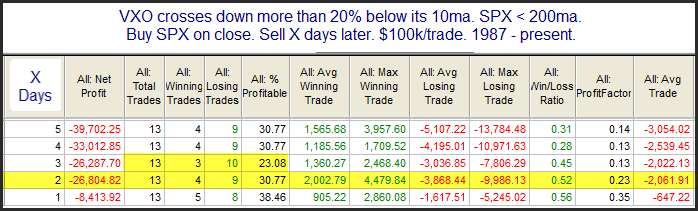

The VIX and VXO have dropped sharply over the last 7 days. These are measures of options premium. When they are falling it means premium is declining, and options traders are less fearful. The study below looks for times when the VXO becomes stretched more than 20% below its 10-day moving average. I have updated all the statistics.

Reward/risk appears to strongly favor the bears based on the limited sample size. Traders may want to take this into consideration when considering their bias over the next few days.

Want research like this delivered directly to your inbox on a timely basis? Sign up for the Quantifiable Edges Email List.