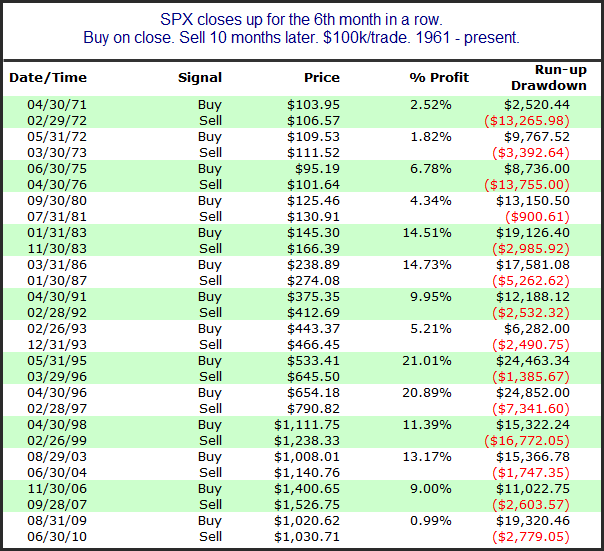

April marked the 6th month in a row that SPX has managed a positive close. I have seen many analysts suggest this means the market is overextended and due to correct in the coming months. So I decided to take a look for myself. I ran a study to examine past performance following 6 consecutive months of gains.

The 1st month out of the gate looks to have about breakeven odds. After that everything points to the bullish case, with strongly positive stats across the board for the next 10 months or so. In fact, 10 months out all 14 instances were higher. Below I have listed the 14 instances.

Some strong results here. Based on this, it appears that the bulls should be celebrating that 6-month rally, rather than the bears trying to use it as evidence for an overdue pullback.

Of course there has also been a lot discussed about “Sell in May” and the possible weak upcoming seasonality. I did a detailed study on this in the intermediate-term section of the Subscriber Letter this past week. If you would like to read it you may sign up for a free trial using the link below.

https://quantifiableedges.com/members/register.php