It’s been a couple of weeks since I wrote “Stops – When Not to Use Them”. In that post I suggested that using stops when trading mean-reversion systems hurts performance in the long run. There were many good comments left after that post which I will address in the next post on this subject. Today, though, I’m long overdue to tell you when I think stops ARE appropriate.

While stops do not work well for overbought/oversold trading, they DO work well with breakouts or trend following systems. Traders that buy on a pattern breakout do so because their analysis indicates a trend could emerge in the stock or security they are trading. A reversal back into the base or below it would invalidate the pattern from a technician’s standpoint. Therefore in such cases I believe a stop is completely appropriate. Once the pattern “fails” you should no longer be in the trade. Of course some people may want to give a little extra leeway rather than putting a stop right at a support point, but even so, there is a point where the breakout simply didn’t take.

For my own breakout trading I tend to use very tight stops. I also tend to show little patience for a trade to work once I enter it. Most successful breakouts have a tendency to work right away, and when the market environment is conducive to breakouts there’s just no point in sitting around with dead wood. I’d rather exit with a small profit or loss and try the next one.

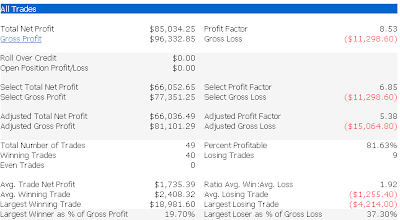

The edge in breakout or trend trading is not in the winning percentage. It’s in the risk/reward. A big winner can gain several hundred percent if it goes on a tear. That makes up for an awful lot of scratches and small losses. As an example in 2003 I did a lot of breakout trading. Cup & Handles, Flat Bases, High Tight Flags, Double Bottoms, etc. – all based primarily on daily bars. It was a tremendous year for trading breakouts because the ones that took caught fire rather quickly. It was also one of my best market years. Yet at the end of the year I went back and tallied the percentage of breakout trades I took that “worked”. In other words, they did better than a very small gain or scratch. My success rate? A little under 15%. And it was a great year. Why? Tiny losses and massive gains.

Everyone’s style is different and someone with more patience would likely have had a better win rate, but the win rate wasn’t important. What was important was controlling the losses, and one way to do that was through the use of stops.

For more discussion on using stops check out some older posts from:

Afraid To Trade

IBD Index

Also, for some (much) older discussion on trailing stops you can check out my “Double Support Trailing Stop” concept.

To be continued…