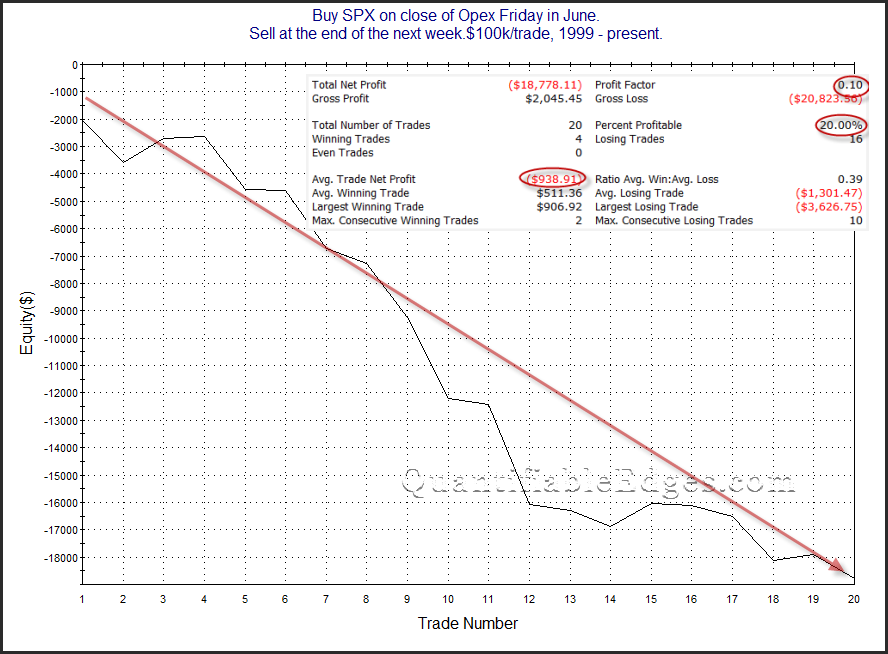

In March I discussed how the weeks following options expiration in March, June, and September have been the worst 3 weeks of the year. Below I have updated the June stats and profit, which I also showed last June.

The strong, steady downslope and bearish numbers suggest we are entering a very weak seasonal period. It will be interesting to see how the market holds up this week, and whether the recent strong upside momentum can overcome the bearish headwind.

Speaking of headwinds, the Quantifiable Edges MS Ride fundraiser is ongoing, and readers generosity to this point has been outstanding. Unfortunately, I broke my wrist last week playing basketball. So I will not be able to face the Cape Cod headwinds on my bike. But I will still be volunteering for the weekend and helping raise funds towards the cause. More info on how to contribute and how to receive research and discounts from Quantifiable Edges with your donations can be found here.