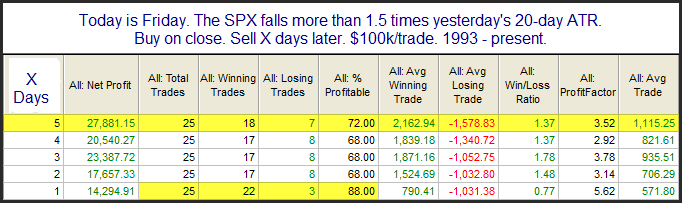

Mondays After Large Drops On Fridays

An 88% bounce rate the next day is extremely impressive – especially considering the study is only based on 2 simple parameters (day of week and large drop). The Crash of ’87 occurred on a Monday after a sizable drop on Friday. The Crash of ’29 also occurred on a Monday. It seems that Wall St.’s collective consciousness since over the last several years calls for protecting yourself going into the weekend if Friday is bad. This suggests that big drops on Fridays have often been overreactions and have therefore resulted in a consistent propensity to bounce on Monday.