VXO Suggesting A Pullback Is Likely

I’ve discussed in the past that it is a common misconception that a low VXO is a bearish indicator. When the VXO becomes extremely stretched, as it is now, then that changes.

I’ve discussed in the past that it is a common misconception that a low VXO is a bearish indicator. When the VXO becomes extremely stretched, as it is now, then that changes.

Today I give you some political stats:

First I wanted to see if there was general excitement about the new guy. In other words, there is not an incumbent victory…

Nothing terribly exciting here. Pretty much 50/50 over the next week.

Next I broke it down by party and ran the stats out a bit further.

Since 1920 this is how the Dow has performed after a Republican has won the white house. (I excluded 2000 since no one knew if a Republican or Democrat won for a long time after the election.)

Still not much better than 50/50 until you get out a couple of months.

Now lets see what has transpired after a Democrat wins:

A few weeks ago I wrote about the propensity of upside gaps of 2% or more to pull back at some point in the following few days. There are currently 2 upside gaps of 2% or more that have yet to close below the opening gap price. They are the 10/28 and the 10/30 gaps. It appears unlikely that the 10/28 level of $87.34 will be threatened in the next day or so. Should the 10/30 opening gap also hold that could be viewed as a significant sign of strength for this early attempt at a rally.

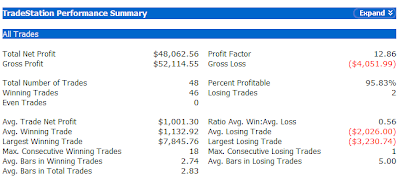

Another possible sign of strength will also be challenged in the next few days. In my August 28th post I showed a system that took advantage of the choppy, downward trading that had existed over the last year plus up to that point. Below are updated statistics of this simple system:

Sell short if the S&P 500 closes higher 2 days in a row. Cover on close below entry price – up to 4 days later. If still not profitable on day 4, close anyway. $100k/trade. June 1, 2007 – present.

Amazingly, the system has not triggered since 9/26/08. Therefore, the 48% profits generated were all achieved prior to the big October selloff. The system is also in an 18-trade winning streak, dating back to April.

The market is reaching short-term overbought conditions that over the last year and a half have led to at least short-term pullbacks. Whether it is able to rally in the face of such conditions or whether it pulls back sharply in the next few days could be a telling sign of strength or weakness, and whether a character change could be in order.

October may have been the worst month in a long time for the stock market, but it was the best month ever for the Subscriber Letter. The primary strategy responsible for the oversized trading profits were the Catapult trades, which combined comprise the CBI. They also performed well during the January and March selloffs, but suffered an unusually difficult period during the June/July selloff.

Before revealing the results, some important notes:

I don’t suggest position sizes. The primary reason for this is I’m not acting as a financial advisor. I don’t feel it is appropriate to suggest allocation sizes without understanding someone’s financial situation and risk tolerance. Even for my own trading I run different portfolios with different levels of aggressiveness. For instance, my most aggressive portfolio is my IRA. Here I may use options to sometimes get 400-500% leveraged. Other portfolios on the other hand normally take much more conservative stances and some rarely reach or exceed 100% exposure.

Since I don’t suggest position sizes this is should not be considered a performance report, but rather a trade idea scorecard. Therefore, no matter how objective I try to be the reporting of the results is always going to be skewed depending on how you approach the trades. For instance, I always recommend scaling into the Catapult positions in 3 parts, whereas the “System” trades (whatever system I unveil other than Catapult) are normally one entry. The “QE Index” trades I normally recommend scaling into as well. For my own trading I trade much larger size with the index trades than any of the individuals. I also control my exposure by limiting the total amount invested per day. As I mentioned, this will vary depending on the account I’m trading. My most aggressive account I may put in up to 100%/day and get heavily leveraged using options. A more conservative account may max out at 15%-20% per day.

It’s unlikely anyone would have taken all of the trades with equal amounts, so personal results would vary greatly depending on the trader’s approach. Still, there was more than ample opportunity to take advantage of the Quantifiable Edges trade ideas in October. With all those caveats in mind, recent results are listed below and broken down by category. Since October was so unusual, I’ve also shown the September results below.

If you’d like a free 3-day trial of the Quantifiable Edges Subscriber Letter, just shoot an email to QuantEdges@HannaCapital.com and include your name and email address.

For the 2nd day in a row the S&P 500 saw a sizable move in the last 10 minutes of the day. This time, though it was to the upside as the index gained nearly 1% from 3:50 to 4pm. We saw yesterday an example of how overly strong reactions are many times overreactions. Tonight I looked at the sharp upside reaction as opposed to last night’s downside reaction.

SPX rises at least 0.75% in the last 10 minutes of the day. Buy on close. Sell at the next days close. $100k/trade. Last 25 years:

Ten out of 12 finished lower the next day. Below is a listing of all the trades:

The last 5 have been especially harsh.

As a commenter pointed out yesterday, overreactions haven’t been limited to intraday bars lately. To add to that, I would say almost every move the market has made in this highly charged environment has been an overreaction. It has in fact created vicious whipsaws in both directions for intraday and swing style traders.

If you left 10 minutes early on Wednesday you missed a lot. The S&P lost over 3% from 3:50 to 4pm and was down over 4% before bouncing in the last minute. I looked back over the last 25 years to find other times the market dropped 3% or more in the last 10 minutes of the day. This was the 1st. Lowering the requirement to 2% unveiled 3 instances. They are listed below along with the next day’s performance:

10/19/87 – S&P rose 5.23% the next day.

