One Strong Short-Term Positive About Thursday’s Breakout

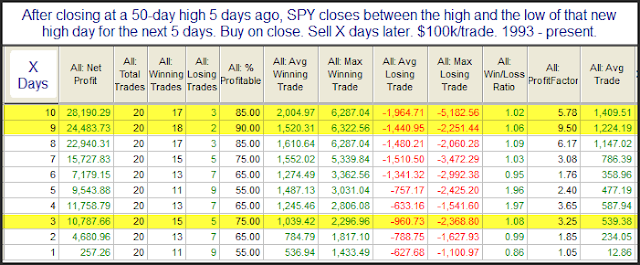

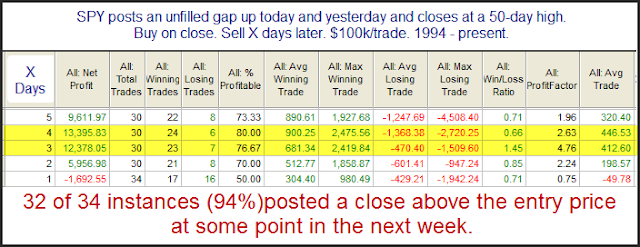

In the 7/19/12 blog I looked at the short-term importance of an unfilled upside gap accompanying a breakout. With yesterday’s breakout occurring along with an unfilled up gapI have revisited that study below.

Results here are strong across the board.

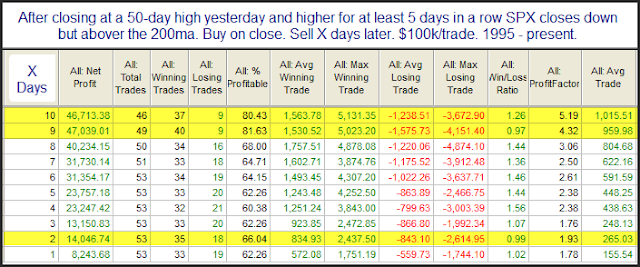

Now let’s look at instances where the 50-day high breakout was not accompanied by an unfilled gap. Interestingly, the number of instances was nearly the same. This study also appeared in the 7/19/12 blog and is updated.

As you can see these moves to new highs that don’t start with an unfilled gap are much less reliable over the short-term.

Technicians will often use the term “breakaway gap”. This suggests the gap occurs on the same day as a base breakout. The idea is that the new high causes excitement and the gap leaves a good amount of people sidelined or stuck short. When it doesn’t immediately fill, it leads these people to chase and helps to propel the market even higher.