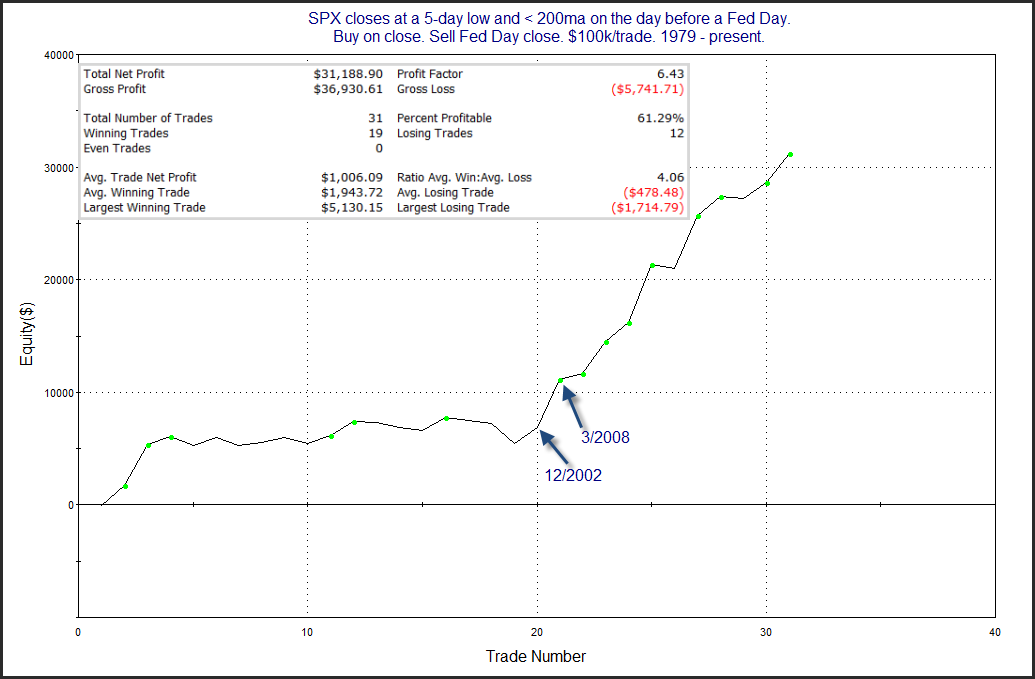

Wednesday is a Fed Day. And a decent amount of the recent selling may be attributable to anxiety over the Fed announcement. I’ve shown Fed Days to be bullish in the past, especially when there has been a selloff heading into the Fed Day. The study below is from this past weekend’s subscriber letter. It looks at other times SPX closed at a 5-day low and below the 200ma on the day before a Fed Day.

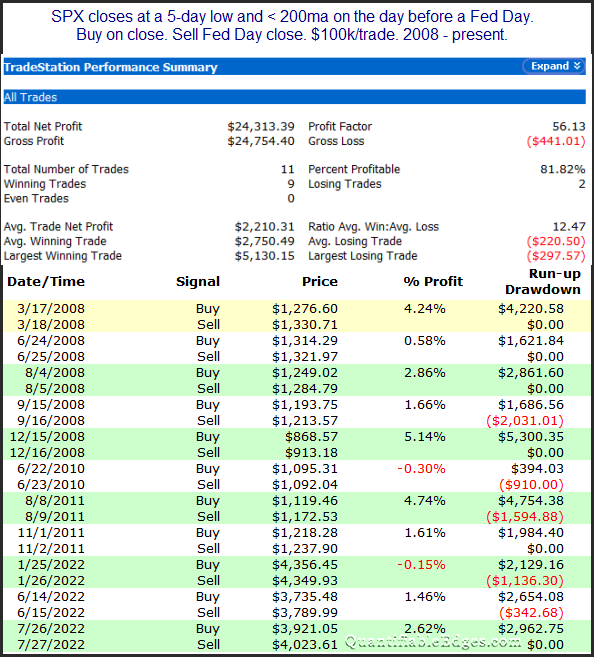

The numbers are strongly positive, and as you can see, the setup really picked up steam starting in 2008. Below are the stats and list of instances from 2008 onward.

SPX would need to close below 3873 today in order to trigger this setup. For many more studies regarding Fed Days, check out the Fed Study category here on the blog.

Want research like this delivered directly to your inbox on a timely basis? Sign up for the Quantifiable Edges Email List.

How about a free trial to the Quantifiable Edges Gold subscription?