With the Fed meeting tomorrow, another volatile day (after 2:15pm) seems a near certainty. CANSLIM traders will be watchful to see if the Fed can help to produce a Follow Through Day. The S&P 500 is already up over 7% off the lows hit last week. I therefore thought tonight would be a good time to post the 3rd part in my series on IBD Follow Through Days: Do Follow Through Days Frequently Miss Too Much of the Move or do They Signal Early Enough to Capture a Sizable Portion of the Rally?

Should you have missed the first few parts in the study on follow through days you may find them below:

Intro

Part 1 – Are They Predictive?

Part 2 – Does Every Rally Have One?

To determine whether they do a good job of catching a large portion of the rally, I first split all the 1% Follow Through Days into two groups – winners and losers. The test I used was the exact test described in part 1 using 1% Follow Through Days after an 8% market decline. I then measured how far from the bottom the market closed at on the follow through day. I am using the 1% Follow Through Day in this test rather than the 1.7% that IBD currently recommends due to the fact that the 1.7% requirement has had about a 20% chance of missing nearly the entire rally.

Interestingly, when I measured the distance from the low that the Follow Through Day closed, it seemed to have no affect on success or failure. For both winners and losers the average Follow Through Day closed about 5.2% higher than the recent low.

I then decided to examine just the Follow Through Days that worked to see how much the market typically gained on a bull move between December 1971 and now. The average bull move over the period was about 28.8%. This includes some fantastic moves such as the 64% market rise from 10/1990 to 2/1994. Of the 35 “successful” Follow Through Days, 25 (71%) of them saw the market gain at least another 10% before correcting again.

Of course there is no chance of actually selling at the top and capturing the entire remaining portion of the move. If you assume the Follow Through Day gets you into a move 5.2% from the bottom and you will end up or missing out on the top third of the move, then on average each successful Follow Through Day would lead to a gain of nearly 14%.

Using the exit criteria described in Part 1, the average loss on failed Follow Through Day would be about 5.6%

Since 55% of Follow Through Days are “successful”, the expected value of buying the S&P 500 at the close of a follow through day with the above assumptions is ((0.55) * 14%) – ((0.45) * 5.6%) = 5.18%. The nicely positive expected value indicates the Follow Through Day is capable of catching enough of the move to make it worthwhile.

An important point that I neglected in calculating these numbers is that most traders that use Follow Through Days don’t simply trade indices. Stock selection and timing are important components of CANSLIM. Should their stock selection and timing be better than the market on average, then they could see gains many times greater than the expected 5.2%.

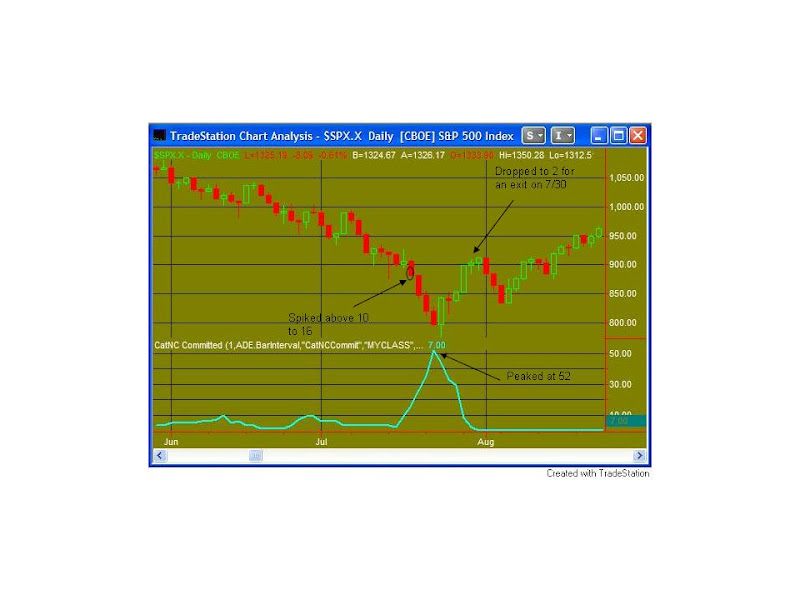

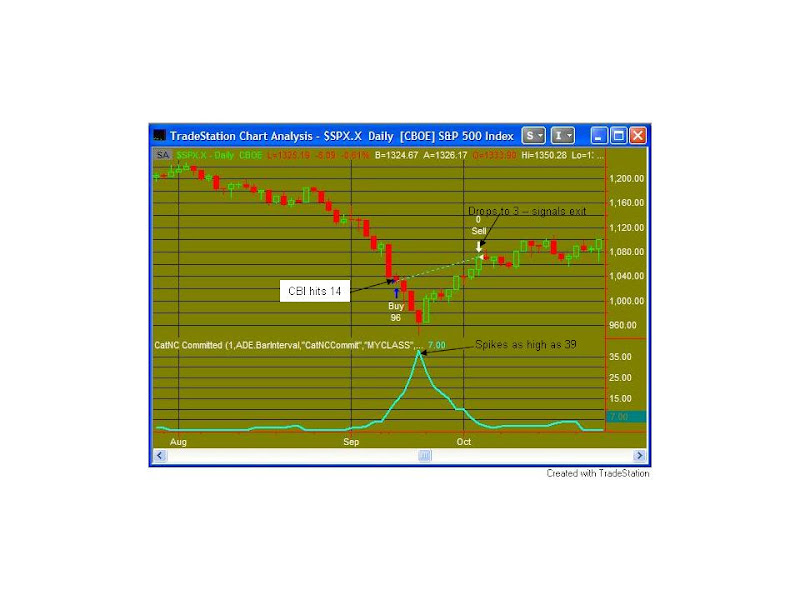

So in summary – here’s the good news. If this is a real bull rally there should be plenty of room left to make money even if a big Follow Through Day occurs soon. The bad news is this really isn’t an endorsement of Follow Through Days. It’s more an exercise in risk/reward analysis. And while the 5.2% that’s being given up on average around the market bottom pales in comparison to the potential gains, 5.2% is still more than S&P returned in total in two of the last three years. It’s not a trivial amount. Fortunately, as I’ve demonstrated in the last few weeks, alternate methods can help capture a good portion of that 5.2%. Still, for traders without better methods of identifying market bottoms, the IBD Follow Through Day seems to give a decent chance of capturing a good portion of a rally.

I’ll continue my series on Follow Through Days shortly with my next installment: Do They Work Better After Small or Large Declines?