Yesterday’s post on Breadth and Helicopters received a slew of comments. There were many well thought out and interesting points. I don’t care to get into a lengthy debate and couldn’t possibly address all the issues that were raised, but I thought I would offer a few comments for further clarification on my thinking. I’ll also touch on a few of the issues discussed in the comments section. Anyone who hasn’t read yesterday’s post or some of the comments people made following may want to check that out before continuing.

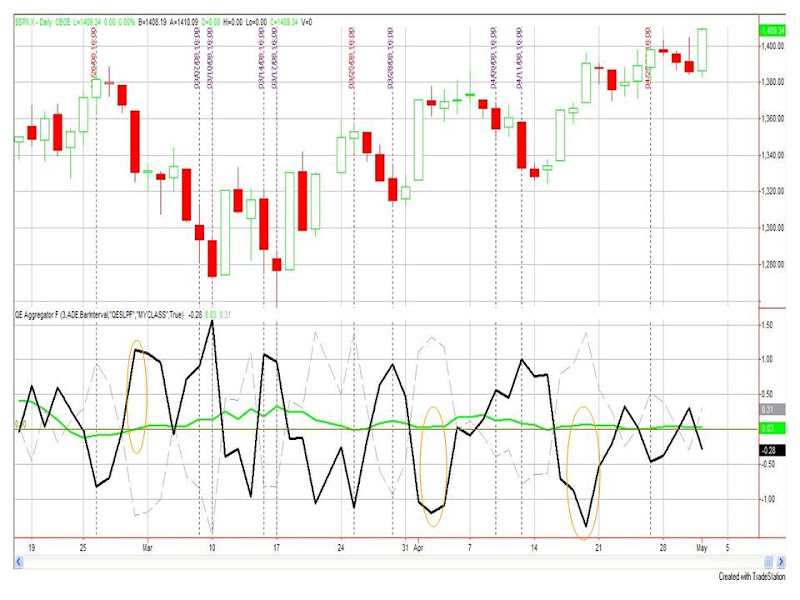

So the June/July selloff took out two breadth indicators with “perfect” records. In my post I indicated that this didn’t sway me from treating them the same as I had previously.

I should mention that I am neither surprised nor concerned that they both “failed” at the same time. For the most part they both measure the same thing – breadth. One looks at broad market advance/decline breadth while the other looks at how broad extreme selling is in a select list of securities. Still, they’re both looking at breadth. There is no question that it became extremely negative in June. And rather than being accompanied by the sharp bounce that has been customary for the last 25 years, the market continued to slide.

One notable about both of the indicators discussed in yesterday’s post is that their history was somewhat limited. The McClellan data I used only went back to 1986 and the CBI data back to 1995. Under most circumstances, if I get enough instances that the results appear notable, I’m more than comfortable only going back this far.

Daniel mentioned an interesting event – the Crash of ’87. What traders should understand is that prior to that the market did behave differently in many ways. I discussed this in both the 7/7 and 7/13 Weekly Research Letters. From the July 7th Letter:

“I go back to the Crash of ’87 for a few reasons. First, it was the last time that strong negative breadth readings, such as the % below 40ma and the 10-day Advance/Decline EMA led to further selling, and in a big way. Second, it led to changes in the way the market is governed and monitored. Some changes, such as the implementation of trading curbs, are well documented. Others, such as the President’s Working Group, are clouded in mystery. Whatever the reason, breadth extremes as we’ve seen recently have consistently marked buying opportunities over the last 20+ years.”

To see an example of how poor breadth readings formerly failed to spark rallies, you may revisit my June 25th post. There I looked at a 10-period EMA of the advance/decline ratio. Readings such as we were hitting in late June have normally provided traders an edge over the last 20 years. Prior to that, expectations were negative to flat.

An aspect to the recent decline that provided a clue as to how bad things were getting was the persistence of the downtrend. Whereas in the past 20 years oversold was met with buying and violent short-covering rallies, it just wasn’t happening in June and early July. I first discussed this in my July 3rd post, which indicated we were experiencing a selloff unlike anything seen for a very long time. On July 7th I followed it up with another post on persistence.

So why didn’t we bounce sooner? Is it likely to happen again? Are we in a 70’s environment or was the selloff just an anomaly? Will breadth indicators remain useful?

My inclination is that we are not going to revert to a 70’s – type market where selling just begets more selling. For the market to change the way it has behaved for the last 20+ years would take a substantial change in dynamics. Has such a change occurred? Difficult to know, but I don’t think so. No uptick rule? Double-short ETF’s? The ability of retail traders to easily trade baskets of commodities via ETF’s? These are all relatively recent developments and they have changed market dynamics in some way. Enough to cause fairly reliable overbought/oversold breadth indicators to become obsolete? I don’t believe so and like I said yesterday, I’m currently just looking at it as a losing episode.

So why did it happen? I don’t know. One observation I would make is that since the Crash of ’87, the government seems to have taken a greater interest in the equity markets. For instance over the past few years there have been several times when the market appears on the precipice of something awful and the Fed arrives with an announcement that seems to spark a rally. This occurred in March. It occurred in January. It occurred last August. It occurred March of 2007. It occurred in June 2006. Those are a few I can recall off the top of my head. Each time the market turned seemingly because of a rate cut, or a bail out, or an expansion of the use of the discount window, or something.

During the recent selloff the Fed has been caught between a rock and a hard place. Whereas under other circumstances they MAY have stepped in sooner with some announcement that could help spark at least a short-covering rally, this time the anouncement didn’t come. The double-edged sword of inflation and recession was threatening and there wasn’t much they were willing to do. Also, the nature of the selloff was not crash-like. There was little panic. The mood was dour as seen by investment and consumer sentiment surveys, but not outright panic as could be evidenced by the VIX. While not immediately hailed, a temporary enforcement of short selling rules in certain financial stocks MAY have helped the recent bounce.

Perhaps stagflation will become a real problem. Perhaps the Fed will continually find itself handcuffed or the government will decide it will no longer considers the equity markets an important consideration in constructing policy. Perhaps the introduction of double-short ETF’s, commodity and currency ETF’s, no uptick rule and other things are changing the dynamics of the market in such a way that certain indicators, such as some of the breadth measures I use, will no longer be effective. I don’t believe that to be true, though and at this point I’m betting against all of that. I will continue to run studies and construct systems in the same manner I did before the latest meltdown.

Now if it keeps happening,..well…then I’ve got some things to ponder.

—————

One last note here. There were also some observations about system development in the comments of the last post. I think it would be worthwhile to talk about some of my thoughts there some day, and I’ll try and do that. Just not today. This post is already too long. In fact I doubt anyone is still reading…

On June 11th the McClellan Oscillator (as measured by TC2000) dropped below -200.

On June 11th the McClellan Oscillator (as measured by TC2000) dropped below -200.