As many readers of this blog are aware, on Saturday I will be doing a 175 mile bike ride from Boston, MA around Cape Cod to its tip in Provincetown for the Multiple Sclerosis Society. I have offered anyone that donates any amount of money a copy of the QE Fed Day MS Ride package, which includes a pdf copy of the Quantifiable Edges Guide to Fed Days, along with Fed Day code to allow people to create their own studies.

To date, 30 Quantifiable Edges readers have donated a total of $1094, which I am very thankful for. Donations have ranged from $5 to $100. And what really struck me when I looked at the list was where the donations have come from. MS is worldwide issue, and so far we have seen donations come from 10 countries on 4 continents! They are USA, Canada, Australia, Germany, Ireland, United Kingdom, Israel, Netherlands, and South Korea! Thanks to all!

The ride is on Saturday & Sunday, so there is a little more time to get your donations in an take advantage of the Bike MS Fed Day offer!

Here again is the process…

1) Go to my personal fund raising page:

https://main.nationalmssociety.org/goto/robridesreallyfast

2) Make a donation of any size (but feel free to be generous!). Note: The MS donation page makes it look like the min amount is $35. But you can click the “other amount” button on the right and enter whatever amount you feel appropriate. Even small gifts are greatly appreciated!

3) Send an email to support@quantifiableedges.com with your receipt from the MS Society, and within 24 hours we will send you the above Quantifiable Edge Fed Day MS Ride package. (If you don’t receive it in 24 hours, feel free to send us a 2nd email, because that means we likely missed the 1st one, or post a comment below letting us know we somehow missed it!)

And once again, here is what you will receive…

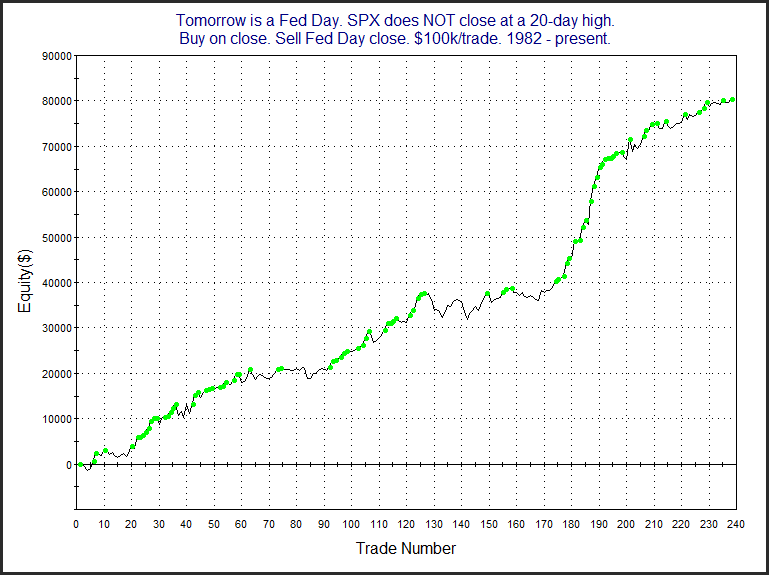

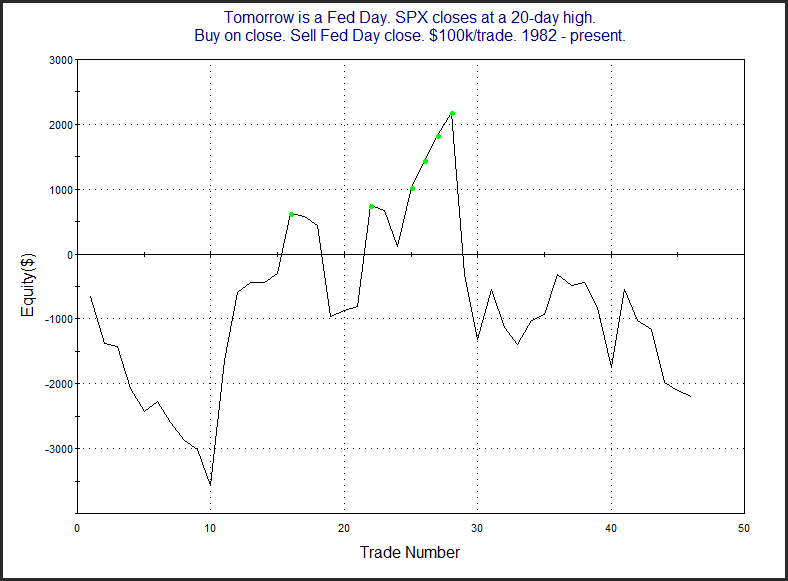

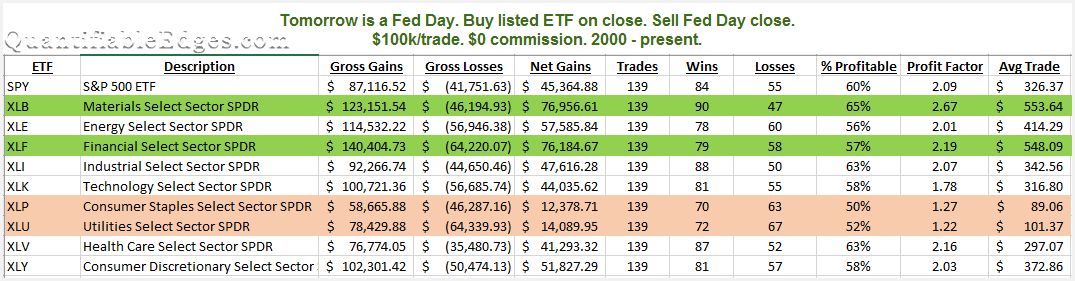

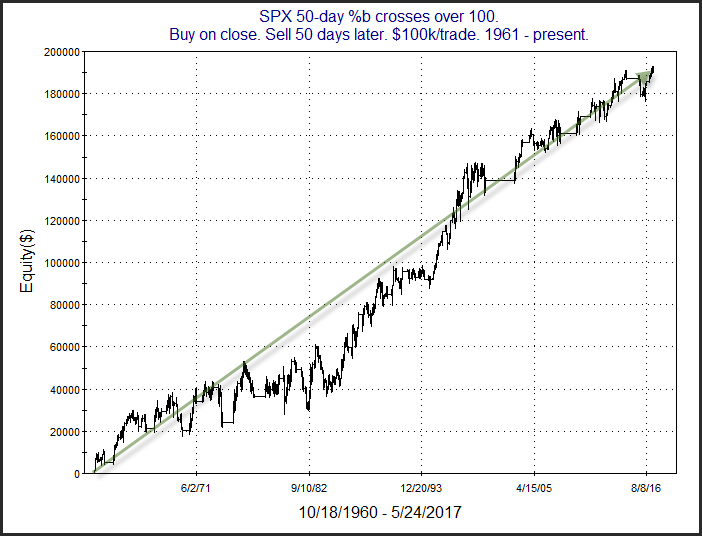

- The Quantifiable Edges Guide to Fed Days (pdf version)

- My Tradesation “Fed Day” code that show every Fed Day and the day before from 1982 – 2017.

- Text file versions of the code in case you do not use Tradesation, but still want the full list of dates, or to translate the code into another program for your own testing.

Note that the code has never before been offered with the book. So even if you already have the book – make a donation and get the code!

Thanks for all your support!

(I will be tweeting updates during the ride, so you can see how far I am getting throughout the day.)