Turnaround Tuesdays

Many traders have heard the term “Turnaround Tuesday”. And with the market a bit short-term oversold after the selloff the last few days many traders are also hoping we see a Turnaround Tuesday. But are they just a myth? I recently put them to the test.

First I looked at performance if the market closed lower 1 day. In the table below I show all the days of the week. The day listed is the trigger day – not the performance day. In other words, if Monday was the 1st down day then the S&P would be bought at the close and sold at Tuesday’s close. So the Monday trigger tracks Tuesday’s performance. Tuesday’s trigger tracks Wednesday’s performance…and so on.

Here we see going back to 1960 that Tuesday had the only positive results of the week.

What if the market was down 2 days (as it is now) instead of just one?

Tuesday is again positive, but in this case Thursday has actually performed a little better.

How about 3 days in a row?

Here again Tuesday is the star of the week.

But these tests all went back to 1960. What if we instead just look at more recent times? Below I show results for just this decade:

In all cases Tuesday shows by far the best potential for a turnaround. The results are even better recently than if you look back 58 years. It appears Turnaround Tuesdays are real…and they’re not just for old folks.

Gold Level Subscription Scorecard For December

December was an extremely quiet month for trade ideas. There were only 7 trade ideas closed during the Month. April and July both had 13 trade ideas closed, which was the previous low. This was due to a few reasons.

First, there were several trade ideas that didn’t receive fills. This was primarily due to the market gapping in our direction and not providing an entry opportunity.

Another reason for the low number of “official” trade ideas was the fact that no Catapults triggered. Catapults were plentiful in October and November. Typically 2-3 times each year there will be a decent sized cluster of catapult trades for traders to try and take advantage of.

Lastly, the action itself in December was extremely choppy. The S&P didn’t close in the same direction 3 days in a row at all in December. Several of the strategies are mean-reverting and mean-reverting strategies don’t trigger when you don’t get far from the mean.

Now for my usual caveats and explanations before unveiling the results.

I don’t suggest position sizes. The primary reason for this is I’m not acting as a financial advisor. I don’t feel it is appropriate to suggest allocation sizes without understanding someone’s financial situation and risk tolerance. Even for my own trading I run different portfolios with different levels of aggressiveness. For instance, my most aggressive portfolio is my IRA. Here I may use options to sometimes get 400-500% leveraged. Other portfolios on the other hand normally take much more conservative stances and some rarely reach or exceed 100% exposure.

Since I don’t suggest position sizes this is should not be considered a performance report, but rather a trade idea scorecard. Therefore, no matter how objective I try to be the reporting of the results is always going to be skewed depending on how you approach the trades. For instance, I always recommend scaling into the Catapult positions in 3 parts, whereas the “System” trades (whatever system I unveil other than Catapult) are normally one entry. The “Index” trades I normally recommend scaling into as well. For my own trading I trade much larger size with the index trades than any of the individuals. I also control my exposure by limiting the total amount invested per day. As I mentioned, this will vary depending on the account I’m trading. My most aggressive account I may put in up to 100%/day and get heavily leveraged using options. A more conservative account may max out at 15%-20% per day.

It’s unlikely anyone would have taken all of the trades with equal amounts, so personal results would vary greatly depending on the trader’s approach. All that aside, below are December’s results (click to enlarge):

In the next couple of days I will post a 2008 summary.

For anyone who would like to trial the Quantifiable Edges Gold Subscription you may do so by simply clicking here.

Links

I’m a little under the weather today, so rather than producing research myself, I’ve decided to add a few links to the blogroll and point out some recent articles I found interesting.

First the articles:

From Active Trader Mag I recently came across this interesting article which places bands around RSI levels rather than looking at absolute levels.

Market Rewind with tests of consistently oversold and overbought RSI readings. Incidentally, one feature of the new Market Rewind ETF tools shows 5-day historical short-term RSI’s on a massive number of sortable ETF’s. I’ve beta-tested the tool. ETF traders should definitely check it out when it goes live.

Can’t get enough RSI talk? Check out MarketSci and Woodshedder.

For those looking to improve their intraday trading, it’s not uncommon that Traderfeed comes up with a gem like this one last week.

Now few a few blogroll additions that are long overdue:

Behind the Headlines – Barrons columnist Michael Kahn offers more insights on his blog.

Skill Analytics – Would’ve thrown this one up there a while ago but he just didn’t post that often. Postings have picked up recently and he now provides a nice ETF correlation tool as well.

The Deipnosophist – Smart reading about the market.

I’ll save further additions for another sick day.

How The Market Has Reacted To 2.5% – 5% Drops During The Bear

The SPX closed lower by 3% today. I’ve looked at drops of 5% or more in depth in the last few months and found there to be a tendency for a short-term bounce following such steep drops. Tonight I decided to see how drops between 2.5% and 5% have fared since the beginning of the bear market.

In these cases further downside was more common. 84% of instances closed below the trigger price at some point in the next 3 days.

