Mondays 2% Gap Down

I’ve shown before that 2%+ gaps down almost always bounce at some point in the next few days. The last time I reviewed this can be found here:

https://quantifiableedges.blogspot.com/2011/03/2-gaps-down-other-disasters.html

This morning I added a few filters and looked at just what might be expected on the day of the gap. This first study shows what has happened when the 2% gap down occured after a 100-day low.

Low instances but a possbile upside tendency. But next is the bad news. The study below looks at 2% gaps down on Mondays.

Tough call this morning. I think we should see a bounce in the next few days, but it may not be immediate.

A Look At This Mornings Gap Probabilities

The gap down this morning is coming after a recovery attempt yesterday. I ran a few tests to see how the day has played out in the past under similar circumstances. The market has been moving around quite a bit this morning so I am showing 2 sets of results below.

The 1st one looks at times the market gapped down at least 1%.

Winners outnumber losers 7-3 but the losers are so much larger on average that the net expectation is about flat.

This next one looks at gaps between 0.5% and 1%.

Here again the odds appear to favor a rise over the course of the day. Losers were a bit larger here as well, but not nearly to the same degree.

Bottom line is that it appears likely the gap down will be bought up during the day, but if it isn’t then this could turn into another huge down day.

"Turnaround Tuesday" After 5+ Lower Closes

I’ve discussed before the propensity for Tuesday to serve as a day where short-term selloffs reverse. Historically it has outperformed every other day of the week in this regard. Last night I examined SPY performance following at least 5 straight down days going into Tuesday. Those results are below.

Instances are low but the stats are overwhelmingly bullish over the 1st 3 days. Of further note, all 10 instances managed to close above the entry price at some point in the next 3 days. So even when Tuesday failed, it was made up for on Wednesday or Thursday.

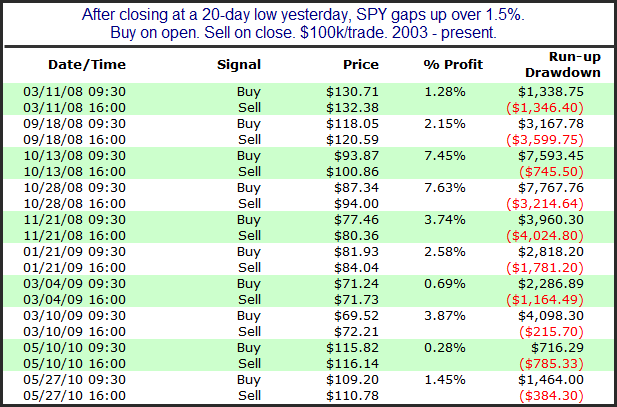

Gaps Up From A 20-Day Low

Debt ceiling progress has the market gapping up this morning. As I type the SPY is up between 1% and 1.5% pre-market. Below I take a look at gaps up from a 20-day low based on the size of the gap. First are gaps between 0.75% and 1.5%.

12 of the last 13 have been losers with the 1 winner only posting a gain of 0.1%.

Next is a look at gaps of 1.5% or more.

It appears the larger the gap the higher the propensity for it to run after the open.

One other factor that traders may want to consider about the potential of today’s gap is the 1st of the month seasonality. I looked at this in combination with large gaps last December.

Gaps Down After 4 Lower Lows

The market is already short-term oversold and now SPY is gapping down large this morning. I looked at other times there were 4 lower lows followed by a gap down below the previous day’s low. Below are results looking back to 2006.

Not a ton of instances but the stats lean quite heavily to the long side. Between 2003 and 2006 the upside tendency was not apparent. I was unable to look back past 2003 this morning. Below are all instances from 2006 – present.

If you find morning gap analysis like this useful, you may want to check the work of my friend, Scott Andrews over at MasterTheGap.com. I look at studies like this occassionally, but it is his primary focus.

Very Low Volume At A New Short-Term High

I have been away for a while. When I’m away subscriber services continue pretty much as normal but blog posts tend to suffer. I’m back and will have a couple of posts this week and then get back to the 3 or so per week starting next week.

Edges After Poor Employment Days

The gap down on Friday occurred in reaction to the release of the employment report. The employment report is typically released on the first Friday of the month, though in some cases such as this month it occurs on a different day. This weekend I spent a good amount of time going through the BLS website and programming in all the employment days from 1993-present.

