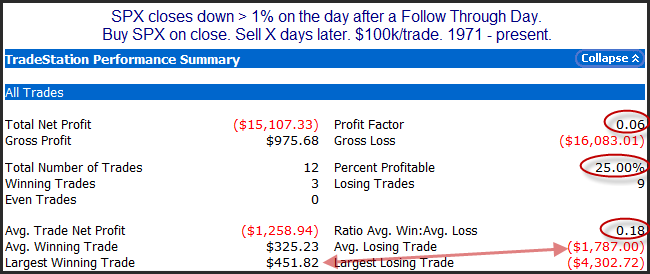

Yesterday I discussed Tuesday’s Follow Through Day (FTD) and some possible implication based on breadth and volume statistics. Wednesday was interesting because we saw a big selloff immediately follow Tuesday’s FTD. Past occurrences of this have been somewhat rare, but also somewhat suggestive on a 1-day timeframe. This can be seen in the study below.

As I mentioned, the number of trades is a bit low. But the early indications appear to strongly favor another day of selling. Especially impressive is the fact that the average of the 9 down instances was nearly 4x as large as the biggest up day. That is a risk/reward scenario that strongly suggests a 1-day downside edge.

Want research like this delivered directly to your inbox on a timely basis? Sign up for the Quantifiable Edges Email List.