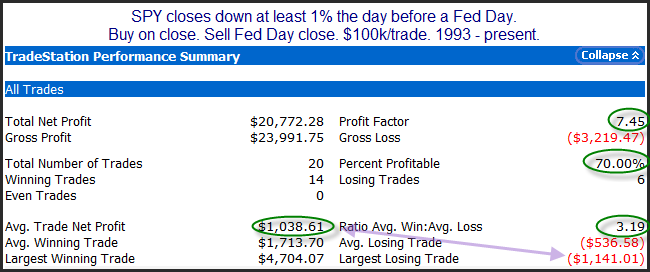

Selloffs as strong as we saw on Tuesday have been fairly rare just ahead of a Fed Day. In fact it was the 1st time since October 2012 that SPY closed down over 1% on the day before a Fed Day. Below are results of all instances since SPY’s inception in 1993.

The stats here appear strongly bullish With a profit factor over 7 and the average trade nearly as positive as the worst trade was negative, risk/reward appears to heavily favor the bulls.

Want research like this delivered directly to your inbox on a timely basis? Sign up for the Quantifiable Edges Email List.