Subscriber Letter Trade Results for March

Between vacation the 1st week in April and taxes the 2nd week it’s taken me forever to finalize the March trade results, but they’re finally here. March was the 1st difficult month the Letter has had since last August. There were 2 main culprits – Catpults and Index trades.

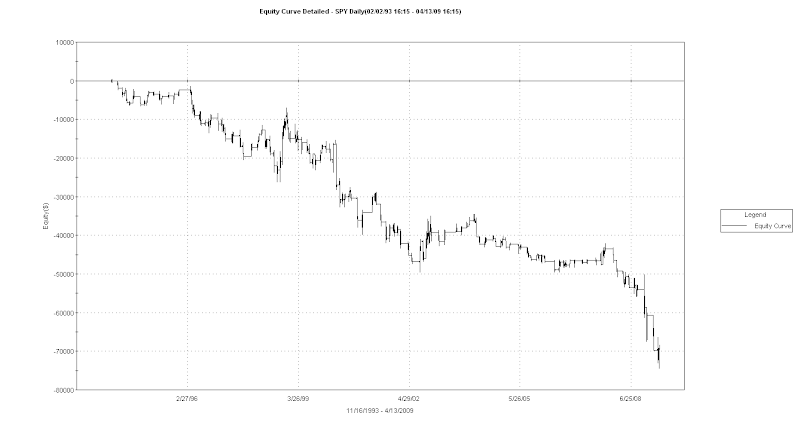

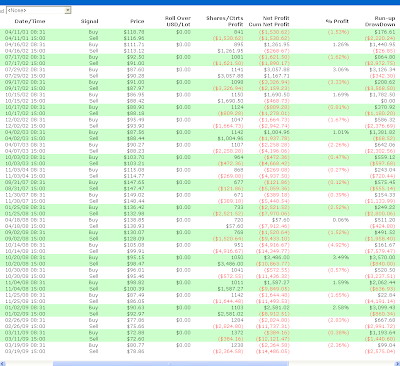

The Catapult trades had their worst bout in a long time. The primary culprit was the single worst trade in the history of the system. As I’ll describe below, the results are just a scorecard and not a portfolio return. The Catapult trades are normally scaled into in 3 lots. I always just list the gain/loss of each lot rather than slicing the results of those that only had one lot on. Since I don’t suggest allocation sizes it hardly matters, but listing each lot can exaggerate results sometimes. In October for instance, the results were exaggerated upwards. This month, downwards. The net additive results of all the Catapult trades was a loss of about 17% on 21 lots – or about -0.8% per lot. The single worst trade I referred to above had 3 lots active and they accounted for a loss of 58%.

To be fair, it wasn’t just the Catapults that faltered. I was too early to enter some of the index trades as the market collapsed in late February / early March. I also took them off too early in the bounce. The net additive result of the 5 index-sized lots was a loss of 2.8%. These positions are typically scaled into as well and they were in March, with a maximum of 4 on at one point. What I did very right was I avoided trying to short the bounce on the initial thrust off the bottom. Many traders that use overbought/oversold methods mistakenly viewed the initial bounce as a simple “overbought in a downtrend” setup. I discussed extensively in the Subscriber Letter that shorting the initial bounce appeared to be a dangerous proposition. The only short index trade idea I took wasn’t until 3/26 and I exited it with a nice 2.9% profit on 3/30.

Other systems were quiet as I often defer to the Catapults in times of market stress. It didn’t work out this time, but it traditionally has (see last October and November for some outstanding examples). There was only 1 system trade idea tracked outside of the Catapults and it went for a decent gain.

April so far has been much more efficient. There have been only a handful of trade ideas that have received fills and results have been strong so far. I’ll get to those results next month, though. Below are some of the usual caveats and explanations followed by March’s results.

As mentioned above, I don’t suggest position sizes. The primary reason for this is I’m not acting as a financial advisor. I don’t feel it is appropriate to suggest allocation sizes without understanding someone’s financial situation and risk tolerance. Even for my own trading I run different portfolios with different levels of aggressiveness. For instance, my most aggressive portfolio is my IRA. Here I may use options to sometimes get 400-500% leveraged. Other portfolios on the other hand normally take much more conservative stances and some rarely reach or exceed 100% exposure.

Detailed trade by trade results will appear in this weekend’s Subscriber Letter. If you haven’t checked out the gold membership area yet, then click here to sign up for a free trial (only a name and email address required). It’s not just trade ideas. It contains research far beyond the blog as well as members-only charts, systems (with code included), and custom indicators.