Some times when conducting historical analysis a small sample set can tell you that the market is doing something extraordinary. Indicators reaching excessive readings often suggest an edge because when things get too extreme, mean reversion tendencies tend to kick in.

There are other instances where a small sample set simply suggests the market is not acting as it should. Monday’s action may be a good example of this. Gains of 3% – 4% that occurred on Friday were given up Monday in all indices on an intraday basis and most on an end of day basis. The S&P 500 rallied over 4% on Friday. After dipping below Thursday’s close late in the day Monday, it barely closed above it. I ran a test to find other times since 1975 that the market had gained at least 4% one day and then printed a low below the close of 2 days ago.

Today was the first.

I loosened the requirements to 3.5%. Still nothing.

3%. Nope.

2.5%? Yes – two instances. Even at 2% there have only been 6 instances in the last 33 years where the market has given back all its prior day gains.

Now, in case you interested, all six of these did bounce above the selloff day’s close within 2 days. In fact, 5 of them managed to bounce the next day. The bounces did tend to die out after day 3. So perhaps there’s a small upside edge based on this study, but that’s not the real takeaway.

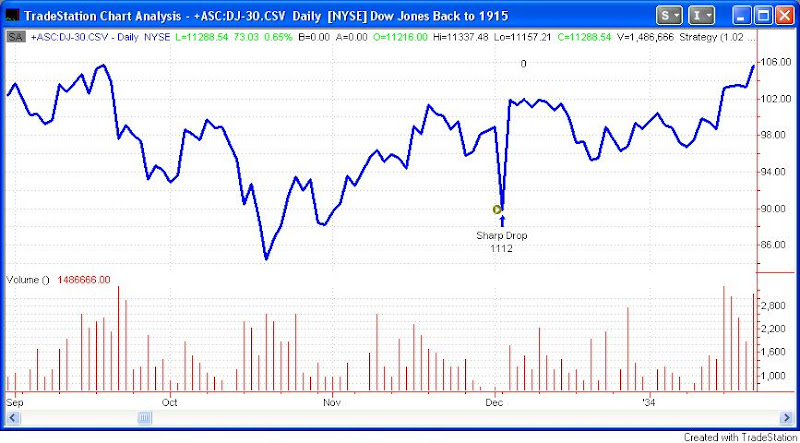

What’s significant here is that the market is acting in a way that it shouldn’t. It especially shouldn’t if it is planning on launching a great bull move. Look at some of the charts I’ve posted in the blog the last few days. Look at periods like March ‘03, July & October ’02, September ’01, September & October ’98, November ’97 and any other bottom you find. Massive one-day gains coming off lows simply don’t get wiped out the next day. It doesn’t happen. It happened Monday.

I would consider Monday’s action a warning sign.

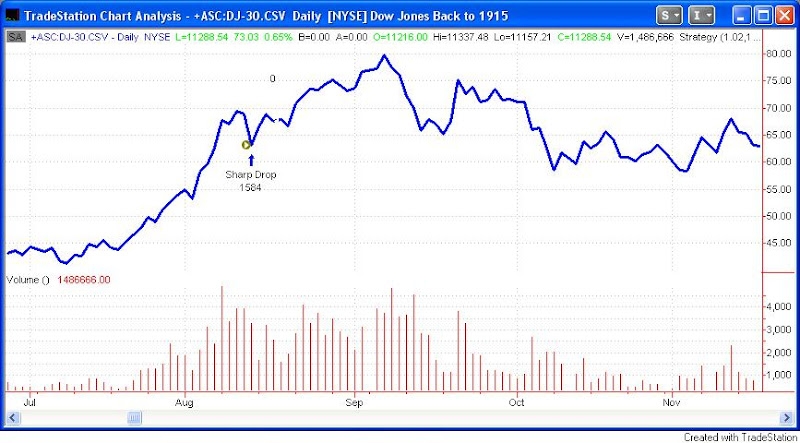

If nothing else traders should still be operating under the assumption that the market environment remains extremely choppy. Look to take advantage of the chop. As an example, the incredibly simple system I published for shorting a few weeks back has had 4 trades since. Here they are (all trades based on SPX closing prices):

Short 8/27 – cover 9/2 – 0.32% gain

Short 9/8 – cover 9/9 – 3.41% gain

Short 9/11 – cover 9/15 – 4.43% gain

Short 9/19 – cover 9/22 – 3.83% gain

That’s 12% from just the short side in a little over 3 weeks. All based on an incredibly simple system. Playing the chop has been working. Monday’s action suggests that despite last week’s bottom attempt, this hasn’t yet changed.