Quantifiable Edges Aggregator Suggesting A Short Bias

The dashed line shows the average return of the S&P over the last few (in this case 3) days. The solid black line I refer to as the Differential line. It subtracts recent performance from recent expectations. When the Differential is negative it indicates the market has outperformed expectations over the last few days. A positive Differential indicates the market has underperformed expectations over the last few days.

As of last night’s close the green Aggregator was slightly below 0 and the black Differential line was squarely below 0. This means that the studies are indicating a slightly bearish bias over the next few days while the market has outperformed expectations over the last few days and is overbought. This is a configuration I will typically look for to enter short trades. A configuration to enter long trades would see both the green and black lines above 0. It’s important to note that the Aggregator is not a mechanical system. It is simply a graphical representation of my studies vs. the S&P 500.

For a free trial to the Quantifiable Edges members area and to see how I incorporate the Aggregator in my analysis simply click here.

When the S&P Jumps Higher Yet New Highs Contract

To get a decent sample size I loosened the parameters to look at all times the S&P made a higher high by at least 1.5%. The results are below:

Should You Time The Entries Into Your 401k?

With market action slow over the last week I thought I’d address a question I received about 401k timing and RSI(2). From David recently:

“Could 2 period RSI be used to produce better dollar cost averaging returns in a 401k?Instead of doing 401K contributions on 15th and 30th of every month, what do you think of having the contributions go into a money market account, and waiting for the next RSI

I ran a test from 1/1/98 to sometime last week. If someone placed $100 into their 401k twice a month for the last 11 years the total invested would be $26,400. (I used the 1st day of the month and the 1st trading day after the 14th for simplicity.)

If their returns matched the S&P 500 that $26,400 would now be worth $19,748.34.

If instead of investing the $100 on or about the 1st and 15th, the person decided to enter on pullbacks to where the 2-period RSI was below 20, the $26,400 would now be worth $19,777.66.

In other words 11 years worth of effort would have made them an extra $30.

The issue is they are only making $100 trades the entire time. $30 isn’t great but it isn’t terrible when you’re only trading with $100.

The lesson here is that trying to time the entry of your money into your 401k is a waste of time. If you are going to boost your returns you need to focus on trading the account.

Gap Shrinkage & What It Suggests

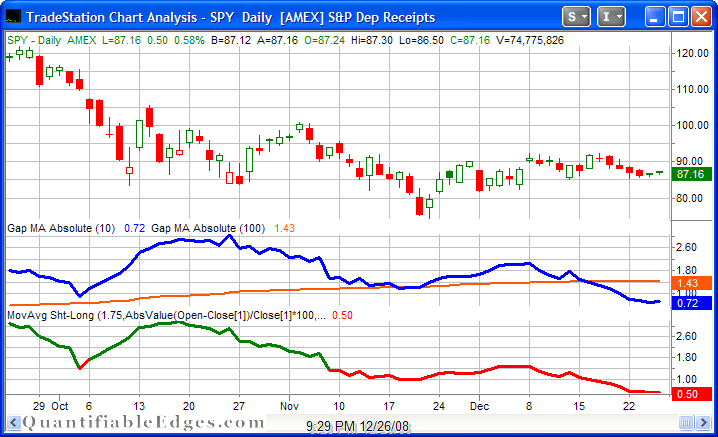

Measures of volatility I provide charts of in the subscriber’s section of the website include the Absolute Average Gap of the SPY and Nasdaq. The current chart for the SPY may be found below. Note how it has gone from extremely volatile relative to the norm to extremely muted.

Taking a broader view of this indicator I broke it down by times the 10-day exceeded the 100-day average absolute gap and times the 100-day exceeded the 10-day. When the 10-day has exceeded the 100-day (signifying the market has been subject to gap more than usual as of late) the average 1-day return for the SPY was 0.027% . When the SPY was gapping less than usual (the 10-day was less than the 100-day) the average 1-day SPY return was 0.018%. In other words the market has performed 50% better following periods when is has been more gappy than average vs. times when it’s been less gappy than average.

Twas 3 Nights Before Christmas

With only two trading sessions left until Christmas, we are now in a seasonally strong period for the market. Below is a breakdown of the last 21 years and how the S&P has performed from this point forward.

The next 1 to 5 days have been especially bullish. If you decided to buy the close 3 sessions before Christmas and then sell the 1st profitable close after entry then 18 of 21 trades would have been winners within 2 days and 20 of 21 within 5 days.

Nasdaq Volume Spyx Suggesting A Short-Term Drop

On the front page of the website I currently show the S&P 500 Volume Spyx chart every night. Subscribers also see the Nasdaq Volume Spyx chart. (More information on Quantifiable Edges Volume Spyx indicators are available here.)

Below is a copy of Friday’s chart. The -18.66 reading is extremely low.

Is The Break Above The 50-day MA Likely To Ignite A Strong Rally?

Also interesting is that the worst 6 weeks was down less than 11%. This suggests a trading range may be more likely than a runaway move up or down.

To baseline the results a little bit I also looked at 50ma crosses when the S&P hadn’t spent at least 50 days below the average: