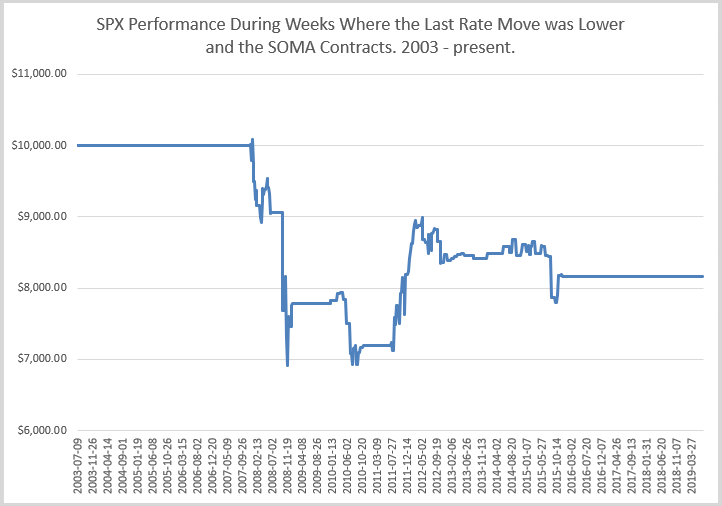

Part of the reason the market has rallied over the past few days is an indication that a rate cut is likely coming as soon as the next Fed meeting. It is interesting timing for the Fed to begin cutting rates, since their QT program still remains in place (though it is winding down). By reducing the SOMA at the same time they are cutting rates, the Fed is basically going to be driving with one foot on each pedal. They’ll be instituting both a contractionary policy and a stimulative policy at the same time. While curious, that is not unprecedented. I decided to examine SPX performance since 2003 during weeks where 1) the most recent interest rate move was lower, and 2) the SOMA contracted. Results of starting with a $10,000 portfolio and not including any trading costs can be seen below.

Results overall have been fairly poor, and very inconsistent. Not terribly encouraging. Of course rates were already at zero for many of the past instances. And the SOMA decreases occurred during policies like Operation Twist, where there was not actually an overall reduction in the SOMA, but rather week to week oscillations. So past comparisons like in the chart above are not perfect. If the Fed does cut rates, it would also be very unusual from the standpoint that the market is currently at new highs. Looking back to 1990, the only other instance I could find where the Fed began a rate cutting cycle while the SPX was within 1% of a 200-day high was in July of 1995. That rate cut was followed by 7 months of continued rallying for the market. Bottom line is that I am seeing mixed messages using difficult comparables with regards to the Fed. Anticipating market reaction in such an environment can be difficult. I will likely be relying more on some of my other indicators in the coming months to help set my market bias.

Want research like this delivered directly to your inbox on a timely basis? Sign up for the Quantifiable Edges Email List.

Learn how to identify edges and formulate swing trading strategies in the new Quant Edges Swing Trading Course!