I looked at Friday’s action a few different ways with regards to employment days. I found it was only the 10th time that the SPY has gapped down over 1% and failed to fill that opening gap. While I didn’t find the results significant, below I have listed the other 9 instances along with their 1-day returns.

These results seem to imply a mild inclination towards further selling the next day. Another way that I looked at employment day gaps was by using a 200ma filter and eliminating the 1% size requirement. Overall the results of doing this didn’t suggest much. I did find it interesting though that there have been three instances since the March 2009 bottom and all three instances were followed by further declines ranging from 2.4% to 4.3% during the course of the following week. Those three instances occurred on 7/2/09, 8/6/10, and 6/3/11.

I don’t believe either of these employment day studies is worth heavy consideration. My main take away is that the reaction to the employment report is not necessarily an overreaction. As the employment day results showed there does not appear to be an inclination for an immediate reversal. In fact, downside follow-through may be more likely.

Employment day seasonalities aren’t typically as pronounced as Fed Day seasonalities, but they can be worth examining on occasion. Therefore I went ahead and incorporated the employment day code into the QE Tradestation Indicators & Functions Package. This way package purchasers or Quantifiable Edges subscribers may explore employment days further on their own. (Those who previously purchased the package may download this updated version at no additional charge.)

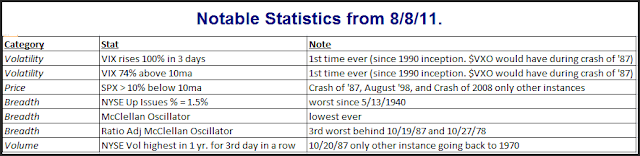

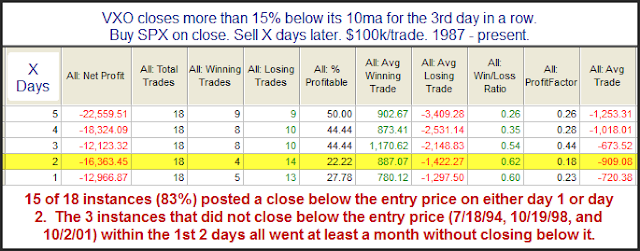

When the VXO is Extremely Low for 3 Days in a Row

I continue to see a good mix of studies. The one below is bearish but I could also point to some bullish evidence that is perhaps just as compelling. Anyway, when the VXO has remained extremelely stretched for multiple days, it typically signals the SPX is about to pull back. You can see this in the study below, which triggered on Friday at the close, and could be found in the intraday Quantifinder prior to that.

I find the note at the bottom of the table to be especially interesting. It implies that the current setup provides a high probability of a quick pullback, but if that pullback doesn’t appear quickly that there is a good chance that the market will continue to power higher.

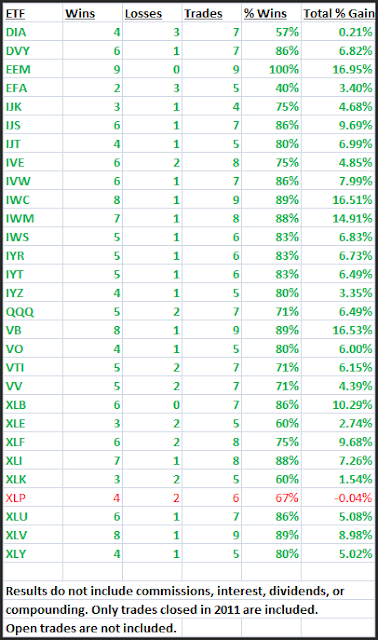

QE Big Time Swing System 1st Half Results Update

I’ve updated the Quantifiable Edges Big Time Swing System overview page with results through June 30th. There is not a trade currently open. I don’t update results that often since the system only trades about once per month on average. The 1st half of 2011 produced a tame but still positive return of 3.00% for SPY (including dividends, commissions of $0.01/share, and an assumed interest rate on cash of 0.18%). This was achieved with 1 short trade and 5 long trades.

