosening the criteria to require only a 10% gap down yielded the following results.

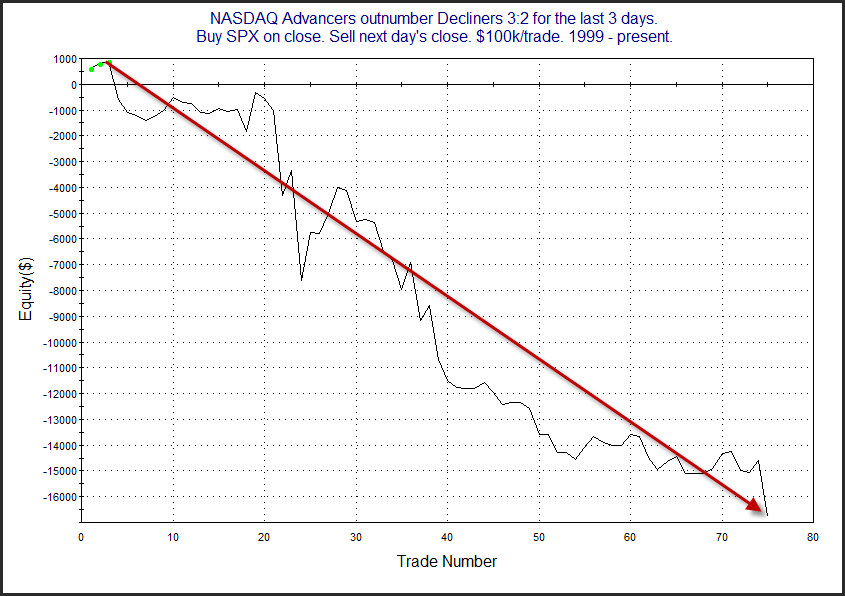

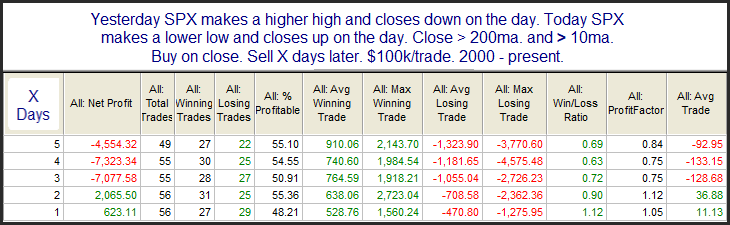

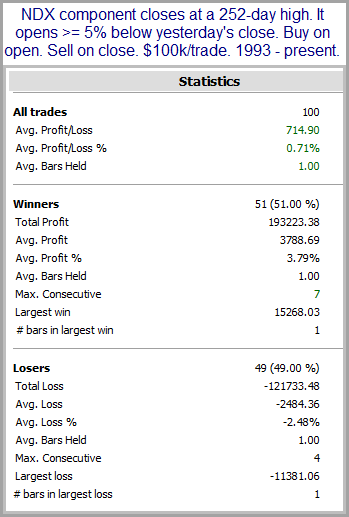

Most of the gains here were thanks to the COMS and VRTX trades from above. I also decided loosen the criteria further and require just a 5% gap down from a 1-year high. Below is a results summary.

Exactly 100 instances and about even as to whether the stock bounced or sold off further. But winners outweighed losers by a sizable amount, making for strong net gains for the study.

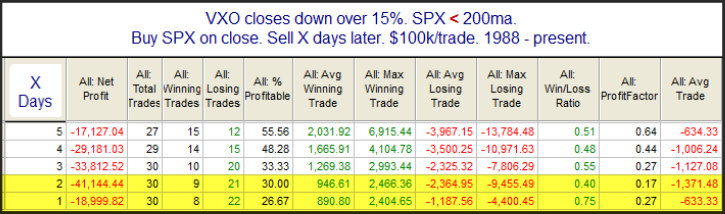

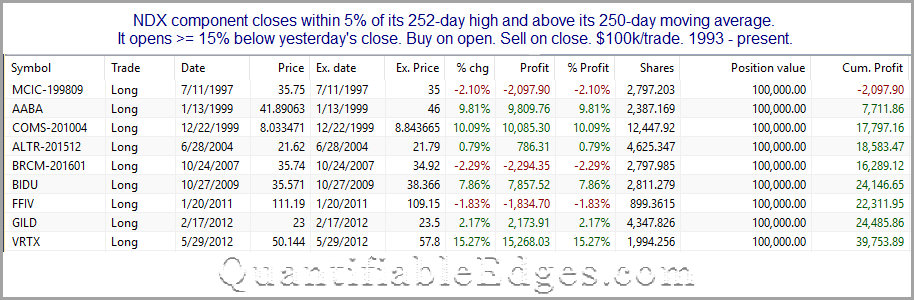

Lastly, I went back to the 15% gap down requirement, but I loosened the other criteria so that a stock simply had to close above its 250-day moving average and within 5% of its 252-day high. Those instances are all listed below.

It appears the overall tendency when a leading NDX stock gaps down a sizable amount from a high area is for the stock to rebound some between the open and the close. But volatility and variance is very high. Traders need to decide whether the upside edge and the potential reward are worth the risk when considering trades in FB on Thursday.

Note: Tests were run on Amibroker using Norgate data.

Want research like this delivered directly to your inbox on a timely basis? Sign up for the Quantifiable Edges Email List.