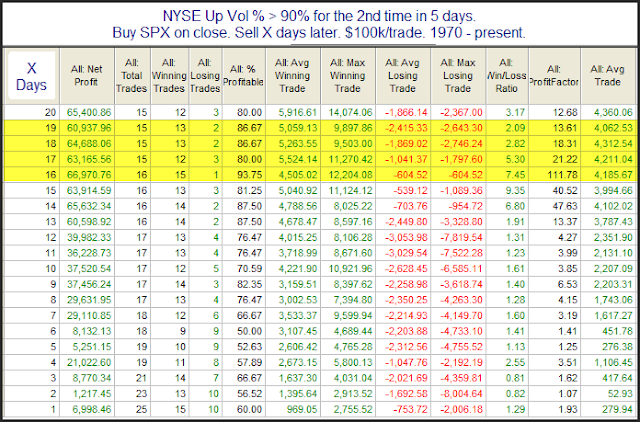

Bad breadth on an up day is something that has been shown to lead to bearish inclinations in the past. On Monday, according to my data provider, the SPX closed up while the NYSE Up Volume % came in at 44.7%. This triggered the below study, which I last showed way back on 3/31/10 in the Subscriber Letter. I have updated the results.

As you can see the numbers are strongly bearish. But there are some caveats to consider today. SPX barely closed below its 200ma. It also barely closed positive on Monday. And the NYSE Up Volume % was only barely below 45%. Therefore, while all of the criteria were met to trigger the study, the fact that they were just barley met suggests Monday’s setup is not typical of the rest of the sample. So the reaction may not be typical either. Still, the fact that it did trigger suggests a move lower is possible and bulls should be on the alert.