We’re now entering the dog days of summer. Volume at the end of August is typically slow and many times this means less trading opportunities.

According to Dr. Brett Steenbarger “Great traders do their best work when they are not trading; unsuccessful traders do not work when they are not trading.”

With that in mind, I’ve decided to run a “Dog Days Of Summer” special promotion.

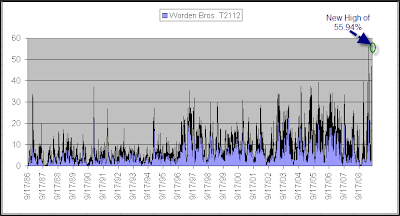

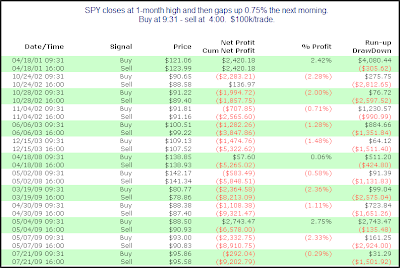

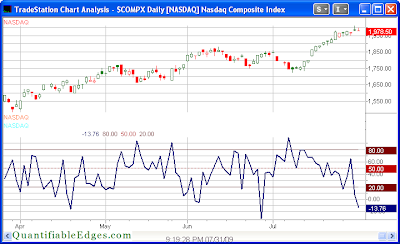

In 2008 I put together a package of Tradestation code that allowed traders to import the strategies used to test most of the studies posted to the blog in the 1st Quarter of 2008. Traders that have purchased the package have used the code to help them explore their own ideas about the market. The studies make terrific starting points for further research. They also serve as nice templates to use when exploring your own ideas. The package sells for $195.

From now until the end of August, anyone who signs up for an annual subscription to Quantifiable Edges will get the $195 2008 Q1 Studies Package included Free.

Whether you want the nightly Subscriber Letter and intraday notes and Quantifinder provided with the Gold Subscription, or the Weekly Research Letter and Silver edition Quantifinder provided with a Silver Subscription, you’re still eligible for the Dogs Days of Summer special promotion.

And yes, I’m even including it as part of the Blogger Triple Play package which comes the the VIX and More and Market Rewind products. Triple Play is now better than ever with the new features recently added to the ETF Rewind product.

So if you’ve been waiting for the right time to try an annual subscription – wait no longer. And if you’ve been considering buying the Q1 2008 Quantifiable Edges Studies Package, now you can get it free with your choice of an annual subscription. See subscription comparison here.

I hope some traders are able to take advantage of this offer and use the Dog Days of Summer to better their trading and gain new insights from both their own research and the research of Quantifiable Edges over the next year.

If you have questions, feel free to contact support @ quantifiableedges.com (no spaces).