9/29/08 – S&P rose 5.27% the next day.

10/27/08 – S&P rose 10.79% the next day.

This is too small a sample size to use for analysis, but a nice illustration of a simple adage. An overly strong reaction is often an overreaction.

The CBI spiked back up on Monday. After hitting 48 earlier this month it quickly dropped down to 7. It never made it back to the neutral “3” level, but the sharp move from 48 to 7 prompted sales in all CBI related trades on the morning of Tuesday the 14th in the Quantifiable Edges Subscriber Letter. The CBI is now growing again and posted a 13 reading at the close yesterday.

Like nearly all breadth indicators, the CBI has not been quite as reliable this year. Still, the move to 13 has prompted me to take some long exposure. For those not familiar with my CBI you may read an intro here. Plenty of additional information is available by using the CBI label here. Below is graph of S&P 500 along with the CBI for 2008:

A couple of weeks ago I showed a table detailing a number of extremes the market had reached. The sharp bounce on 10/13 relieved many of them. Now some are back – along with a few new ones: (click to enlarge – for some reason I’ve had trouble making the .png’s larger in Blogger the past few days)

On the NYSE up issues accounted for less than 40% of the total issues traded. This only the 3rd time since 1970 that the up issues % was below 40% while the S&P 500 rose at least 1%. I ran a study tonight that looked at other times the market had risen at all when the Up Issues % was less than 40%.

Also, here’s an interesting tidbit from last night’s Subscriber Letter… How incredible has the market action been of late? Since 1960 the S&P has had 14 days where the market sold off 5% or more. The 1987 crash accounted for 3 of them. The 2000-2002 bear market only had 1 – on 4/14/2000. In the last month the S&P 500 has seen 5 days with losses of 5% or more.

A common misconception among traders is that an extremely low VIX or VXO compared to its short-term moving average has bearish consequences. On Tuesday the VXO closed over 15% below its 10-day ma for the 2nd day in a row. Below is a test that shows results of shorting the SPX when the VXO is stretched below certain levels for at least 2 days in a row. It covers once there has been a reversion to the short-term mean:

The system as designed shows a slight edge when there is a mild VXO stretch. As the stretch gets larger the edge disappears. To understand why this occurs, consider what would cause the VXO to get extremely stretched, as opposed to slightly stretched. A mild stretch might be the result of a typical move higher in the market. An extreme stretch is more likely to be the results of a strong thrust higher in the market. If the market is truly strong, then the result will be more upside – not downside.

When trading below the 200-day moving average the difference is even more pronounced.

Here we see the mild stretches have more bearish implications. A drift higher in a downtrending market can offer short opportunities. A strong move higher, on the other hand, can lead to a vicious short-covering rally – not something you normally want to step in front of with short trades.

I used some other studies back in May to illustrate these concepts as well.

There are indicators suggesting short-term downside, such as the volume study I posted yesterday. The extremely low VXO is NOT suggestive of a selloff, though.

Last week I looked at the extremely light volume on the Nasdaq rally and suggested it had bearish implications. The plunge came soon after. Monday’s rally was also suspiciously light. This time the setup occurred in both the Nasdaq and the S&P. Below are the stats for the S&P:

Volume action continues to disappoint. I’d be surprised to see a reaction as negative as last week, but volume is suggesting that perhaps buying enthusiasm isn’t as strong as would appear based on price alone. A pullback may likely be in order in the next few days.

Just a few quick observations this morning. Although the market rose last week, several measures of breadth and volatility remain at extreme levels suggesting more of a bounce is likely. For instance, the VIX made a new intraday high on Thursday and a new closing high on Friday. The CBI remains elevated at 13. Worden Bros. T2114 also remains extremely elevated. T2114 measures the number of stocks trading at least 1 standard deviation below their 40-day moving average. T2114 closed at over 90% on Friday despite the fact that the market rose last week. The current 90% reading still exceeds all other periods other than the Crash of ’87.

The market is looking to gap up this morning. The SPY is up over 2% a little before the open. Traders may recall my post from last Monday that suggested 2% gaps tend to pull back at some point over the following few days. It happened twice last week. The market has been extremely choppy. If this pattern of choppiness is to be broken there will need to be a strong move right from the start which utilizes the extreme conditions mentioned above to mount a sizable rally.

As violently choppy as the market has been it is also possible that both the short-term bullish and short-term bearish indications are satisfied over the course of the week. In any case, it should be another interesting one.

The VIX put in a huge spike yesterday to another new high. The SPX manage to hold above its recent low before rebounding. Below I looked at long-term VIX spikes that were not accompanied by long term SPX lows and performance moving forward:

In the past there this particular setup has provided traders an upside edge.

Here’s a chart of the Dow Jones:

Here’s another chart of the Dow Jones:

The 1st one is 1929. The 2nd one is 2008.

They sure look a lot alike to me.

On Wednesday the S&P dropped 9%. It was the 3rd time in less than a month that it dropped over 7.5%. Since my S&P data only goes back to 1960, I checked out the Dow to see if it had ever dropped 7.5% 3 times in one month. It had. Once. In the 1929 picture you see above. While history never plays out exactly the same I’m sure everyone is wondering how the current picture resolved itself in 1929. Was the initial crash low broken?

Answer: Yes. The current period compares to the beginning of November in the 1929 chart. There was one final leg down before a sizable rally ensued that lasted well into 1930.

Of course if we zoom out a bit more…

This is not a quantitative study. It is not a commentary on the state of the economy or the action of the government. It is definitely not a prediction. But if you thought there was no way it could get much worse from a long-term standpoint…well…it could.