While the SPY return was mild, it’s encouraging to see that most other ETFs did quite well. In the system manual I discuss how I tested the system for robustness using a list of 29 ETFs other than SPY. Statistics for each ETFs full history can be seen on the Quantifiable Edges Big Time Swing overview page. 2011 statistics can be seen in the table below:

For those looking for a system that they can use as a base to build their own system from, the Big Time Swing is an attractive option. It is all open-coded and comes complete with a substantial amount of background historical research. And since it is only in the market about ¼ of the time, it can easily be combined with other systems to provide greater efficiency of capital. Once you’re ready to try and improve the system yourself you can also refer to the system manual or the August 2010 purchaser-only webinar – both of which discuss numerous ideas for customization.

And if system development isn’t your thing, the Big Time Swing System provides easy to follow mechanical rules that you can follow. The standard parameters have performed quite well. There are only about 12 trades per year averaging 7 trading days per trade. All entries and exits are either at the open or the close. And to be sure you have everything set up properly traders may follow the private-purchasers only blog that shows all SPY signals and possible entry/exit levels. This service is free for 12 months from the date of purchase.

For more information and to see the updated overview sheet, click here.

If you’d like additional information about the system, or have questions, you may email BigTimeSwing @ Quantifiable Edges.com (no spaces).

3 Unfilled Up Gaps for SPY

Short-term direction is unclear at the moment. There is a mix of studies suggesting both bullish and bearish inclinations. Here is an interesting one from last night’s letter with bearish inclinations.

The fact that the gaps up each day went unfilled could suggest that a good portion of the buying may have been done by shorts who were forced to cover as prices began to get away from them. The number of instances has been quite low. On average we’ve only seen this setup occur about once every 2 years. In every case there has been a move lower in the next day or two. Statistics strongly favor the downside.

Note: for this study (and most others related to SPY gaps) I consider the gap to be from the previous day’s close – not the previous day’s high.

When Follow-Through Days are Followed by 3 Down Days

After posting a Follow-Through Day (FTD) on Tuesday, the market has now pulled back for 3 days in a row. Using the database of Follow-Through days from the original FTD study, I took a close look at short-term performance after other such post-FTD pullbacks. Of the 74 previous FTDs identified using the standard parameters from the original FTD study, 11 were immediately followed by three down days. Results following those instances can be found below.

We see here some extremely positive stats and what appears to be a strong inclination for an immediate move higher. I’ll also note though, that only 3 of these 11 instances resulted in successful intermediate-term rallies from the FTD of 3 days prior.

The Impact of Breadth on Follow-Through Day Effectiveness

The higher volume and the strong gains on the 4th day of an attempted rally means Tuesday qualified as a Follow-Through Day (FTD) under the Investors Business Daily rules. Most striking to me was not the price gains or the volume but the exceptionally strong breadth on Tuesday. I ran several tests that examined how strong breadth on a FTD might affect its chances of success.

Before I show some of those tests I thought I would point you to the rules of FTDs and some of the assumptions I used in testing them. I basically followed all of the rules as IBD laid them out. Two rules that IBD has never clearly defined are what entails “success” or “failure”. I defined “failure” to be a close below the intraday low of the bottom prior to the FTD. I defined “success” as a move either 1) twice as large as the distance from the low of the potential bottom to the close of the FTD, or 2) a new 52-week high. More detailed explanations of the rules may be found using the link below:

https://quantifiableedges.blogspot.com/2008/01/ibd-follow-through-days-pt-1-are-they.html

Whether a FTD successfully predicts a rally is not an indication of whether someone trading individual stocks using IBD’s techniques would make money or not. What it does measure is the usefulness of FTDs as a market timing indicator. I believe this is a fair way to test them since IBD claims they are valuable in identifying when downtrends are ending and new uptrends are emerging.

