A Look At Low Equity Put/Call Ratings Since March

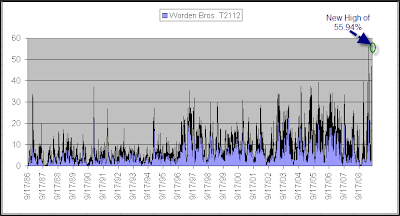

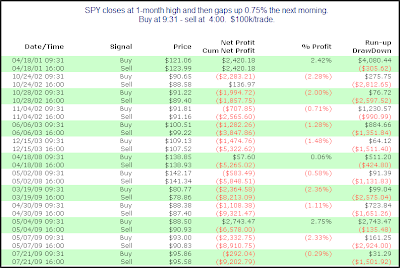

One notable from Friday was the extremely low reading in the CBOE Equity Put/Call Ratio. It closed at 0.49 – more than 31% below its 200-day moving average. In June I looked in detail at other times the Equity Put/Call closed more than 25% below its 200ma. It suggested a bearish edge for the following day has existed since the end of 2007. Concerned that the results were just a byproduct of a bear market I also showed all of the trades since the March low. Below I’ve updated that list with some additional observations.

The far right hand column shows the intraday runup/drawdown. I’ve circled in green the -$393.90 result from July 31st. Since the trades are based on $100,000 each, $393.90 represents a move down of about 0.4%. What you’ll notice when looking at the list is that the 0.4% drop that day was the smallest intraday drop of any of the 15 instances listed since March 10th. In red I have circled every instance where the intraday runup the next day was less than 0.4%. As you can see of the 15 instances, 7 of them had an intraday runup of less than 0.4%. This is all during a huge rally off the March lows. While it’s just one of the studies I looked at in last night’s Subscriber Letter, this one suggests risk/reward favors the downside for Monday.