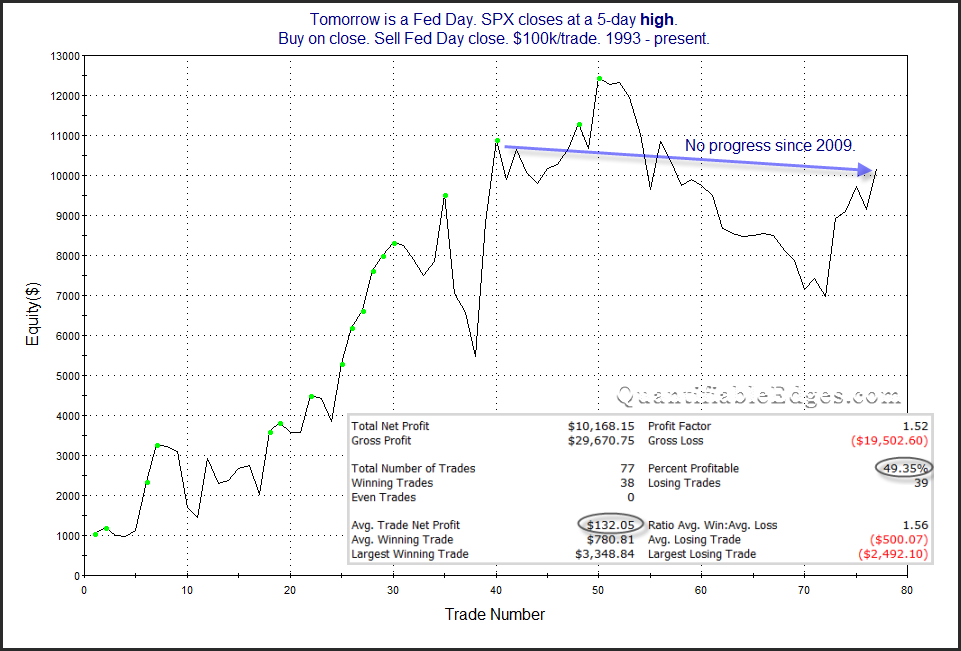

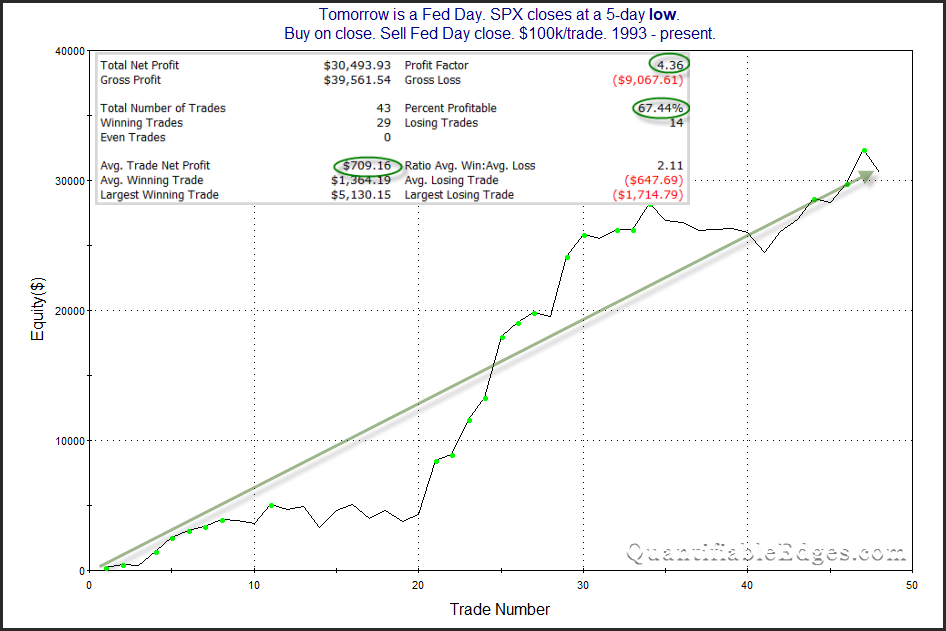

While the Fed decision will certainly play a part in how the market performs on Wednesday, another factor that has historically played into Fed Day odds is simply how the market performed leading up to that decision. A rally into a decision has often lead to disappointment (or “sell the news”). A selloff into a decision often indicated the market is preparing for the worst, and you’d see a relief rally. This is demonstrated in the studies below. They show SPX Fed Day performance when SPX closed at a 5-day high vs a 5-day low the day before. With SPX now in the middle of its 3-day range, we could easily end up at either of these extremes on Tuesday.

Clearly a 5-day low sets up for better Fed Day odds. It will be interesting to see how the market acts over the next two days heading into the Fed decision.

Want research like this delivered directly to your inbox on a timely basis? Sign up for the Quantifiable Edges Email List.

How about a free trial to the Quantifiable Edges Gold subscription?