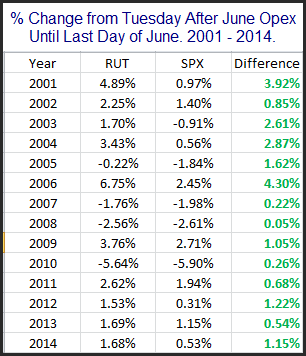

Yesterday I published a study that showed the week after June opex has exhibited weakness in recent years. An astute newsletter subscriber suggested to me that this could be partially due to Russell rebalancing, which always happens at the end of June. His comments led me to wonder how the Russell 2000 might have performed versus the SPX during late June. The table below shows how the Russell 2000 has done versus the SPX from the close the Tuesday after June Opex (which would be today’s close) until the close on the last trading day of June.

For the last 14 years the Russell 2000 has outperformed the SPX during this late June period. The average outperformance was 1.52%. This would seem worth keeping in mind over the next week.

Want research like this delivered directly to your inbox on a timely basis? Sign up for the Quantifiable Edges Email List.