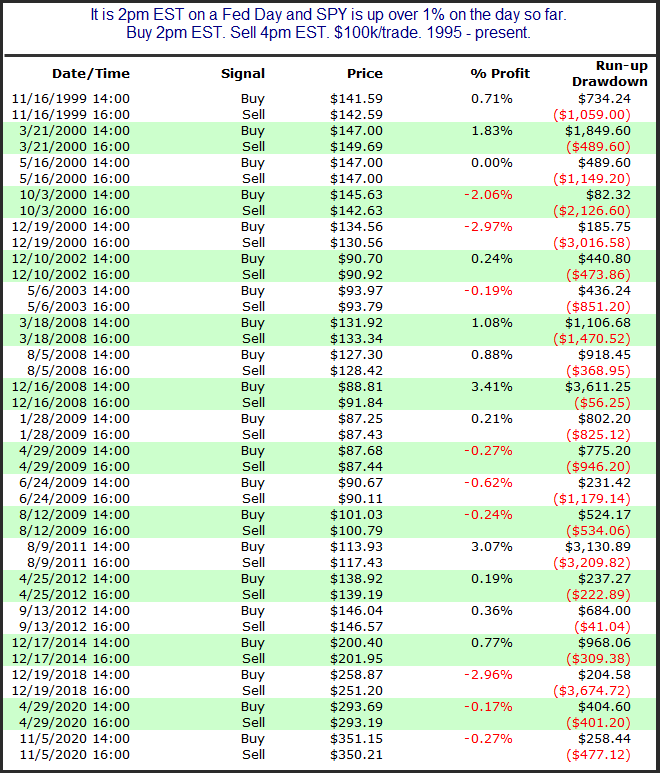

The market is off to a strong start to the day, with SPX up over 1% at around noon EST. I decided to look back at all times the market was up at least 1% at 2pm on a Fed Day (the typical time for a statement release). Below is the full list of instances and their 2pm – 4pm EST performance to finish the day.

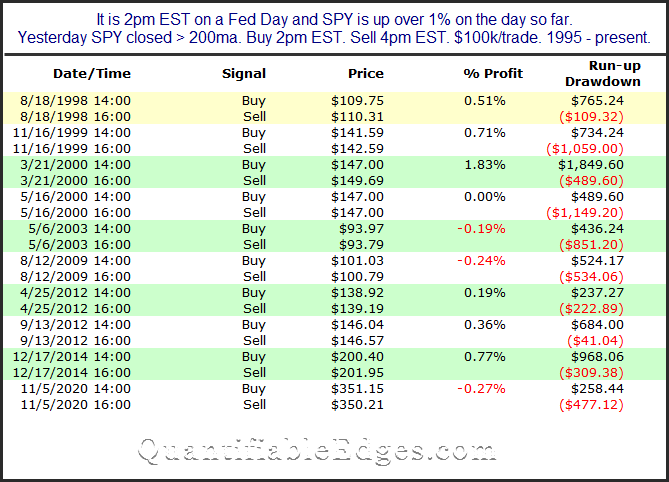

Returns here are mixed, and don’t suggest a strong directional edge either way. There have been some strong moves in both directions after the announcement. I also filtered for times SPY was in a long-term uptrend (above its 200-day moving average). Those results are below.

These results are a bit more encouraging. Six of the ten instances saw further gains. One finished flat vs 2pm. The other three saw only mild declines, but still finished the day overall positive. Should be an interesting finish to the day. The good start seems to be a potential positive.

Want research like this delivered directly to your inbox on a timely basis? Sign up for the Quantifiable Edges Email List.

How about a free trial to the Quantifiable Edges Gold subscription?