Overall market movement has an influence on the performance of individual stocks. This is true over both short and long-term timeframes. For short-term traders, the importance of supportive market movement can be difficult to quantify. Using Quantifiable Edges long-established stock trading systems and our long-established market timing tool, I demonstrate and quantify the relationship between market movement and system trade probabilities for individual stocks and ETFs.

Quantifying the Importance of Market Direction for Individual Stock & ETF Trades

The research paper is available for free download by all registered users at Quantifiable Edges. (Anyone that has ever bought anything or signed up for a free trial or registered for our free downloads. In other words, anyone with a username and login.) If you do NOT qualify, but would like to get a copy of Quantifying the Importance of Market Direction for Individual Stock & ETF Trades, you may sign up for a Free Trial, or register for our Free Downloads. This will grant you access to all of our other free downloads as well, including the Quantifiable Edges CBI Research Paper, the Fed-Based Quantifiable Edges for Stock Market Trading research paper, and more.

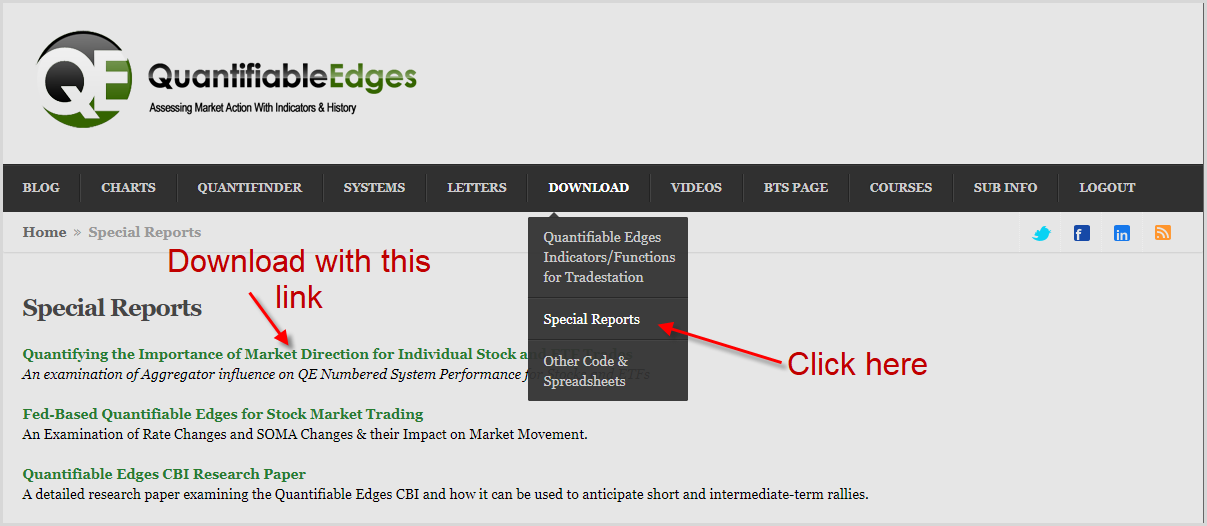

If you already have a username and login at Quantifiable Edges, just login and follow the simple instructions below to download the research paper. I hope you find the research helpful!

Want research like this delivered directly to your inbox on a timely basis? Sign up for the Quantifiable Edges Email List.