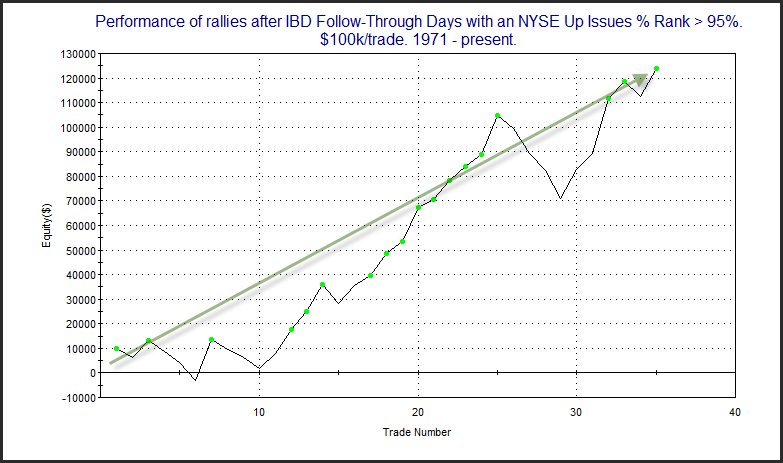

Using the original parameters as described in the post I linked to above there have been 74 FTDs since 1971. Thirty-eight of them (53%) led to successful rallies. This is an interesting stat but it doesn’t tell the whole story. Below is an equity curve that I don’t believe I’ve ever shown prior to last night’s subscriber letter. It shows how someone trading the SPX would have performed using FTDs as a buy trigger and then exiting the trade when the rally either “succeeded” or “failed”.

As you can see FTDs worked very well during the long bull market of the 80s and 90s. But in the 70s, and again since 2000, FTDs have struggled as a market timing tool.

As I mentioned earlier, breadth was also very strong on Tuesday. When compared to the past year the Up Issues % on the NYSE was higher than 98.4% of all days. I used the Up Issues % Rank to normalize breadth over the long test period, and broke down FTD results based on those times the 1-yr % Rank was > 95% and those times it was < 95%. First let’s look at times like now where the NYSE Up Issues % Rank was > 95%. (An Up Issues % Rank > 95% means that a higher % of issues traded up today than in 95% of all days over the past year.)

In this case 22 of 35 FTDs (63%) have been followed by successful rallies and gains have been fairly steady over the years.

Now let’s look at FTDs that came without very strong relative breadth.

Results here were never strong and they’ve turned quite negative in recent years. Rather than a 63% success rate as happened with strong breadth, only 44% of instances here succeeded.

So for those who may not have considered it in the past, examining breadth strength on FTDs seems a worthwhile endeavor.

Traders On Alert for a Follow Through Day Should Review Quantifiable Edges FTD Research

From the 5/2 peak down to the low on 6/16 the SPX declined 8.2%. After such a decline, Investors Business Daily followers will be eagerly awaiting a follow-though day (FTD) before looking to aggressively allocate intermediate-term trend following positions to their portfolios. I conducted and published to the blog extensive research into IBD Follow-Through-Days (FTD) over the last few years.

I’ll be updating some of it and showing some new information in the next several days, but I would suggest readers that are interested in FTDs may want check out the links below.

This first one is a summary post with links to different areas of the research.

https://quantifiableedges.blogspot.com/2008/07/follow-through-days-quantified.html

This second link will bring up all blog posts with an “IBD Follow Through Day” label. There have been a few since the summary post above was published.

https://quantifiableedges.blogspot.com/search/label/IBD%20Follow%20Through%20Day

I’d strongly encourage traders who use FTDs to learn the real facts about them. And keep an eye out for some new FTD research coming soon!

VIX Spikes While SPX Also Rises

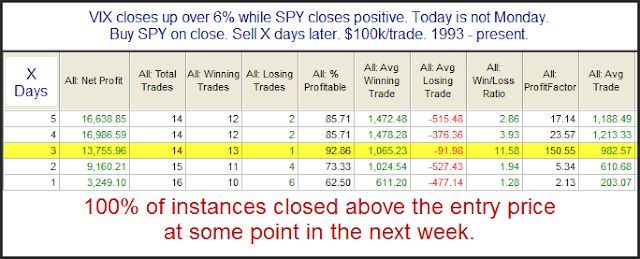

While the major indices finished Thursday with mixed moderate moves, the VIX jumped quite a bit higher. It finished 6.7% above Wednesday’s close. It’s very unusual to see the VIX spike up on a day the SPX also closes higher. This is especially true on a day other than Monday, since Mondays show a tendency for a rising VIX. The study below addresses this.

Instances are a little low but appear overwhelmingly bullish.