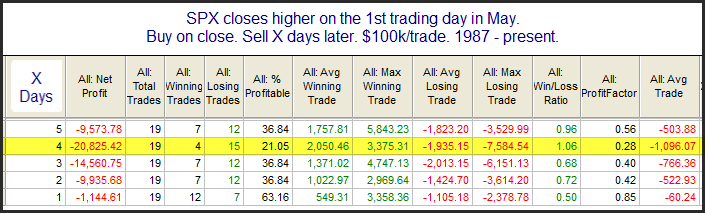

Yesterday I showed the strong seasonal tendency of the SPX on the 1st trading day of May. Today is a look at what has happened after a positive start to May…

Of the 19 instances that rose on the first day in May since 1987, 15 of them closed lower 4 days later. The market got a little bit of a head start downward this morning. I’ll also note I am seeing mixed indications, with some bullish evidence as well. So it will be interesting to see how things play out over the next few days. But seasonality is certainly pointing lower.

Want research like this delivered directly to your inbox on a timely basis? Sign up for the Quantifiable Edges Email List.