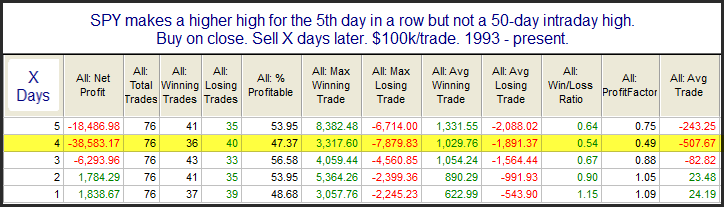

SPX managed to make an intraday high for the 5th day in a row on Friday. An interesting study from the Quantifinder looked at the possible impact of 5 higher highs occurring. The studies examined the impact of the position of the market when the 5 higher highs occurred. I broke it down again over the weekend. I wanted to see all times the 5 higher highs were accompanied by a 50-day high versus times they weren’t. First let’s look at times where 5 higher highs occur without a 50-day high.

Stats over the 1st few days suggest a possible mild downside edge. After 5 higher highs the market will sometimes need a breather.

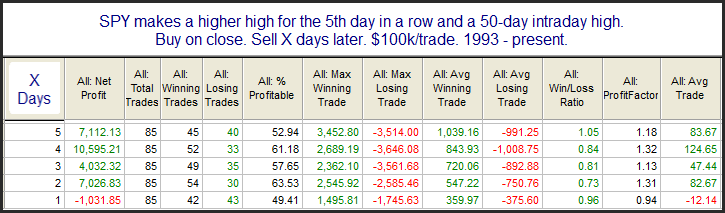

But what of times (like now) when a strong uptrend exists, and the market is also making a 50-day high? Those stats can be found below.

Interestingly, the number of instances has been nearly the same. But with an intermediate-term rally also occurring the tendency to pull back no longer exists. So the 5 higher highs are really of no concern in situations like the current one.

Want research like this delivered directly to your inbox on a timely basis? Sign up for the Quantifiable Edges Email List.

How about a free trial to the Quantifiable Edges Gold subscription?