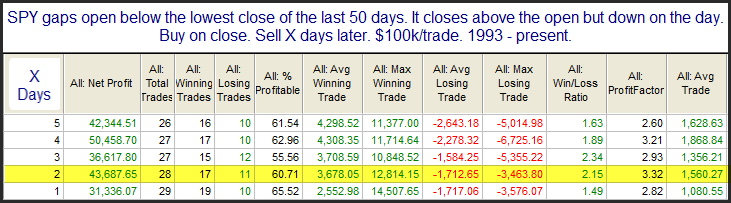

The market tested its recent lows on Tuesday, and that may have washed out the sellers, at least temporarily. Tuesday did not see a “turnaround” with a higher close, but it did manage to rally strongly off the lows. And the big gap lower, reversal upwards and higher close triggered a few interesting Quantifinder studies. The study below is one example of what I am seeing. It simply looks for gaps to 50-day lows and partial reversals.

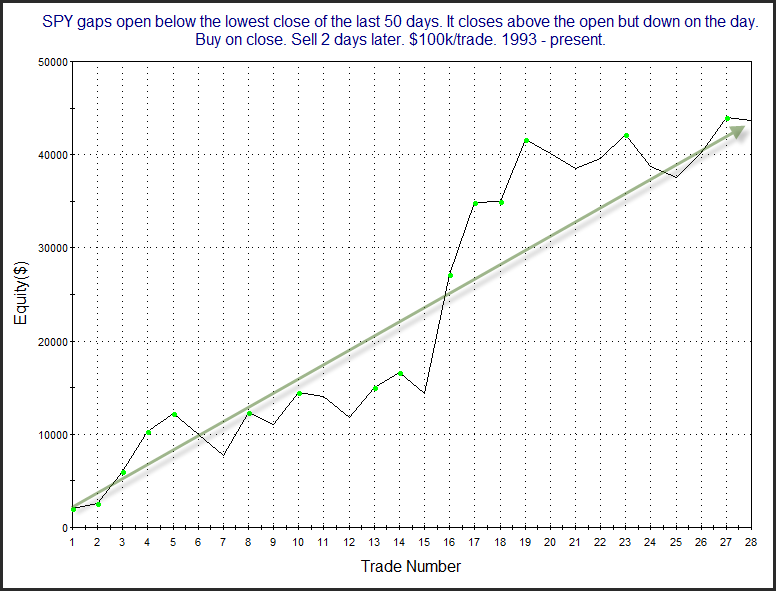

These numbers are impressive, especially over the 1st couple of days. Below is a look at a 2-day profit curve.

The move from lower left to upper right serves as some confirmation of the edge implied by the numbers. This suggests the rebound Tuesday was strong enough, and from a low enough level, that there is a good chance the market will continue to rally over the next few days. Short-term traders may want to take this into consideration when establishing their trading bias.

Want research like this delivered directly to your inbox on a timely basis? Sign up for the Quantifiable Edges Email List.