Why Tuesday’s 90% Up Day May Not Be Bullish

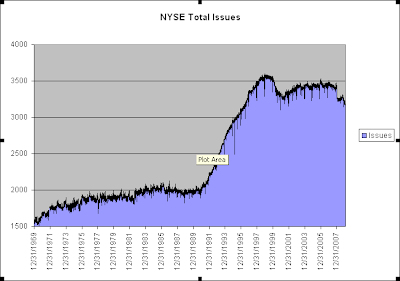

Lowry’s has shown 90% days to be effective in determining market bottoms. For those who are unaware a 90% day is a day where volume and points are 90% one directional. A 90% up day would occur when 90% of the volume traded and points traded on the NYSE are to the upside.

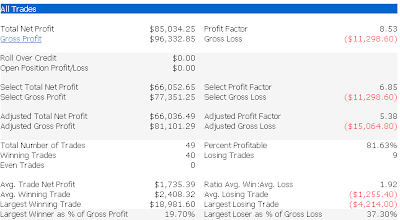

Tuesday was a 90% up day. Lowry’s looked for cluster of them in order to determine a bottom. (You can find a free copy of their report Identifying Bear Market Botoms” here.) Unfortunately, I’ve found 90% days coming directly after a bottom tend to lead to market weakness. For the below study I ignored the points qualification and just looked for 90% up volume days.

Both 1 and 8 days later all of the instances saw the S&P trading lower. Interestingly, while the test went back to 1970, 6 of the 8 instances found have occurred in the last 2 years. Prior to that it was unusual for a 90% day to occur directly following a low.